US technology stocks underperformed after NVIDIA's quarterly results. Weekly market recap, trading week 35/2024

Summary of the trading week in several posts with the most interactions on X

In this series, I’ve been bringing out financial posts with the largest number of interactions from my feed on the X platform over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

This week was focused on NVIDIA’s quarterly earnings results and US consumer confidence surveys. At first glance, both were positive but when one digs deeper into the data he could find a slightly different picture. In effect, the S&P 500 finished the week slightly up while technology stocks were the biggest laggards.

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 finished up by 0.2%, marking the 4th consecutive week of increases.

- Nasdaq index was down 1.0%

- Dow Jones increased by 0.9%

- Russell 2000 (small caps) was down by 0.2%

- VIX index fell by 6%

- Gold was down slightly by 0.4%

- Bitcoin dropped by 8%

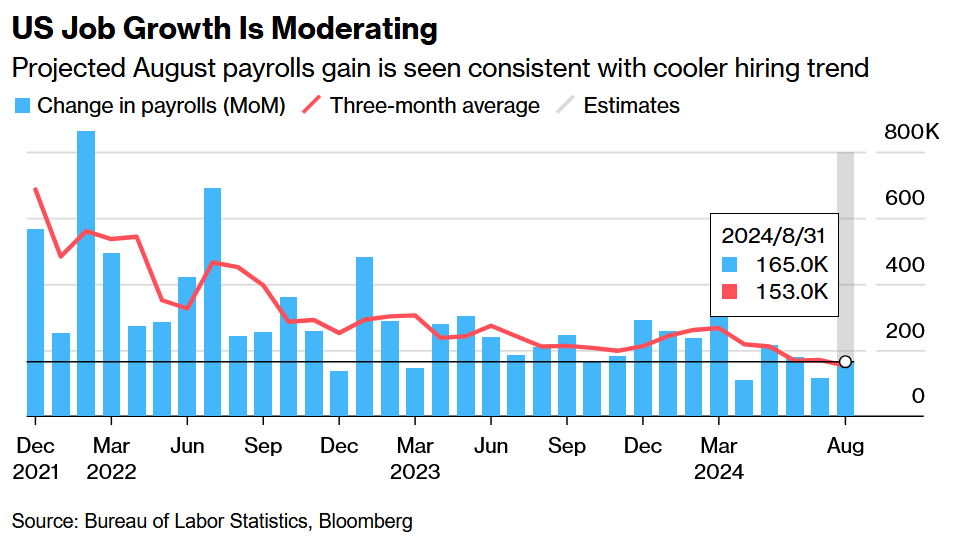

For the trading week ending September 6, key events are:

- US ISM Manufacturing PMI data for August on Tuesday

- US JOLTS Job Openings data for July on Wednesday

- US ADP Nonfarm Employment data for August on Thursday

- US Non-Farm Payrolls for August on Friday

All eyes will be on US labor market data during the week looking for hints as to whether it has deteriorated further.

Analysts anticipate the job market added 165,000 new jobs in August, higher than the 114,000 gain seen in July. The US unemployment rate is expected to tick down to 4.2% from 4.3% in July.

2) Why global central banks are buying record amounts of gold?