What to expect from the major central banks this year?

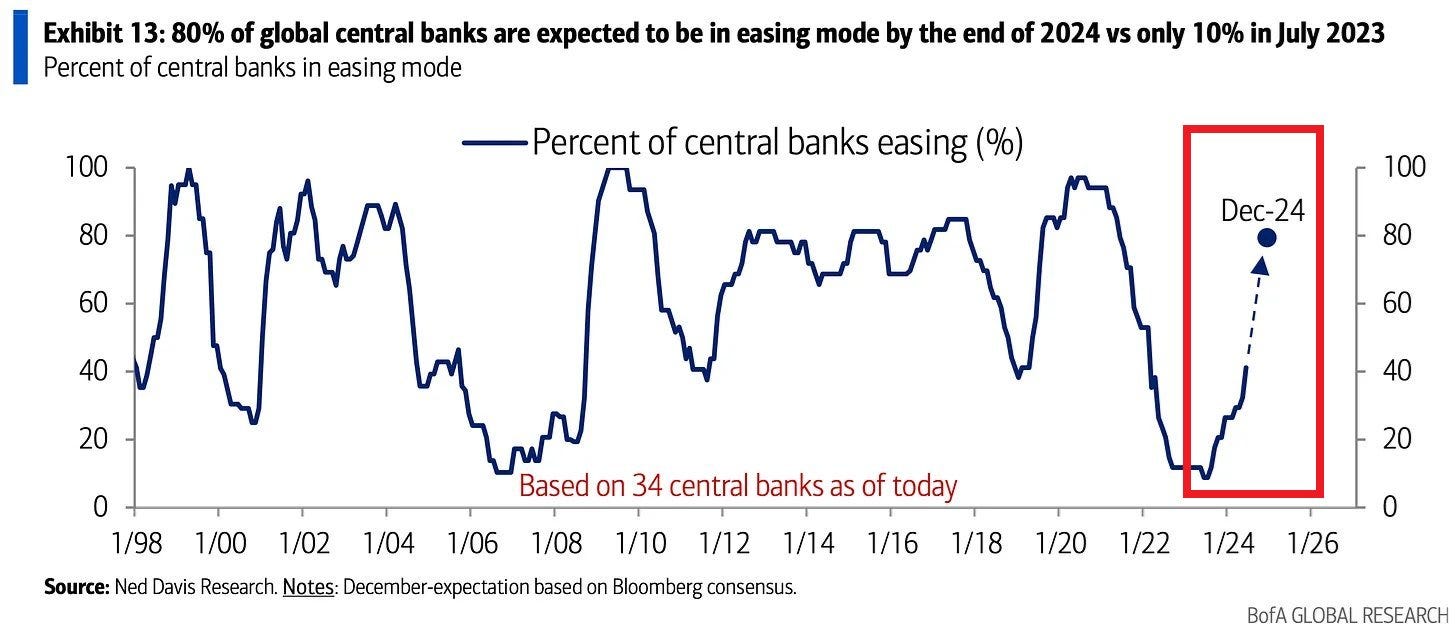

80% of global central banks are expected to ease their monetary policy by the end of 2024

First of all, I would like to express my profound gratitude to all of you for subscribing to this content. The number of subscriptions and followers has recently exceeded 1,200! Additionally, the follower count on X (formerly Twitter) has crossed above 13,000! As a token of appreciation please find a 10% discount for an annual subscription. ONLY 1 DAY LEFT!

27 of 34 world central banks are expected to ease their monetary policy by the end of 2024, the highest share in 3 years.

It means that they will stimulate a slowing economy using different tools. The most common method is to reduce interest rates (borrowing costs) in a country/economic bloc to support lending.

14 of the 34 largest central banks have already been easing their monetary policy, which is up from 3 banks in July 2023.

In June, Canada and the European Central Bank were the first major institutions to cut interest rates in this economic cycle.

Anticipating the next central banks’ moves is extremely important for investors because the monetary policy is one of the major drivers of the economy, impacting the ability to invest, and influencing currencies, commodities, and precious metals prices as well as stock markets.

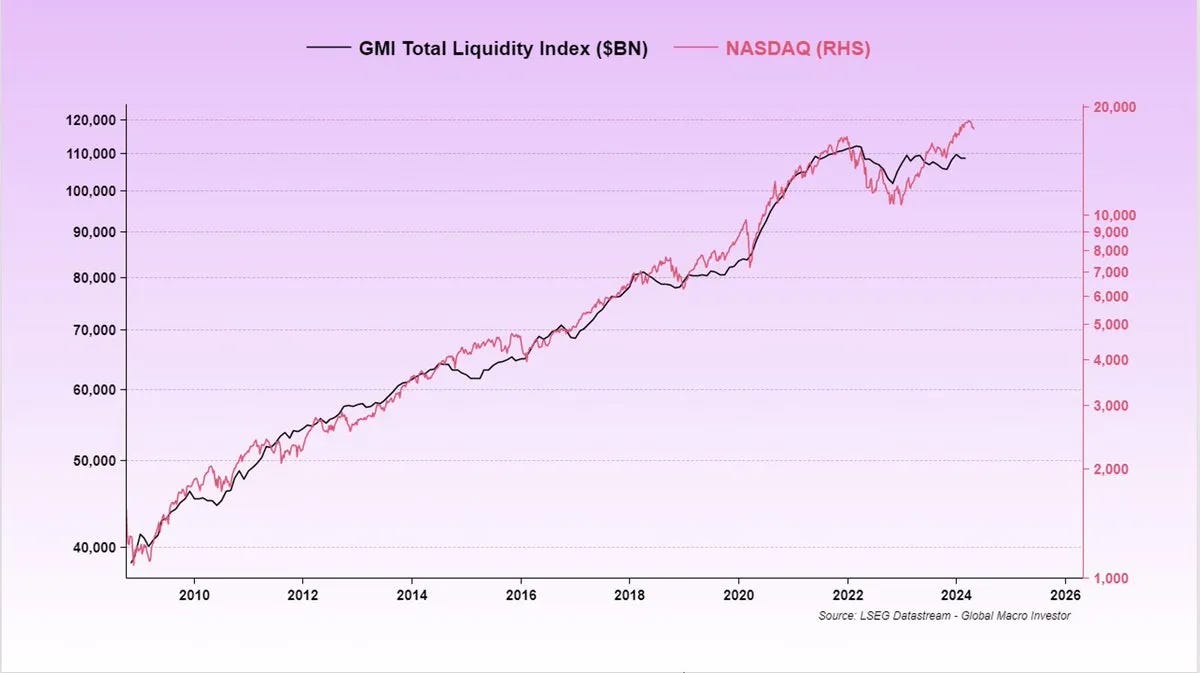

Central banks’ policy is also the key factor influencing global liquidity which affects the stock market. In the longer term, total liquidity is rising giving a boost to stocks. However, there are periods when central banks hike rates and withdraw liquidity from the system which in turn slow the economic activity or even leads to a recession. That eventually triggers a bear market.

After that, they slash rates and inject massive amounts of liquidity to support economic recovery which helps the stock market and other risky assets to recover as well.

Having said that, let’s review what to expect from the most powerful institutions in the world this year: the Federal Reserve, the European Central Bank, the Bank of Japan, the Bank of Canada, the Bank of England, the Reserve Bank of Australia, the Reserve Bank of New Zealand, the People’s Bank of China, the Reserve Bank of India, and the Swiss National Bank.

WILL THE FEDERAL RESERVE CUT RATES IN SEPTEMBER?