Weaker US jobs data pushed stocks up. Weekly market recap, trading week 18/2024

Summary of the trading week in several posts with the most interactions on X

In this series, I’ve been bringing out financial posts with the largest number of interactions from my feed on the X platform over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

That was another busy week for markets with most focus on Wednesday’s Fed meeting and US jobs data released on Friday. The US labor market analysis will be posted and sent via email during the week whereas the Fed event has been covered on Thursday in the below article:

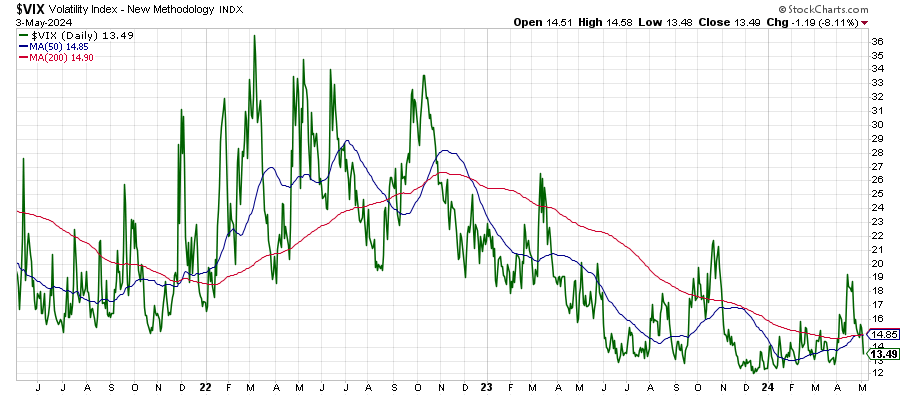

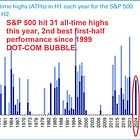

1) Weekly performance. In the below attachment, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin. After a rough first three weeks of April, US stocks have finally seen some relief. The S&P 500 ended up for the 2nd consecutive week, this time by 0.5%, with Nasdaq gaining 1.5%. The S&P 500 still sits below its 50-day moving average but finally broke above 5,100. The notable positive for the markets is that the VIX index crashed again this week and dropped below the 50-day and 200-day moving averages. This should support stocks in the short term. Gold has been in a consolidation for the 2nd straight week while Bitcoin finished up after some wild swings.

For the key events ahead there are 8 Fed speakers, Michigan Consumer Sentiment data on Friday, and less than 20% of the S&P 500 reporting their earnings. It appears that a pretty quiet week for the markets is coming.

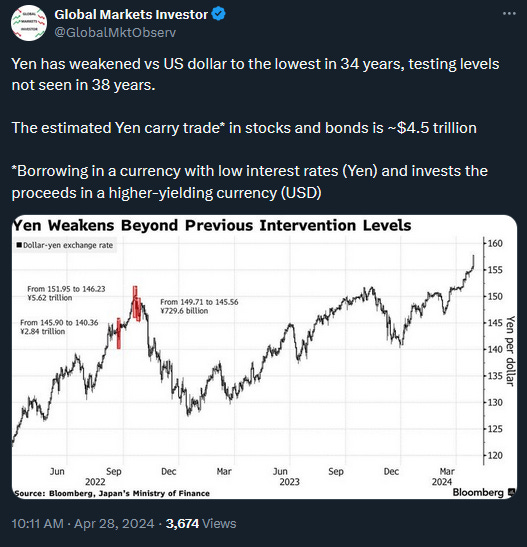

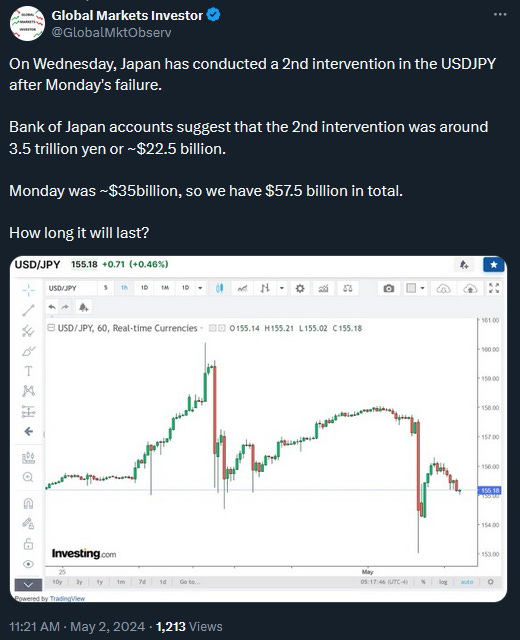

2) Let’s briefly cover the Japanese Yen volatility. Over the last 2 years, the Yen has been rapidly weakening versus the US dollar as interest rates in the US are more than 5% higher than in Japan. Investors have been conducting the so-called carry trade to exploit the difference between rates and profit from it. In simple terms, it means that they borrow at low interest in Japan, sell the Yen for USD, and invest in bonds or stocks in the US. The estimated carry trade in US stocks and bonds is ~$4.5 trillion, a pretty big amount. As more investors engage in this trade and buy US dollars vs the Yen, the more the Japanese currency weakens. In effect, the USDJPY pair has briefly risen to 160 last week and been trading at the highest level in 34 years (see posts below).

This forced the Japanese authorities to intervene as the weakening Yen is hurting some domestic companies in Japan due to imports from abroad getting more expensive. The Ministry of Finance has intervened twice this week, on Monday and Wednesday, burning $58 billion out of ~$1.28 trillion of their reserves. It has helped to bring the Yen back to 153 from 160 high, more than a 4% gain. The problem is unless the rate differential narrows, these types of interventions will just provide another opportunity for investors to exploit the carry trade. Another issue is that the Bank of Japan can not rapidly raise rates due to a gigantic national debt level. This would trigger the debt interest cost to spike and create significant problems for the Japanese budget. Looks like cutting rates in the US by the Fed is a more viable option for them, but it will take some time to happen. You should not be surprised then if USDJPY will be testing 160 once again in the next few weeks.

YOU CAN FIND AN UPDATE TO THIS ANALYSIS BELOW:

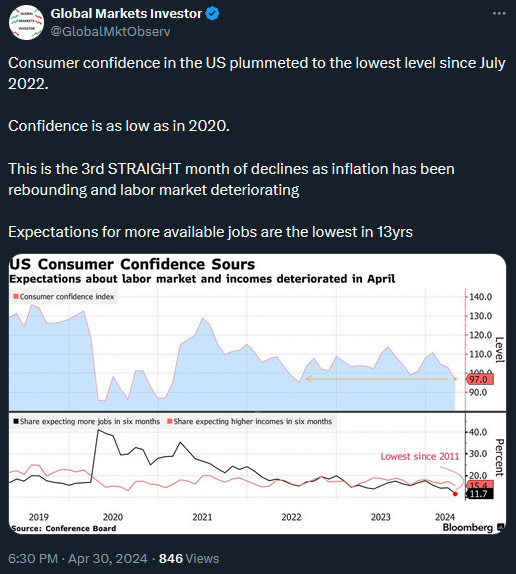

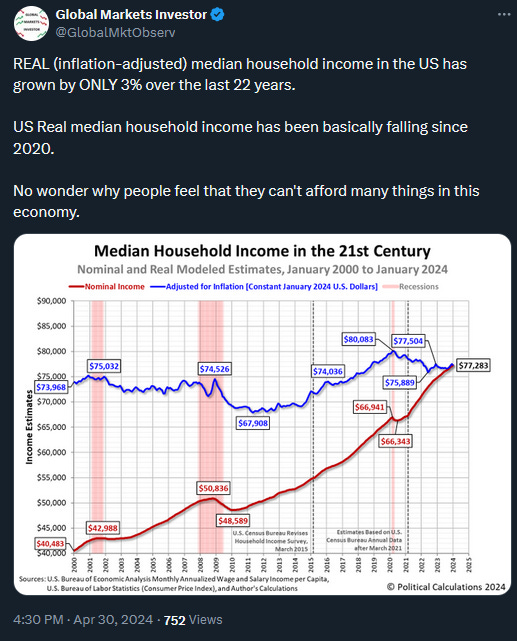

3) US Consumer confidence dropped to the lowest level in almost 2 years. Moreover, the expectations index declined below 80 which by the Conference Board definition often signals a forthcoming recession. This data should be closely monitored in the next few months. All of these not promising news comes as the real (inflation-adjusted) median household income in the US has stagnated (see the last post).

