US stocks recorded the worst start to September in 23 years. Weekly market recap, trading week 36/2024

Summary of the trading week in several posts from the X platform with the most interactions

In this series, I’ve been bringing out financial posts with the largest number of interactions from my feed on the X platform over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

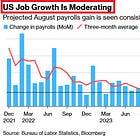

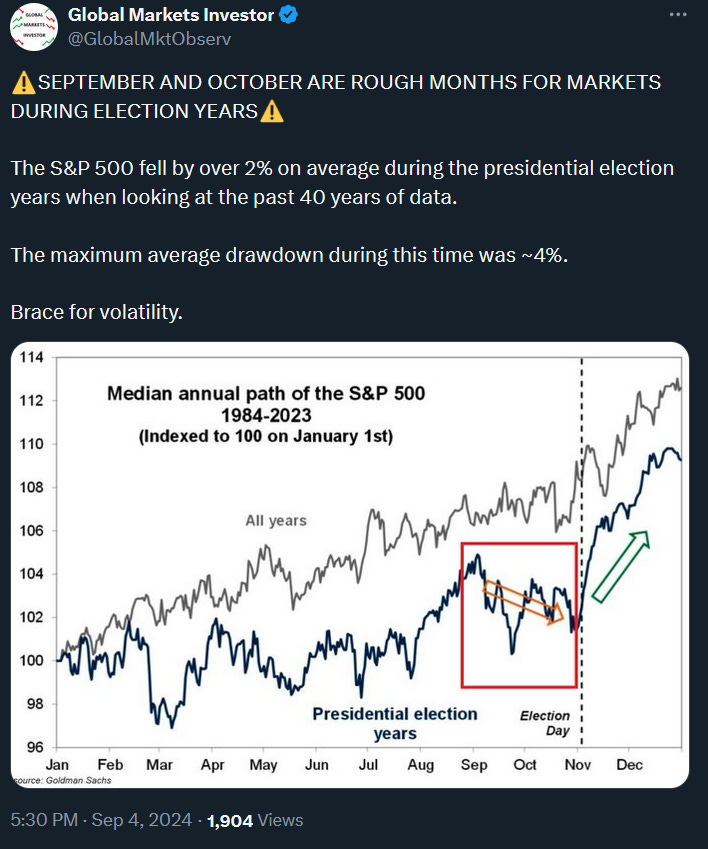

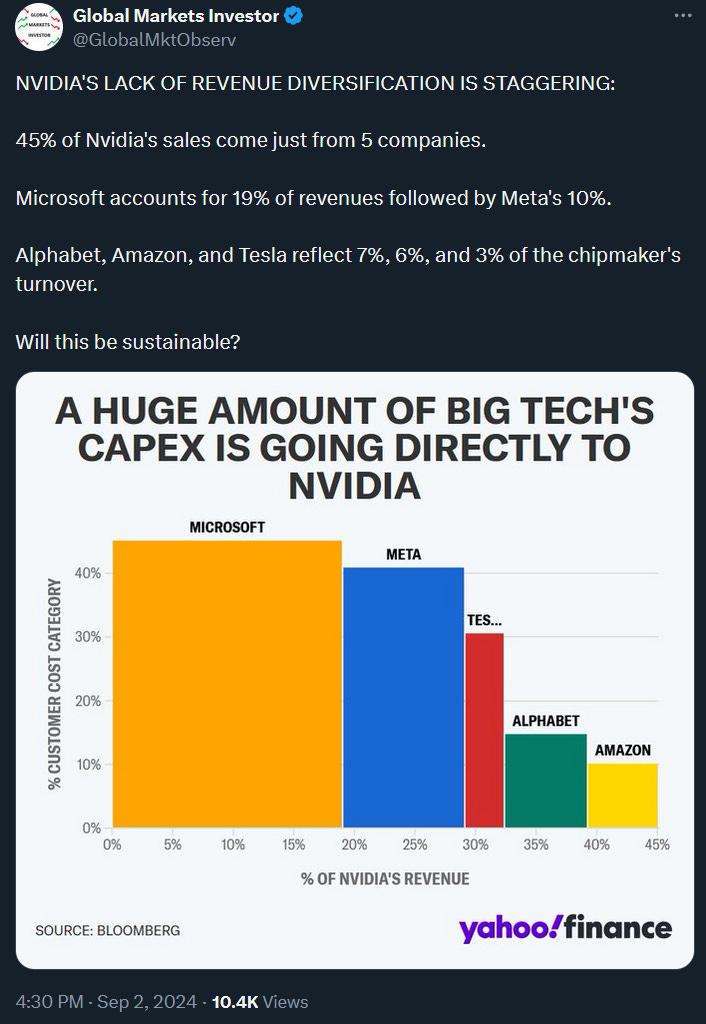

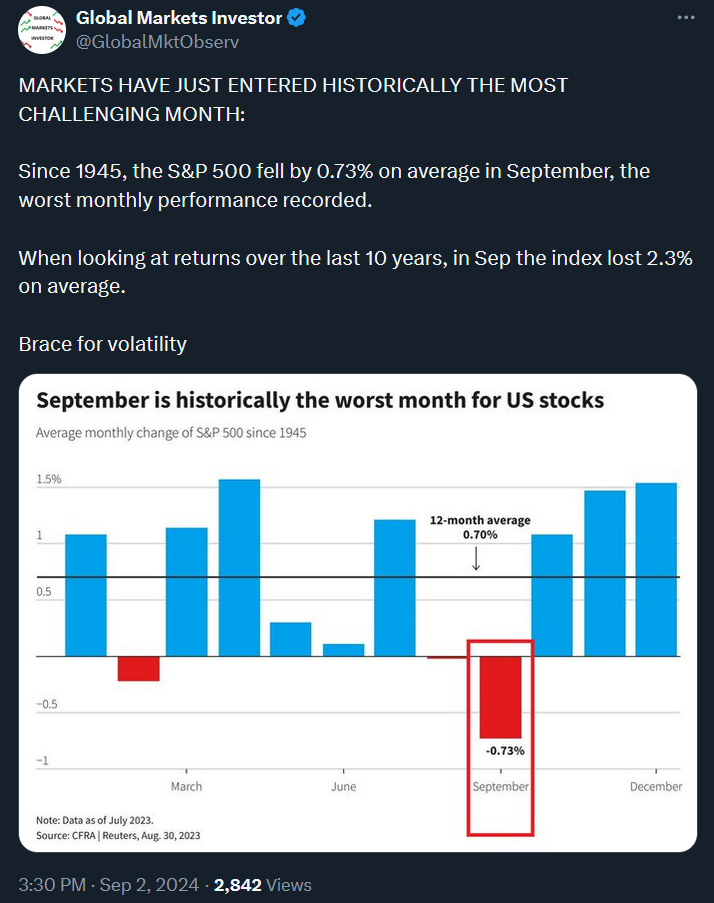

That was a pretty intensive week with the US labor market data in focus. September is usually a rough month for stocks and the first days have already proven this with major indices dropping by 3-6%. Notably, the S&P 500 and the Nasdaq marked the worst first 4 days of September since 2001, according to Dow Jones Market Data. The S&P 500 also suffered the largest drop since the March 2023 regional-banking crisis. Meanwhile, NVIDIA is down by 27% from its peak and erased over $600 billion in market value.

