Why subscribe to Global Markets Investor?

EXAMPLE OF A REPORT FOR PREMIUM SUBSCRIBERS:

There’s a lot of noise in financial and social media about markets and the economy. This constant analysis goes through the noise, provides the most recent available information, and shows key data that moves the markets. It also utilizes nearly 10 years of market experience and industry knowledge including several years working for one of the largest investment banks on Wall Street. Additionally, it debunks misleading headlines and makes deep dives into the financial markets and economic reality. This, in turn, facilitates the investment and saving process of ordinary people and professionals.

By subscribing you will always be up-to-date with what is relevant and you will be aware of the key risks. In effect, your investment returns and financial literacy will substantially improve.

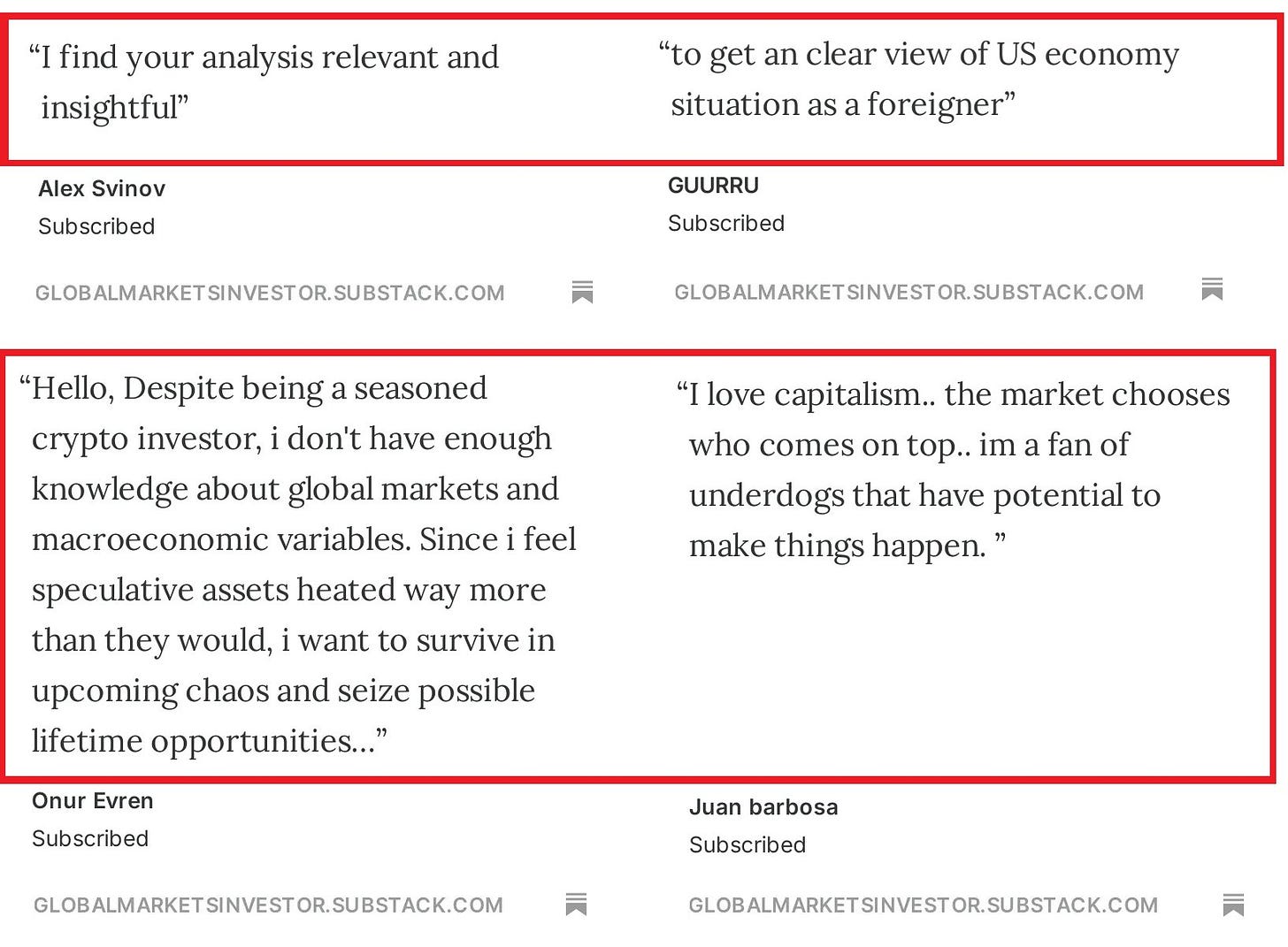

This is what paid subscribers wrote about this content and agreed to share:

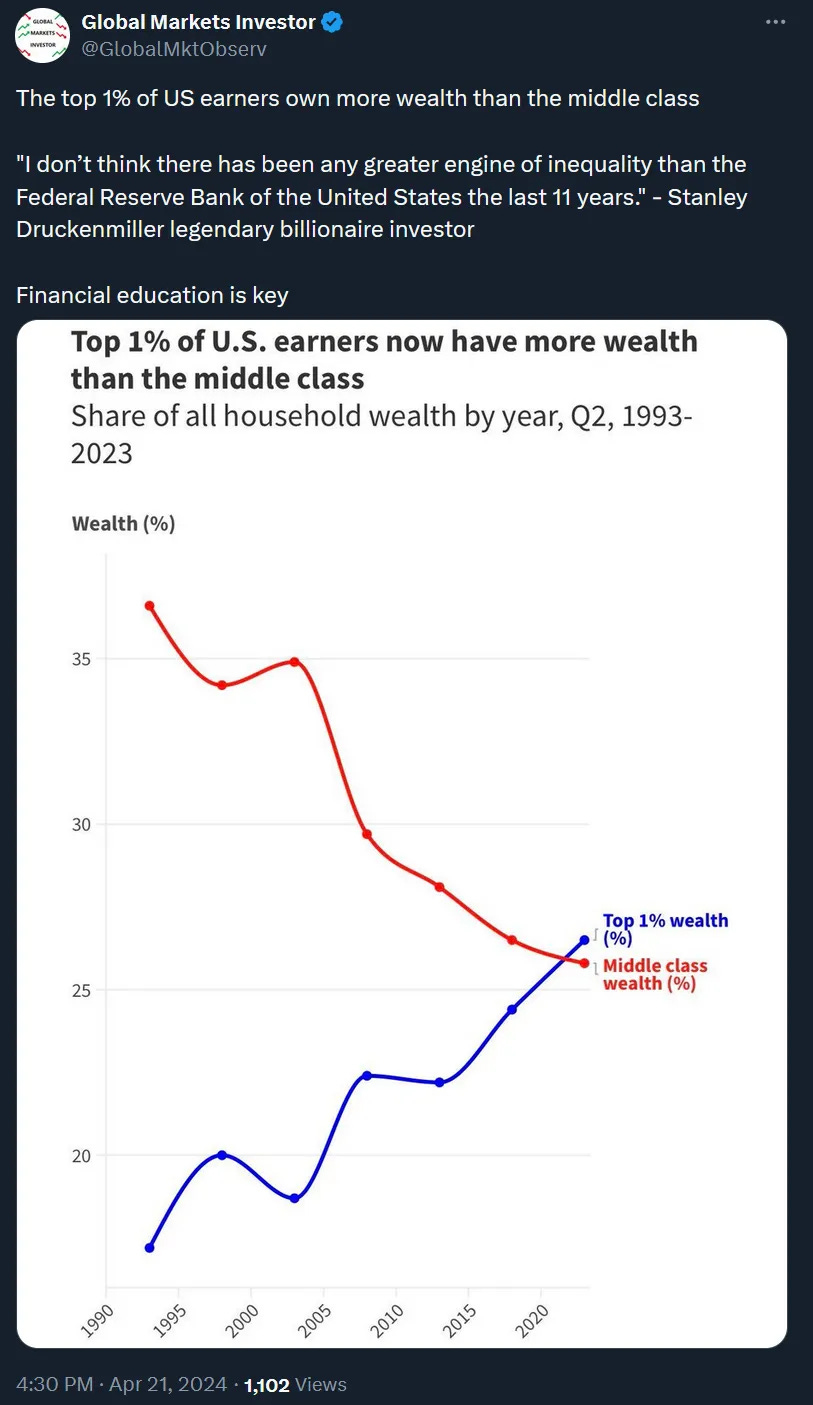

This is 100% true. This page and articles aim to show the real picture. The ultimate goal is to expose absurds within the US and global economy by going beyond mainstream media headlines and providing unbiased analysis.

Additionally, the content here aims to improve financial literacy within society as more ordinary people have been struggling to make ends meet and losing their share in total wealth due to reckless policies leading to currency and wealth destruction.

As you can see, rich people have been getting richer at the fastest pace in history. This shows that financial education is key to being successful in life.

The below piece should be the first to start the journey.

Did you know that the average investor has had consistently lower returns than the S&P 500 in the past?

The 20-year annualized return over 2002-2021 of an average investor was just 3.6%, almost six percentage points lower than the S&P 500 return of 9.5%.

If the average investor invested $10,000 and did not contribute any additional capital over those 20 years it would have $20,285.94. At the same time, a portfolio that invested only in the S&P 500 would have $61,416.12, or 3x more when excluding fees and taxes.

In other words, most individual investors have not been able to beat the market. This is especially true during the bear markets as it is shown in the below examples:

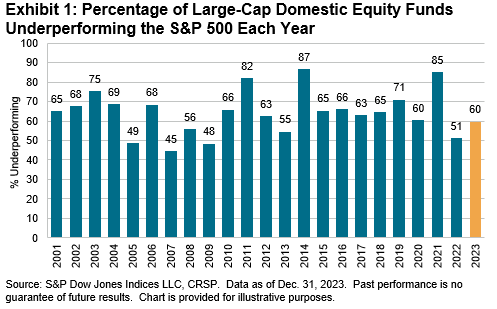

Professional Investment Funds’ performance is even worse.

More than 90% of actively-managed equity funds underperformed their benchmark in over the last 20 years, according to the S&P Global. In other words, only 10% have beaten the market. Moreover, in the last 10 years less than 7% of these funds have beaten the market.

In terms of stock funds solely, in 2023 alone, 60% of all active large-cap US equity funds underperformed the S&P 500. Back in 2021, only 15% of US large-cap stock funds beat the S&P 500 performance. See the chart below showing the 2001-2023 period.

Subscribing to this substack will certainly help you avoid this kind of underperformance.

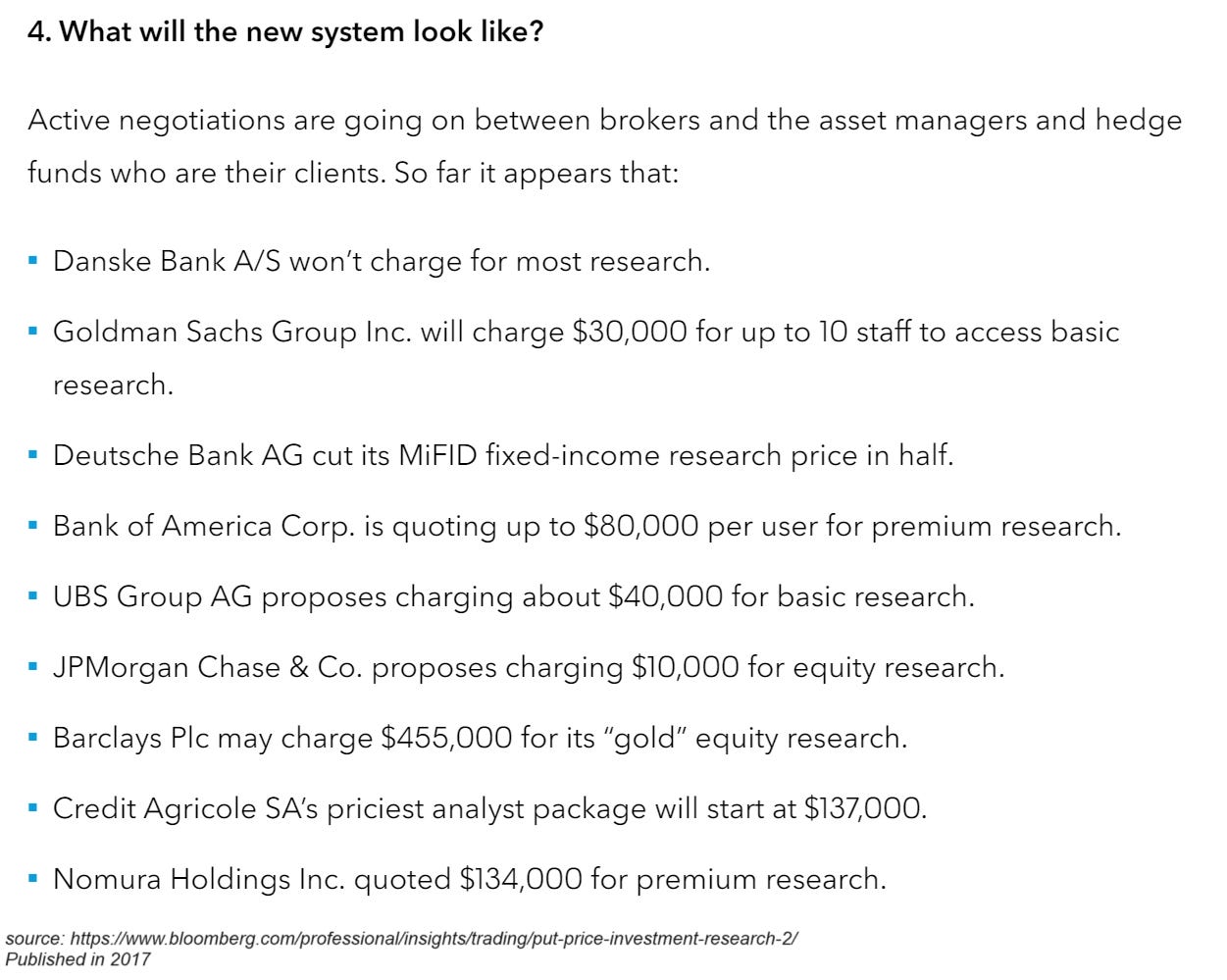

Lastly, it is worth noting that these investment funds pay as much as $500,000 a year for investment banks' premium research. See below Bloomberg data from 2017, showing how much big banks have charged for their research back then.

As you can see, this is a pretty expensive service and currently, these fees are likely higher than that. Here instead, you can find market data and analysis using Wall Street and retail experience for less than $15 per month. Do not wait and try now:

Remember that all information provided on this Substack and in all Global Markets Investor’s articles are opinions and should not be considered investment or financial advice.