What if the Fed does not cut rates this year and hikes instead?

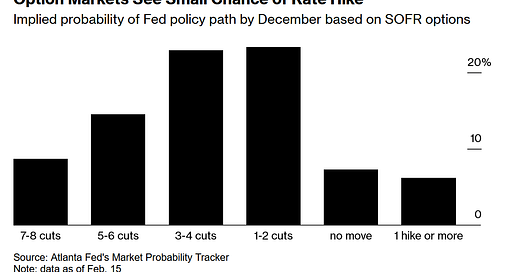

Investors and traders have started pricing a real possibility of a rate hike this year

In the last couple of weeks, the market investors and traders have significantly changed their views about the Federal Reserve interest rate cut expectations for 2024. It has come due to the fact that inflation has not been falling as quickly as expected and the official US labor market data have beaten economists’ expectations in the last few releases (let’s ignore the 2023 downward revisions for now). So what’s going on right now in the markets, what are the risks, and what to expect going forward?

STUBBORN INFLATION

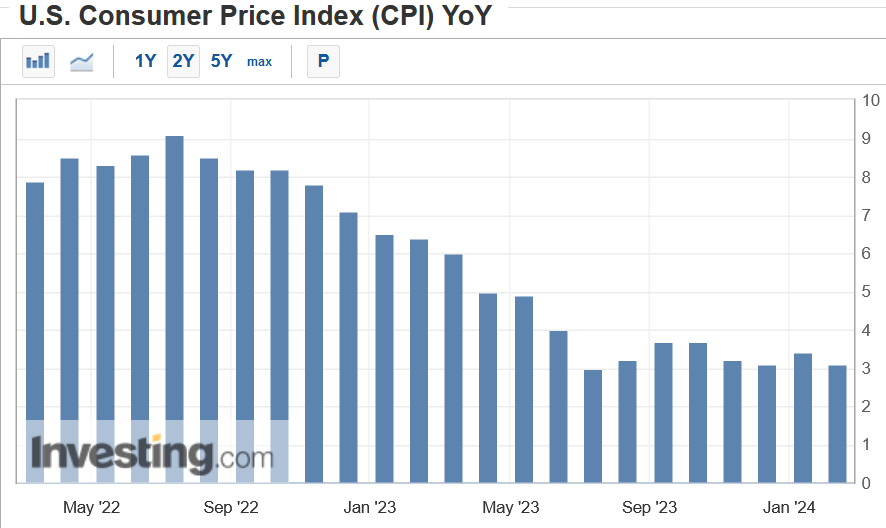

In the last several months the US inflation data has somewhat plateaued not showing any signs of progress in getting back to the Fed’s target of 2% over the long run. The Consumer Price Index (CPI) for January came at 3.1% year-over-year which was above average economists’ estimates of a 2.9% increase. This was the 8th straight month of inflation at or above 3%.

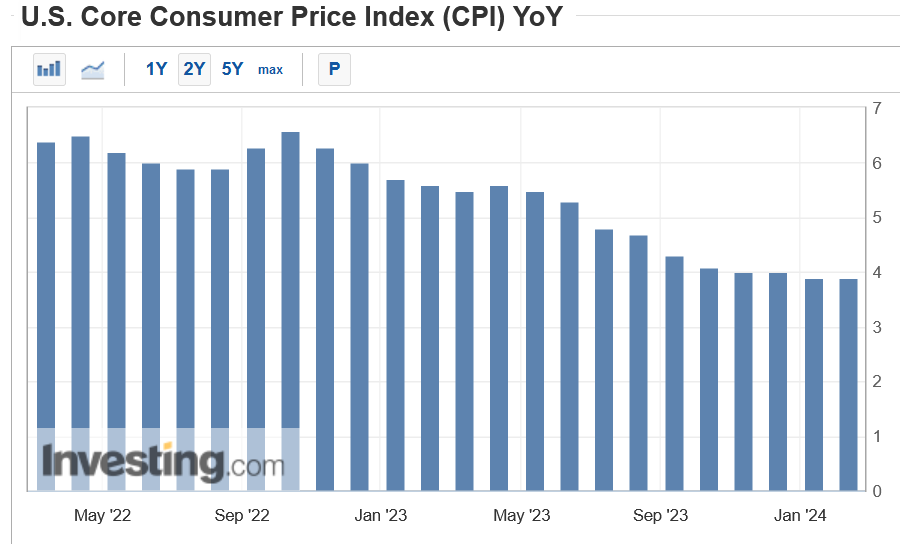

Moreover, when looking at core CPI (inflation excluding energy and food costs) which tends to be less volatile we can see that this metric has stayed around 4% since September. In January it came at a 3.9% year-over-year increase beating forecasts of 3.7%.

