What's happening with US small-capitalization stocks?

Is this finally a time to buy small caps?

US small-cap stocks have just recorded the worst start of the year relative to the S&P 500 in their entire history.

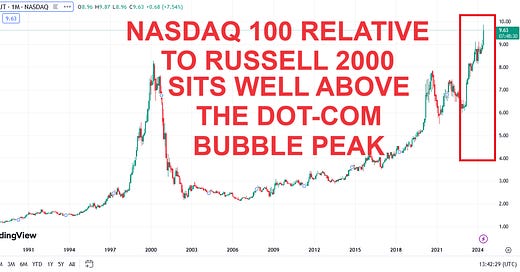

Russell 2000 index underperformed the S&P 500 index by ~15% in the first 6 months of the year. Year-to-date, the Russell 2000 has been basically flat while the S&P 500 has risen by 15%.

This is also the 3rd straight year of worse performance than the S&P 500 in the first half of a year.

Small-cap stocks lag versus large-caps has been truly remarkable in the last 3 years. Russell 2000 has declined by 12% over this time and the S&P 500 has rallied by 28%.

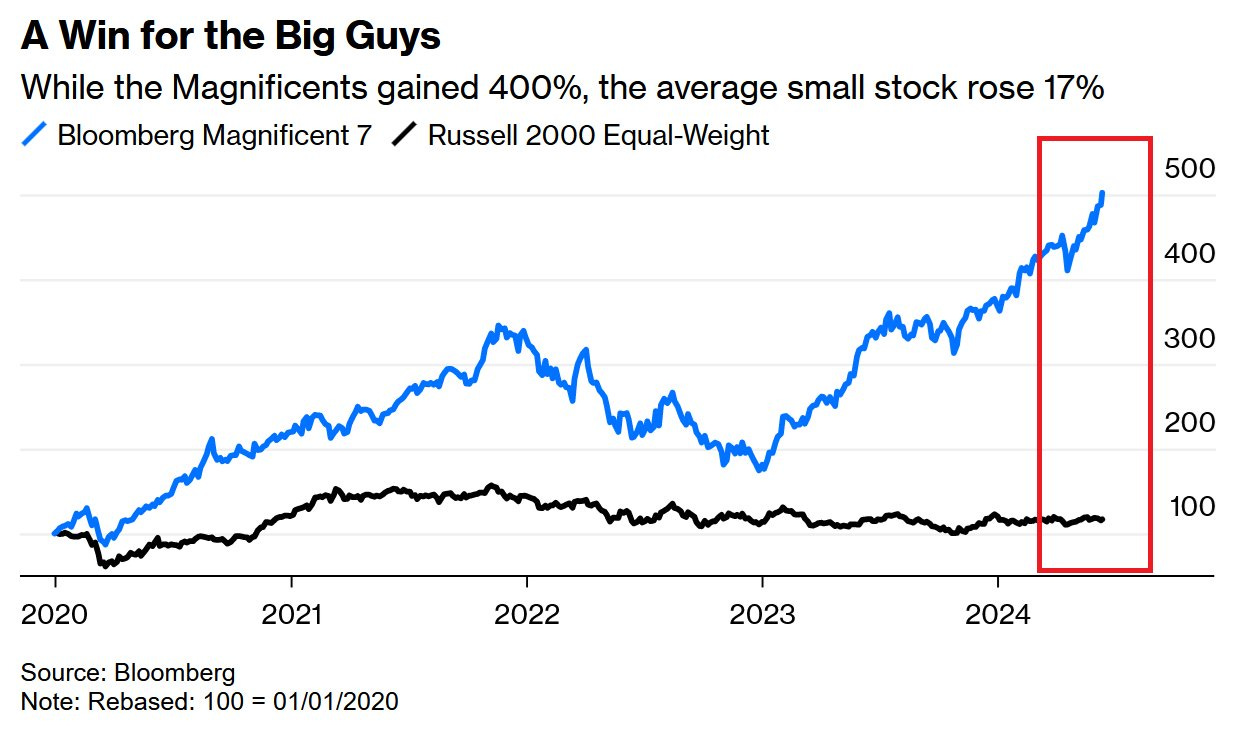

To present even more extremes we can see that since 2020 an average small-cap stock rose by only 17% versus over 400% gain of the Magnificent 7 stocks - Apple, Amazon, Google, Meta, Microsoft, Nvidia, and Tesla.

What are the reasons behind such a historic pain of small caps? When and how it may potentially end? Is this a good time to buy small-cap stocks or still too early?

These and other important questions are answered in the below analysis.

WHY SMALL-CAP STOCKS HAVE BEEN SO WEAK?