Why did NVIDIA stock fall despite beating Wall Street expectations for Fiscal Q2 2025?

NVIDIA shares fell by 6.4% on Thursday wiping out $200 billion in market value following solid quarterly results

On Wednesday (August 28) after the market close, NVIDIA, the second world's largest company released its financial report for Fiscal Q2 2025. As highlighted in the preview expectations were sky-high including Wall Street analysts' anticipation of the company raising its guidance.

To be clear, those expectations, especially the guidance are usually the most important for any subsequent stock movements. Almost everything that is expected by analysts is already priced in the share price. Therefore anything above projections is what provides the further upside to the price.

As you have probably heard, the chipmaker beat all average revenue, margins, and earnings expectations once again. Its outlook for Fiscal Q3 2025 also came above average projections. NVIDIA even announced a massive new $50 billion buyback program. The devil, however, always is in the details and it appears that these great results were not enough to appease investors.

Let’s therefore dig in to find out why the stock fell on Thursday and why the solid beat was not good enough to convince shareholders.

In May, I highlighted the importance of the company’s performance for the whole US stock market and why its huge rally and market-leading position cannot last forever in the below piece:

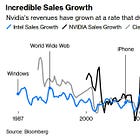

NVIDIA POSTED THE SMALLEST REVENUE BEAT IN 18 MONTHS