Please also check my latest on how US stocks perform after the Fed cuts interest rates.

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 was down by 4.3%

- Nasdaq index fell by 5.8%

- Dow Jones declined by 3.0%

- Russell 2000 (small caps) was down by 5.8%

- VIX index spiked by 48%

- Gold was down slightly by 0.1%

- Bitcoin dropped by 9.3%

For the trading week ending September 13, key events are:

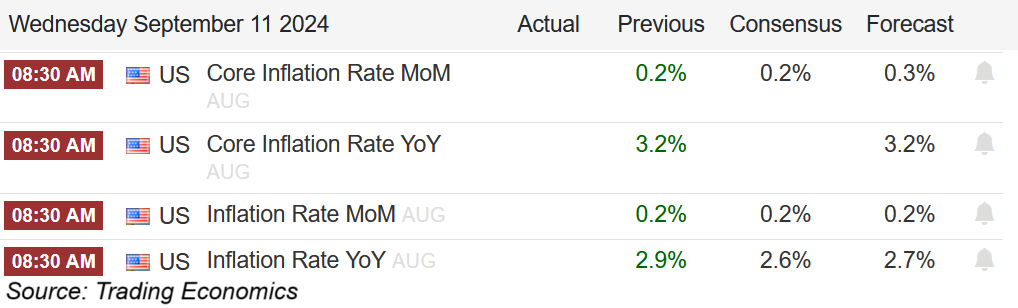

- US CPI inflation data for August on Wednesday

- US PPI inflation data for August on Thursday

- US University of Michigan Consumer Sentiment for August on Friday

Investors will be watching with carefulness inflation data for August since it is the last print before the Fed’s September 18 meeting. Nevertheless, only a significant spike in inflation could stop the central bank from start cutting rates.

Wall Street analysts expect that inflation rate rose by 2.6% year-over-year and the core CPI by 3.2%.

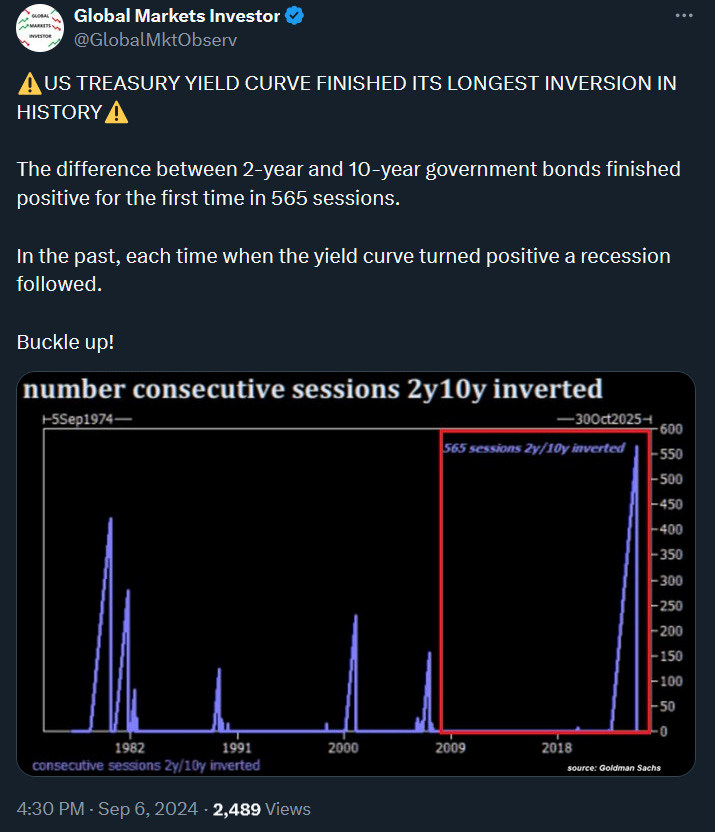

2) This has not happened in the markets in at least 35 years!