So now the US economy has:

1) Plummeting consumer confidence

2) 4 months of hot inflation and more-than-expected inflation

3) $2 trillion annual deficits

4) ~$34.5T in debt

5) Hundreds of thousands of full-time jobs lost over the last 12 months that have been replaced by the part-time job creation

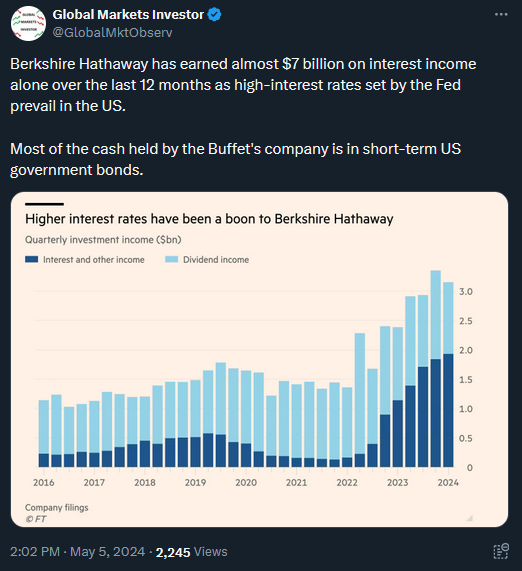

4) Berkshire Hathaway annual shareholders meeting. On Saturday, Berkshire Hathaway announced its earnings results for Q1 2024. Omaha-based conglomerate saw operating earnings increase by 39% year over year with revenue up by 5% to $89.9 billion, with both metrics beating average Wall Street estimates.

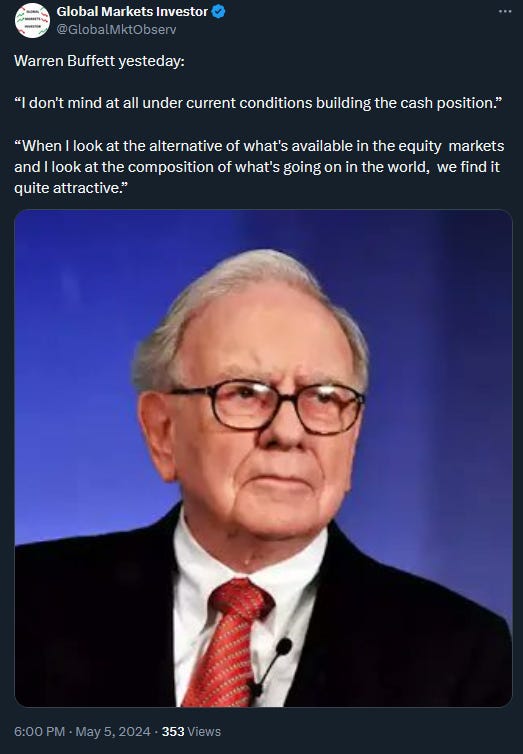

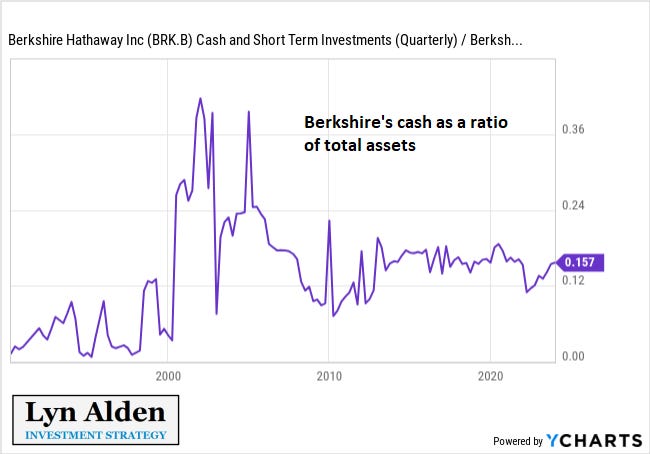

Buffett's company cash pile has reached an all-time high in Q1 2024 of nearly $190 billion, up from ~$170 billion in Q4 2023. Notably, cash as a % of total assets is still well below the all-time highs that occurred in the early 2000s’. However, a more than 70% increase in cash over the last 2 years is pretty notable.

