Weekly market recap, trading week 14/2024

Summary of the trading week in several posts with the most interactions on X

In this series, I’ve been bringing out financial posts with the largest number of interactions from my feed on the X platform over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

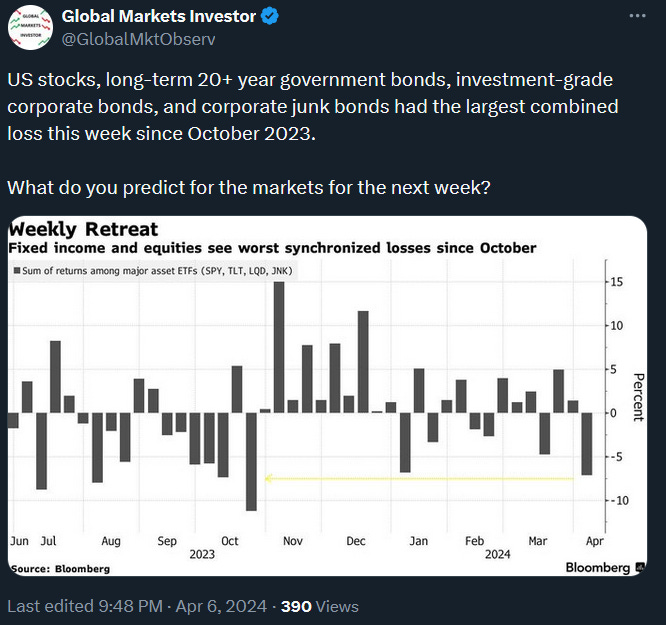

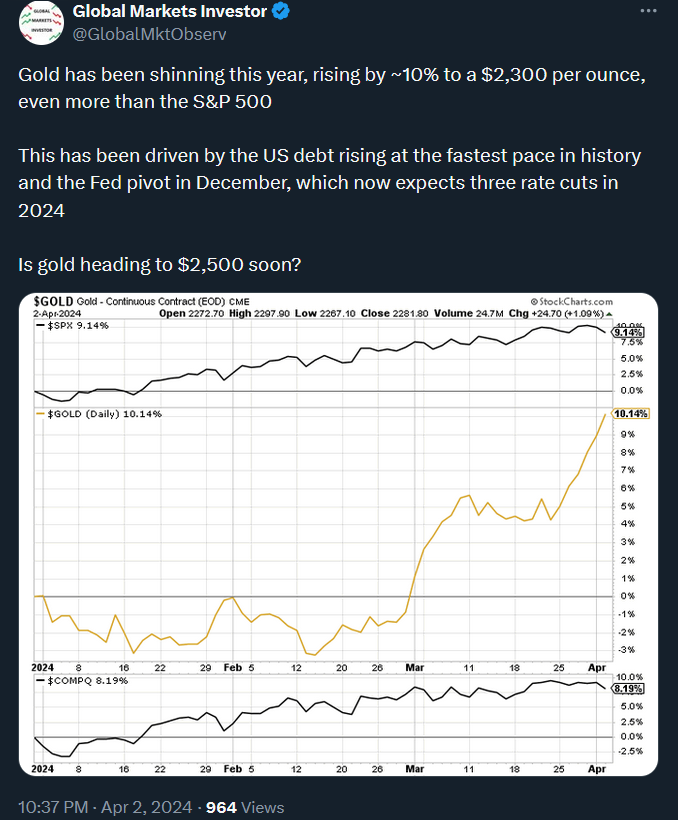

Weekly performance. In the below attachment, you can see last week’s performance of the major US indexes, the VIX volatility index, and Bitcoin. Stocks, Bitcoin, and Bonds had a quite tough week while gold shined. Gold has risen by more than 13% so far this year with still some more room to the upside if some pullbacks take place. Besides, the VIX jumped by 23%, the most since September 2023. This was also the highest weekly close since November 2023.

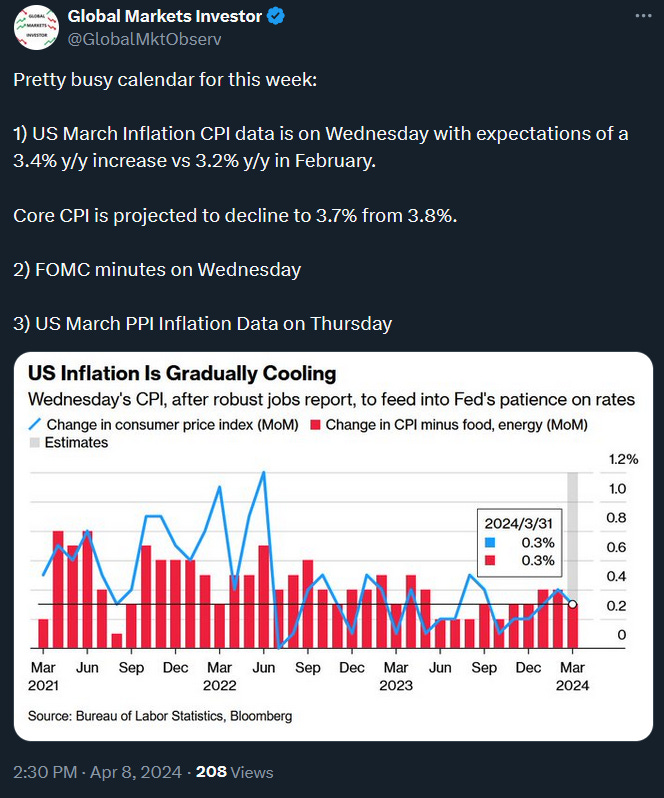

Going forward, there are US March CPI and PPI Inflation as well as FOMC minutes coming up this week (see the last post attachment below). If they come up in line with expectations will trigger the markets to continue going up. Outside the US, there are a few central bank rate decisions this week as well.

Oil is rising for the fourth straight month. Furthermore, it is trading at the highest level since October 2023. This development is not encouraging for both the Fed and US consumers as it will contribute to the bouncing inflation.

On Friday, the BLS released March jobs data that beat market expectations again. The devil is in the details as always. And those details might be a little bit concerning (see the second post). You can see the full March highlights of under-the-surface data in the updated article (the update is at the bottom of the piece):

Some food for thought. Since January, the market has seen a disconnect between falling rate cut expectations and rallying S&P 500. Such a disconnect has occurred in the past triggering some sort of correction and subsequent higher rate cut expectations (so both lines get closer to each other at the same time). It may happen yet again but as always, the timing is unknown.

Market pricing is never perfect and it is also shown in the second post. Traders are currently pricing that the interest rates in the US will bottom around 3.6%. History shows, however, that if any downturn occurs then the bottom will be much lower. In past recessions, the Fed has typically slashed rates by 3-4%.

Lastly, a gentle reminder that the US credit card debt is at all-time highs, even when adjusted for inflation. You can see the full analysis of the US consumer finances below:

If you find it informative and helpful you may consider starting a premium subscription for under $0.50 a day, buying me a coffee, and following me on Twitter: