⚠️US UNEMPLOYMENT RATE IS SET TO RISE FURTHER⚠️

This is the preview of the US job (non-farm payrolls) report for August scheduled to be released on Friday

The BLS releases job (non-farm payrolls) data for August on Friday at 8.30 AM ET.

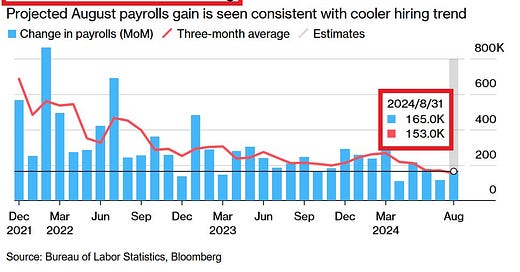

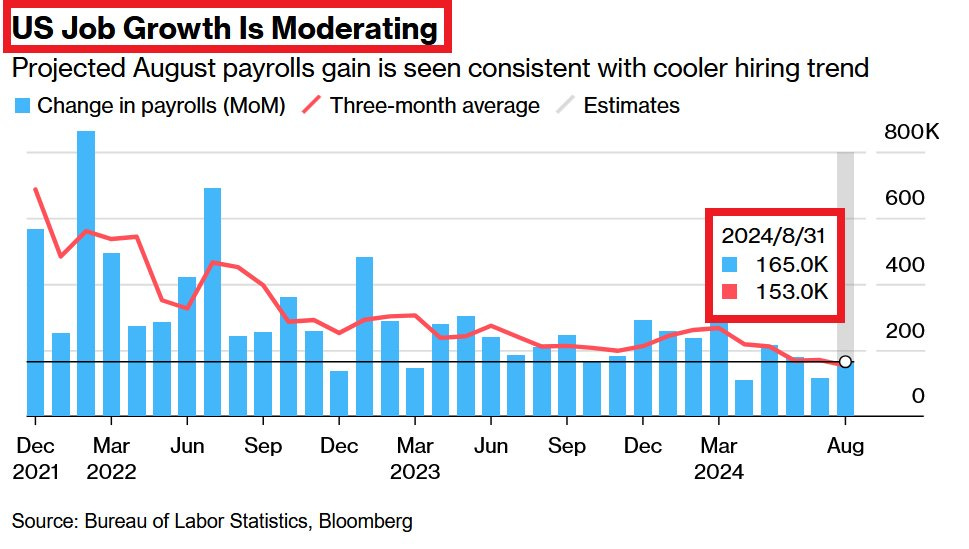

It is estimated by Wall Street analysts that the US economy added 165,000 jobs last month, above the last 3-month average of 153,000.

This looks pretty solid but as most of you know, the labor market reality is completely different.

Coming back to the previous print, non-farm payrolls for July came at 114,000, below the estimated 176,000, the lowest level since January 2021.

The unemployment rate jumped to 4.3% from 4.1%, above average expectations of 4.1%.

Analysts now expect, the jobless rate fell to 4.2% in August.

This is nothing else than noise and information for short-term market traders.

First, because most of the job growth is coming from the government.

Private payrolls excluding 'education & health' as a % of total payroll growth accounted for only 38% in July, the lowest since the 2020 pandemic.

In the past, this only occurred during recessions.

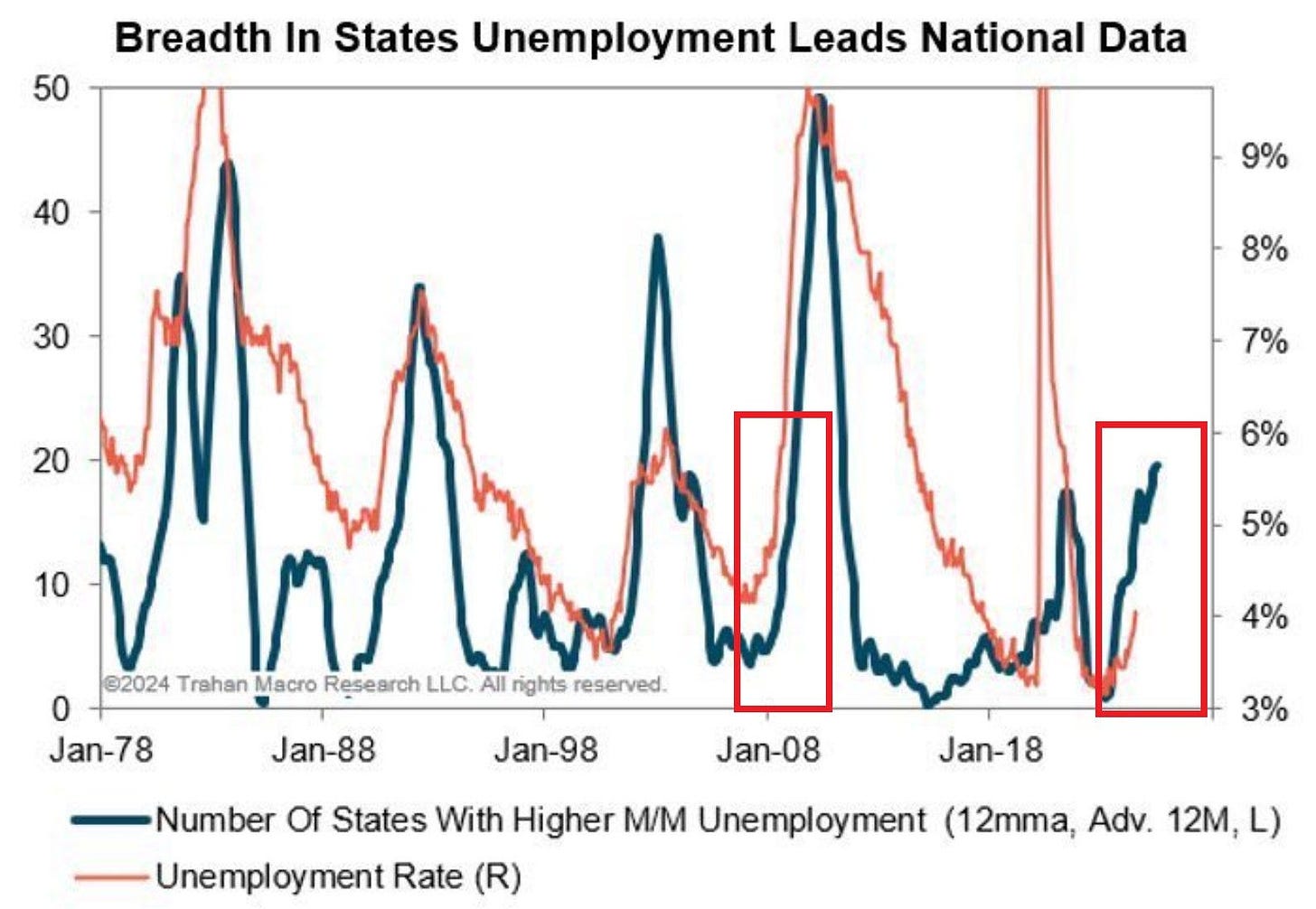

Second, forward-looking data points to a surge in the unemployment rate.

The number of states with rising month-over-month unemployment soared to the highest level since 2009, according to Trahan Macro Research.

This implies the jobless rate could increase to at least 5.5%.

Moreover, the difference between the share of Conference Board Consumer Confidence survey respondents saying jobs are plentiful and hard to get declined to 16.4%, the most since the COVID CRISIS.

This also means the US unemployment rate should jump to at least 5.5% in the next few months.

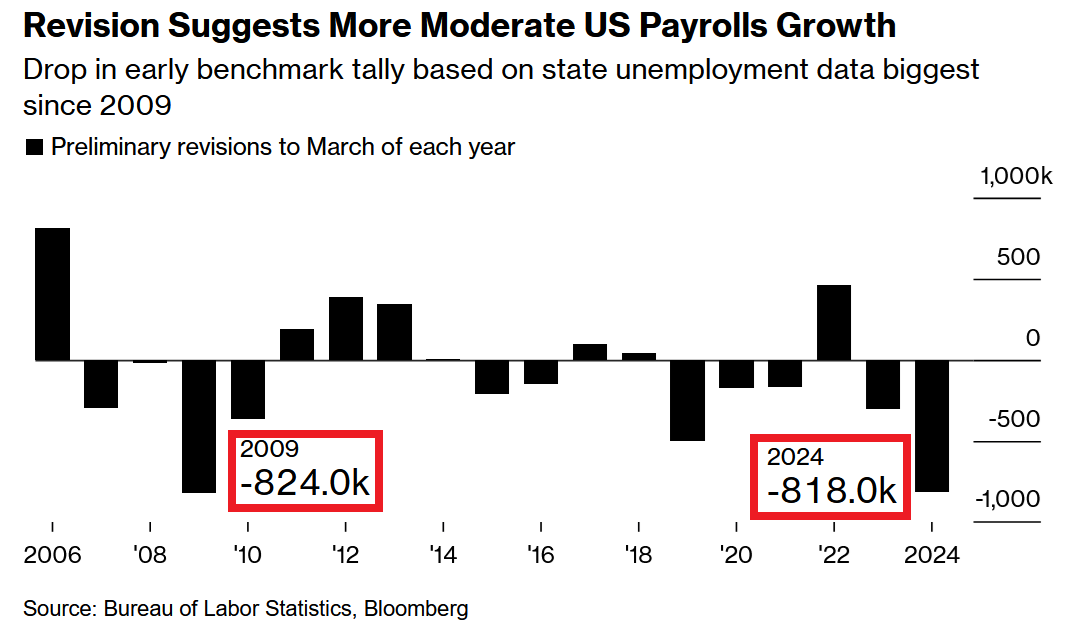

Lastly, downward revisions.

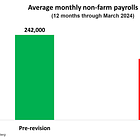

US job numbers have been recently revised down by a jaw-dropping 818,000 for the 12 months through March 2024.

This was just 6,000 below the revision seen during the Great Financial Crisis.

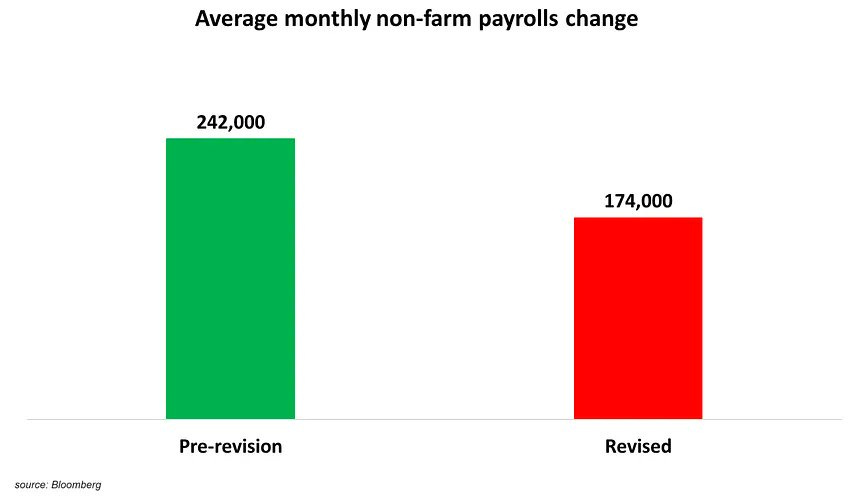

As a result, monthly payroll gains were lowered by ~68,000 a month on average to 174,000 from initially reported 242,000 for that period.

In other words, instead of adding 2.9 million total jobs for 12 months through March 2024, it appears that the US economy added ~2.1 million.

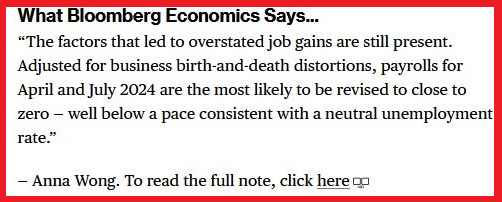

Most recently, non-farm payrolls have been revised down by 150,000 jobs so far (highlighted in red below) in Q2 2024.

Therefore, the US economy created 503,000 jobs in the last quarter (108,000 in April, 216,000 in May and 179,000 in June) instead of 653,000 initially reported.

In fact, Anna Wong from Bloomberg Economics estimate that April payrolls may be revised down to 16,000 from 108,000.

Additionally, the July reported numbers of 114,000 can be adjusted down to as low as 22,000.

Just two months set to be revised down by 184,000 jobs.

In conclusion, Friday's data are still important from the short-term market moves perspective, especially the unemployment rate and weekly wage metrics.

Nevertheless, to find out the real picture of the US labor market we have to dig much further and most importantly - WAIT FOR REVISIONS.

To stay ahead with the US economy and the global financial markets, subscribe below for less than $0.5 a day to get access to more exclusive content.

If you liked this preview please repost it to share the awareness about the true picture of the US job market.

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter:

Why subscribe?