Warren Buffett also called the Oracle of Omaha, CEO and Chairman of Berkshire Hathaway notably cut by 13% its stake in Apple (the world's largest company) to $135.4 billion and is holding now 790 million shares of the iPhone maker. More comments on the event are in the below posts.

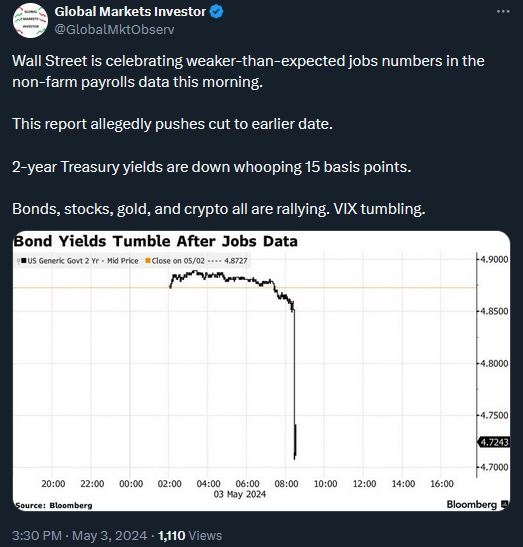

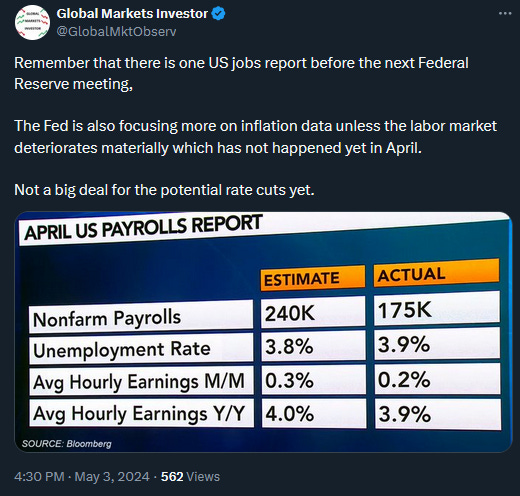

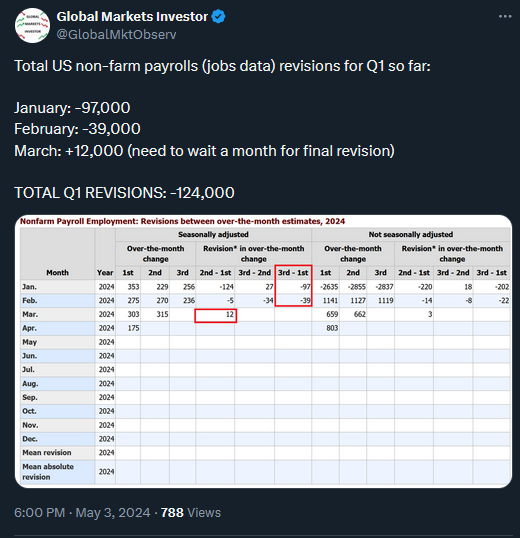

5) US jobs data for April. On Friday, April US non-farm payrolls came at +175,000 vs +240,000 estimated by Wall Street economists.

Notably, February numbers were revised down and March were revised up. Overall revisions for the prior two months totaled -22,000.

Meanwhile, the unemployment rate ticked up to 3.9% from 3.8%.

Still, a decent release but showing some signs of weakness which in turn, provides a slightly higher probability of the earlier Fed cut this year. This is why stocks ended up on Friday, with bond yields dropping. A full US labor market analysis will come up early next week. You can see the preview below:

If you find it informative and helpful you may consider starting a premium subscription or buying me a coffee, and following me on Twitter:

Why subscribe?