What the US stock market valuations are telling us?

The recent market events are truly unprecedented

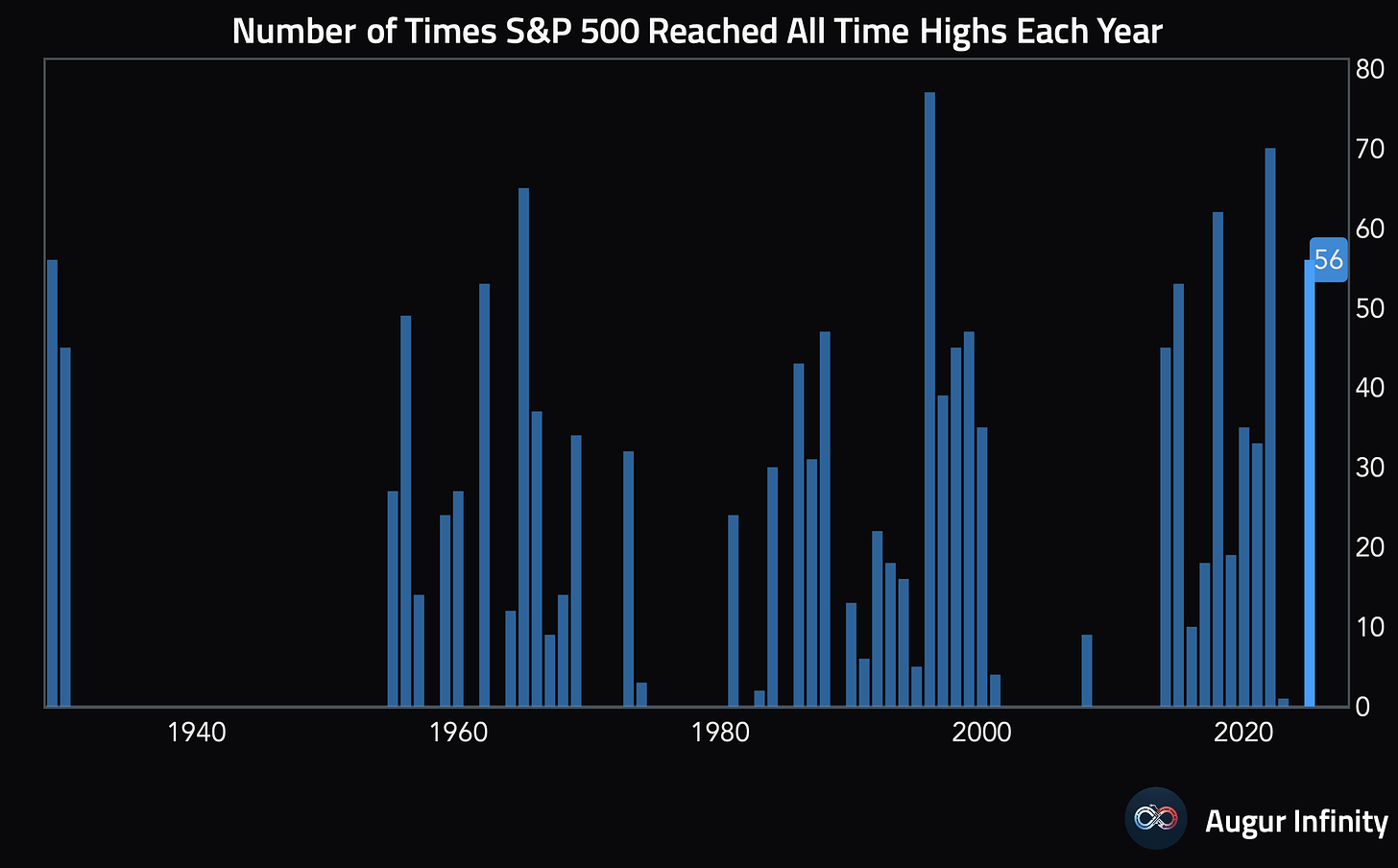

The S&P 500 has hit 56 all-time highs this year, marking the third-best performance this century and the sixth-best over the last 100 years.

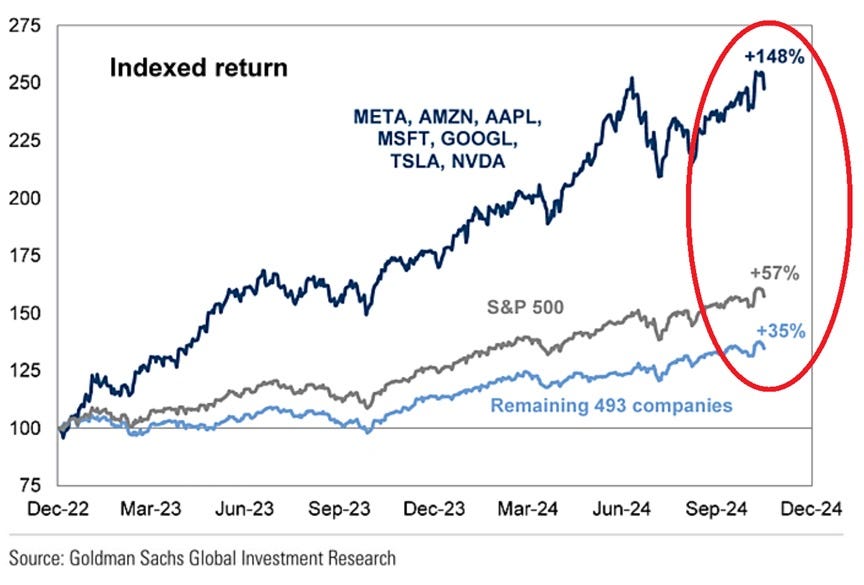

The index has rallied 28% year-to-date and 52% over the last two years. At the same time, the Nasdaq 100 index of technology stocks has risen 28% and 83%, respectively.

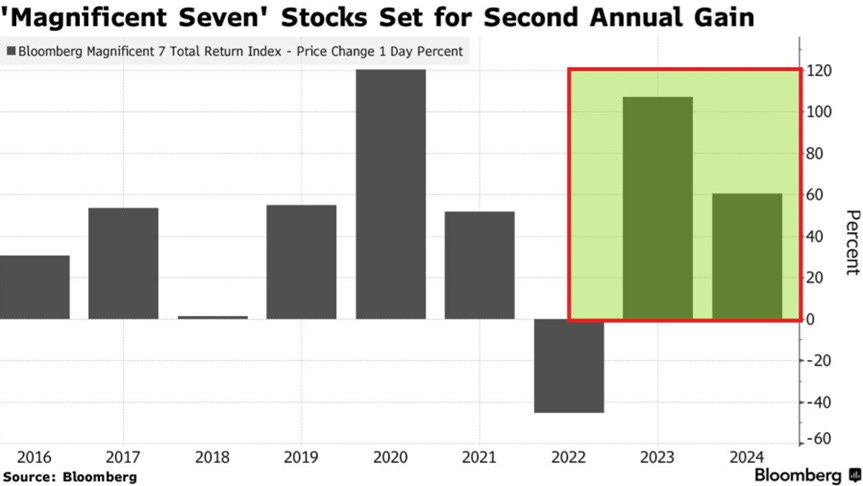

The Magnificent 7 stocks alone have rallied by over 60% year-to-date and 148% since the beginning of 2023.

As a result, the market valuations have also risen as fundamentals (revenues, earnings and their outlook) have not been able to keep up with such a rapid increase in stock prices. How far the valuations have gone and what this mean for the world’s biggest market going forward? You will find the answer in the following piece.

THE RECENT VALUATIONS SPIKE HAS BEEN ABSOLUTELY WILD