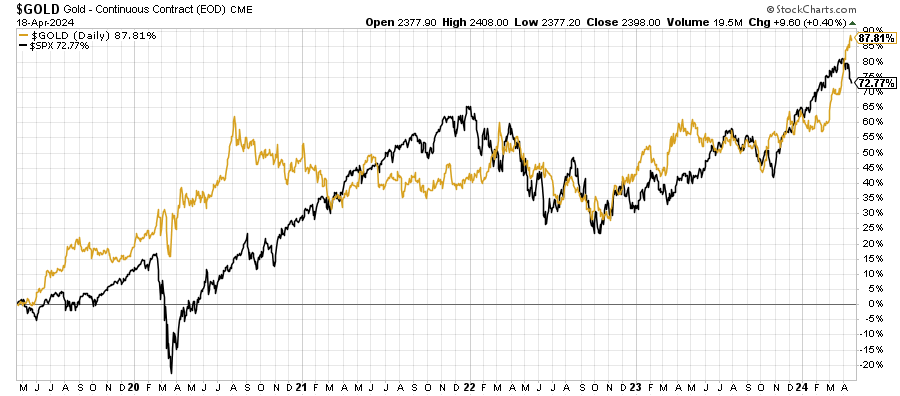

Gold has been experiencing one of the most remarkable performances in history. The so-called barbarous relic is up by more than 15% year to date. By comparison, the S&P 500 rose by only 5% during this time. When looking at a more favorable period for stocks, since the October 30 low, gold is up almost 20% and the S&P 500 is up by 22%. Finally, over the last five years, the yellow metal (gold line) has returned almost 88% versus the 73% return of the S&P 500 (black line). This is truly unheard of.

While most of the mainstream financial media has been excited that stocks have been rising, in the meantime gold prices have been quietly outperforming the most popular stock index in the world. And this is all despite rising real (adjusted for inflation) interest rates and the US dollar.

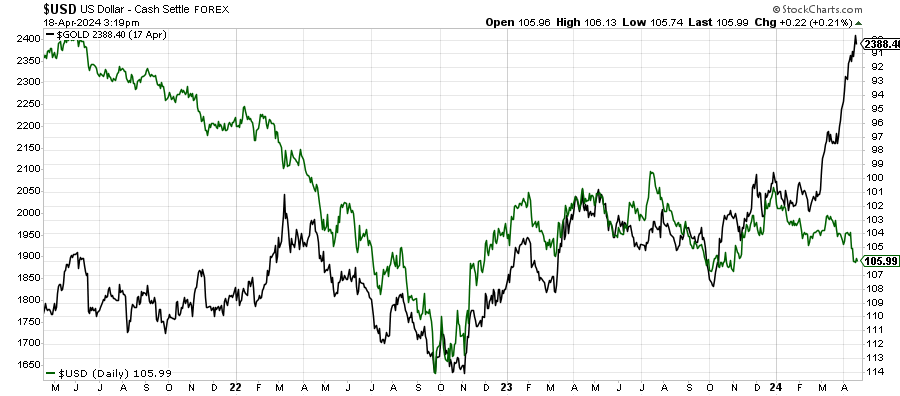

The below chart exhibits the inverse US dollar index (green line) and gold prices (black line) in the past 3 years. Throughout 2022 and 2023, both had held an inverse relationship. This year, however, the relationship broke and both assets have been soaring. This is truly exceptional as gold prices here are denominated in the greenback.

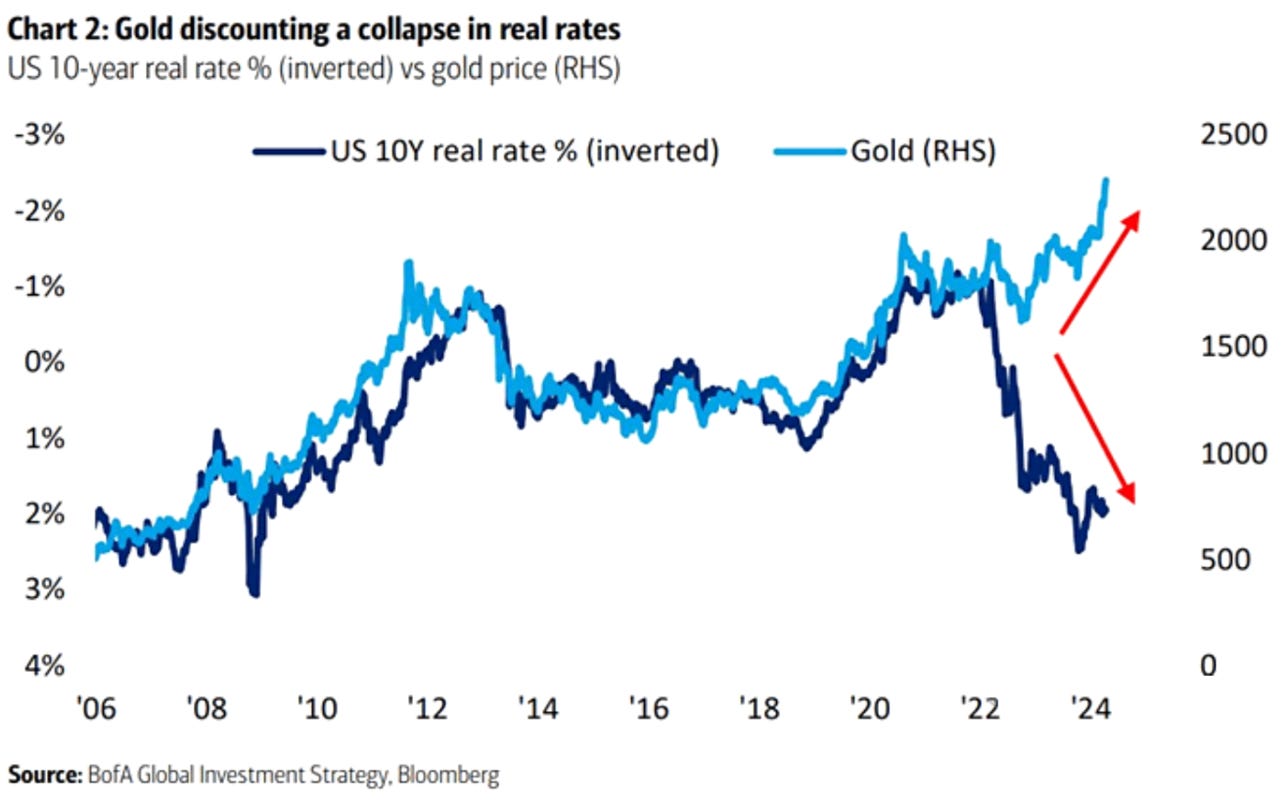

Furthermore, another important interconnection that recently broke was between the gold price and the inverted real (adjusted for inflation) 10-year Treasury yield.

In 2022, for the first time in decades, gold prices continued to advance despite the rising real rates.

That divergence could generally mean gold prices anticipating a drop in real interest rates or at least inflation exceeding the 10-year yields like it took place in 2020.

This time, it means something more consequential for the largest US economy in the world. What exactly? That will be answered in the next sections of this piece.

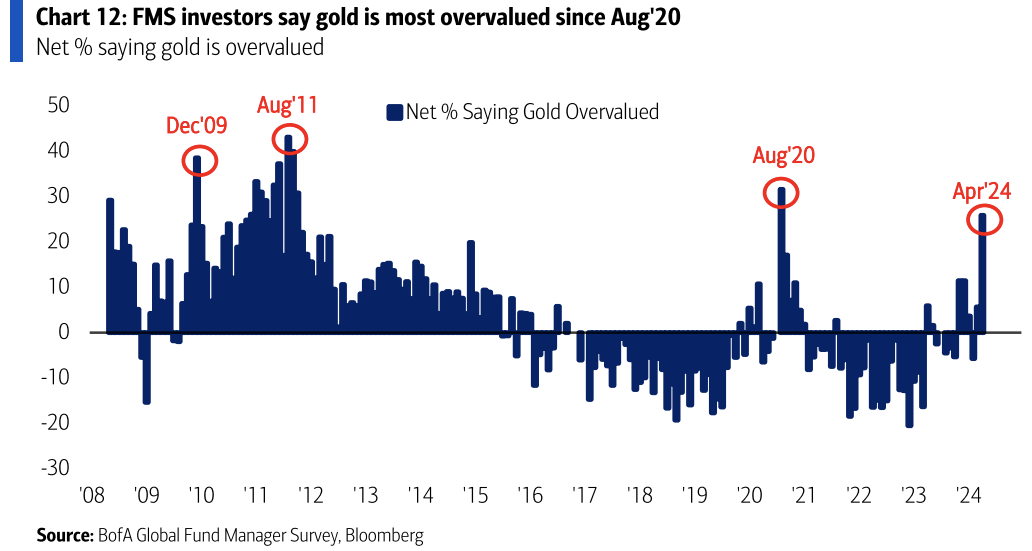

Lastly, before we move on to the main analysis it has to be emphasized that following this unprecedented rally, the sentiment has now become euphoric. According to JM Bullion, the gold sentiment is near extreme greed showing that prices have gone too far in the short-term.

Moreover, when using the Relative Strength Index, Gold prices are the most overbought on a daily timeframe since August 2020, on a weekly since February 2020, and on a monthly since October 2020.

Additionally, financial professionals also believe that gold is overbought. Almost 30% of 224 global fund managers managing ~$638 billion of assets surveyed by Bank of America on April 5-11 said that gold is overvalued. This is the highest respondent share since August 2020.

When recalling 2020, we may see that in August gold started to consolidate for the next few months before it came back to the uptrend. Will that pattern repeat this time? Will the so-called barbarous relic continue its outstanding performance in the upcoming months and years? Is there a real demand for physical gold after all?

These and other questions will be answered in the following sections.

WORLD CENTRAL BANKS RECORD BUYING, RETAIL DEMAND