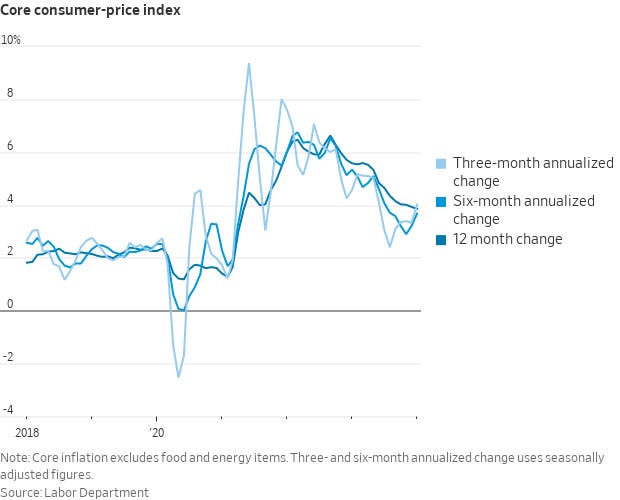

Even those often quoted by analysts' the 3-month and the 6-month annualized core inflation data showed in January that the job is far away from done. The 3-month annualized rate increased to 4% from 3.3% and the 6-month annualized rate to 3.7% from 3.2%. You can see the trend of those two metrics on the graphic:

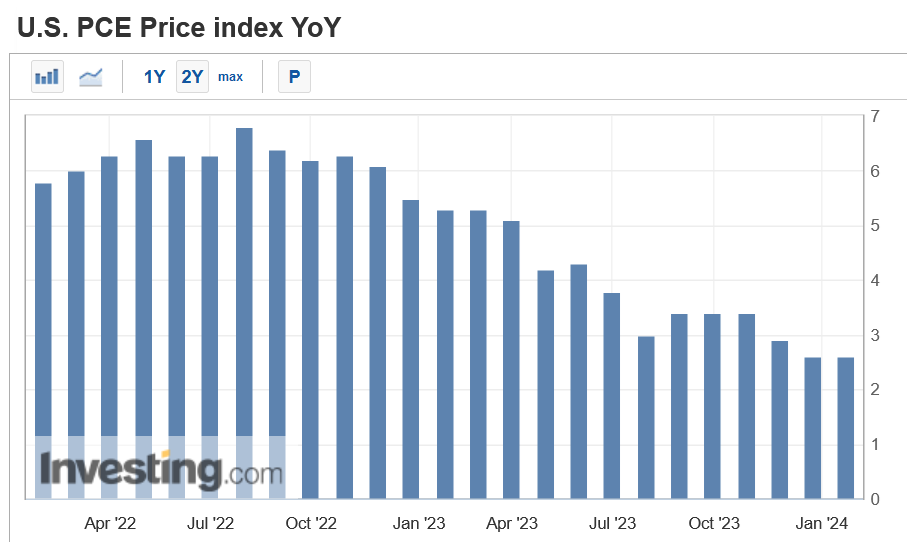

One would say it does not matter that much because the Fed is looking at the Personal Consumer Expenditure (PCE) inflation index also called the PCE deflator, and rightly so. The problem is that the higher CPI inflation as well as PPI (Producer Price Index) inflation which also came in higher than expected in January both translate to higher PCE. The PCE inflation for January will be released on February 29 and we’ll have a look at its forecasts at the end of the section. Before that, we can see on the graph that since July PCE has been hovering between 2.5% and 3.4%.

More importantly, the most preferred Fed gauge the Core PCE (core means excluding food and energy) has been steadily declining, reaching a 2.9% year-over-year increase in December. This in turn translated the famous 6-month annualized core PCE inflation to 1.9% for the second consecutive month (second chart) which made Wall Street and economists celebrate that the US central bank has reached its target. As a result, the market was pricing at least 7 interest rate cuts to happen in 2024.

However, using recently reported CPI and PPI data investment banks were able to estimate January PCE inflation (due on February 29). The table below shows that the total PCE price index is expected to increase by 2.4% year-over-year and the Fed’s preferred core PCE by 2.8% year-over-year which would be only a marginal improvement from December. This in turn would push the 6-month annualized core PCE to around 2.4% or 2.5% in January. It looks like the Wall Street celebration was premature.

