World economy is driven by a massive debt bubble

The United States accounts for the largest share of global government debt

57,000 - this is the number of views of this content over the last 30 days. This is pretty impressive how fast the overall reach has been growing here and on social media. Unfortunately, inflation has also been rising. The best ways to fight this are investing in financial markets and growing business and its profits.

This is why prices for NEW paid subscribers will go up from the 1st of January 2025 to $19.99 a month and $199 a year. This is still below the pricing of most creators and a decent price for the amount and quality of research you receive. You can secure the current (old) pricing below before December ends.

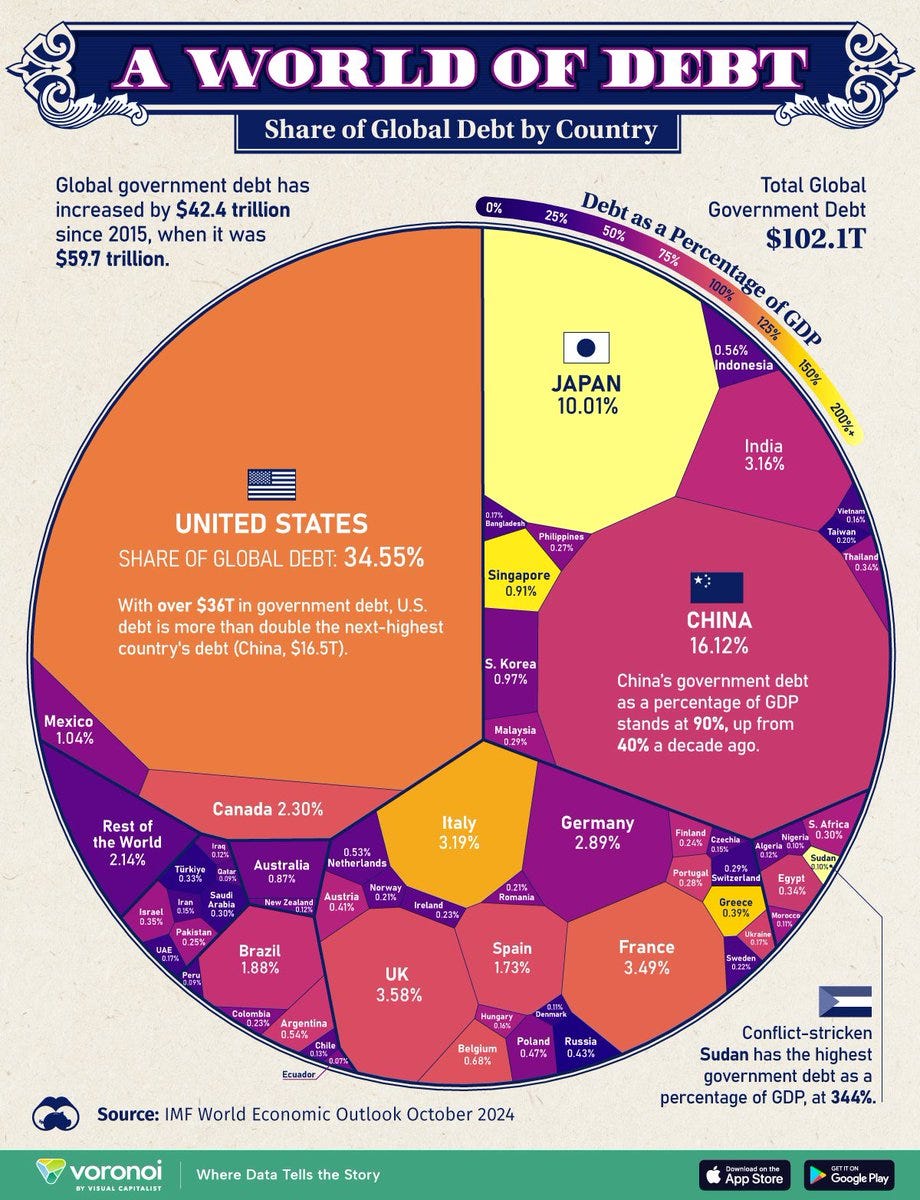

Global government debt amounts to a staggering $102.1 trillion, up by $42.4 trillion since 2015.

The below graphic presents countries' debt share of the total world government debt. Moreover, different colors show public debts as a percentage of each country's GDP. The more yellow the higher (worse) the debt-to-GDP ratio.

The US national debt is the largest among any country at $36.2 trillion or 34.6% of the total.

US public debt is more than double the second-highest which is in China at $16.4 trillion or 16.1% of the total global government debt.

Why too rapidly rising debt is worrying for the people and the economy? You can find out the answer in the following piece:

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter or Nostr:

Why subscribe?