The above analysis might sound convoluted, indeed. The most important thing to remember from this is that the Fed’s favorite inflation metric has likely picked up in January. This definitely complicates things for the US central bank going forward, especially if the trend continues. In other words, the Federal Reserve would need to move further with the first-rate cut. This is not what Wall Street wants to see.

MARKET RESPONSE

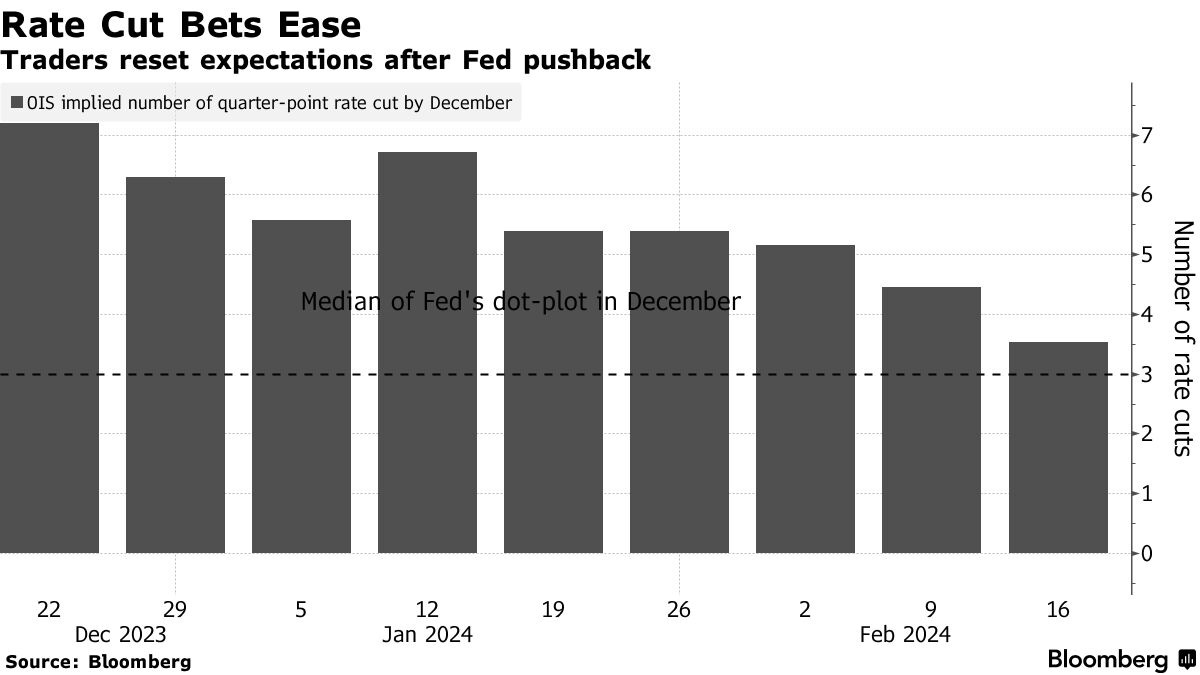

As shown above, the inflation data has been disappointing in recent weeks and the market has started to react. In December, traders were pricing slightly more than 7 interest rate cuts of 0.25% in 2024 as you can see in the below chart’s first column. Right now, they expect between 3 and 4 cuts as it is presented in the last column of the chart. It is a pretty wide shift in expectations. This is also roughly in line with the current Federal Reserve forecast of 3 rate reductions. It is worth mentioning that during the same time, the 10-year US government bond yield has risen from 3.8% to 4.3%

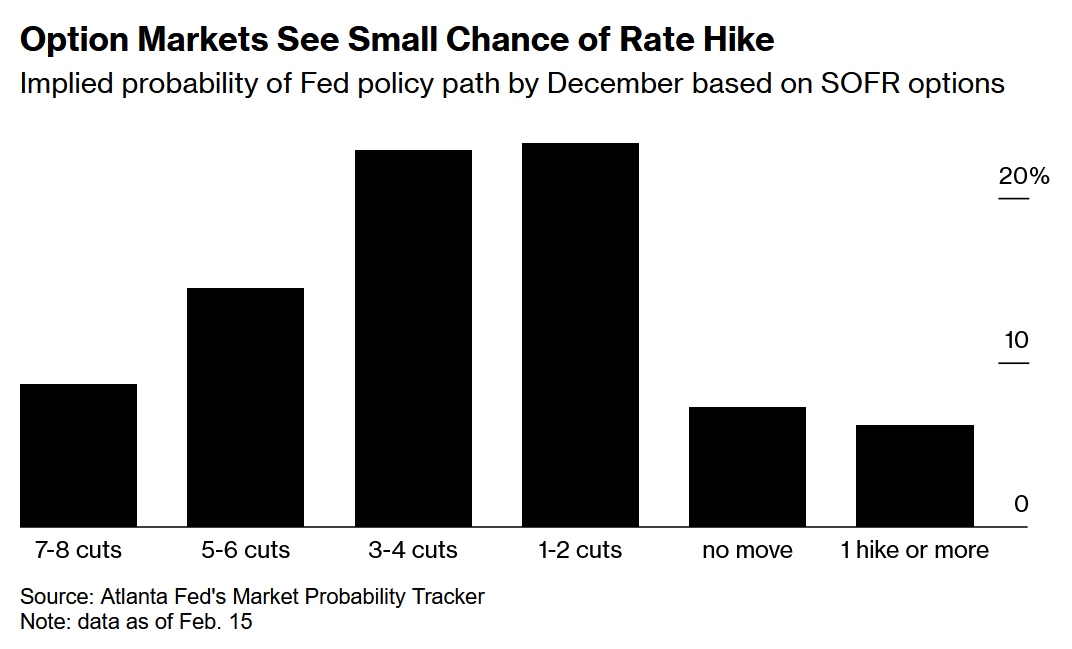

Furthermore, a few days ago the market commenced pricing in at least 1 interest rate hike this year with a probability of 6%. This is a notable risk for the market which has not been expected at all and so far only a handful of market analysts and observers have been humble enough not to rule out such an outcome. Even Fed Chair Jerome Powell on January 31st basically ruled out the possibility of a hike saying that “we believe that our policy rate is likely at its peak for this tightening cycle”.

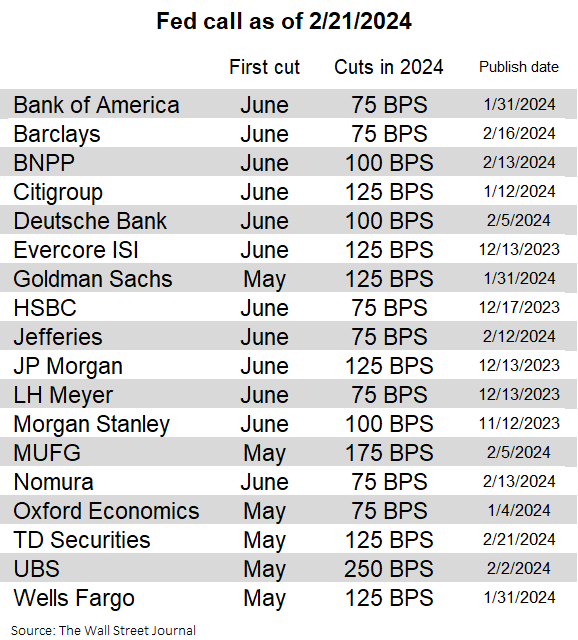

For now, this data means more like a small amount of hedging by investors has occurred in case of a rate hike scenario. However, if this probability would shift more towards 50% that could provide some turbulent times for markets. The US Dollar would strengthen, US government bond yields would continue going up but more rapidly (bond prices down), and therefore some correction could finally occur for the stock market while gold’s consolidation would get longer. For that to materialize, the market needs a couple of months more of surprising (to the upside) inflation data as well as hotter labor market data - wages, non-farm payrolls, and unemployment. Just to clarify, the current consensus does not anticipate anything like this at all and that would be a real shock. Below you can see that major banks expect at least 3 interest rate cuts of 0.25% this year from the Fed.

SUMMARY

Currently, all market participants are trying to figure out how many interest rate cuts will occur in the United States in 2024. Almost nobody contemplates any possibility of another hike. This creates a notable risk to consider especially when looking at recent months’ inflation data which progress has clearly stalled. Any additional upside surprises to inflation may provide a significant conundrum to the policymakers as well as analysts and investors. We also have to remember that this is an election year in the US which adds a little bit of a spice to all of this, especially for the Federal Reserve which considers itself as an independent institution. As a matter of fact, in the past, there have been many election years during which interest rate hikes have been conducted (for instance 2000 or 2004).

If you find it informative and helpful you may consider buying me a coffee and follow me on Twitter: