US stocks posted the best week of 2024. Weekly market recap, trading week 37/2024

Summary of the trading week in several posts from the X platform with the most interactions

In this series, I’ve been bringing out financial posts with the largest number of interactions from my feed on the X platform over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

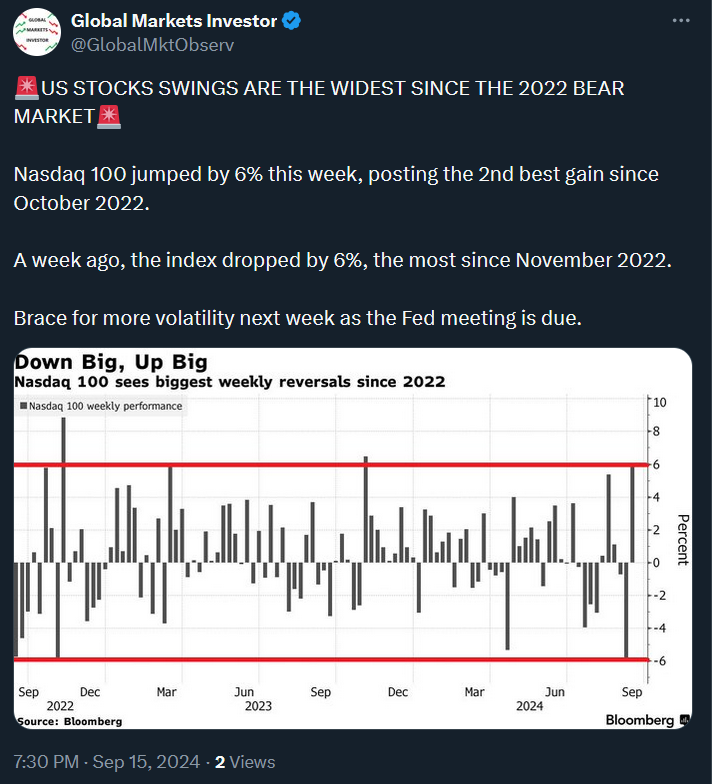

After the worst start to September in 23 years, major US stock indices recorded the best week of the year. This has been driven by the technology sector with NVIDIA's 16% rally. Nevertheless, equities are sitting now at key technical levels. A potential break to the upside will be driven by next week’s events, especially the Fed interest rate decision on Wednesday.

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 was up by 4.0%

- Nasdaq index rallied 5.9%

- Dow Jones increased by 2.6%

- Russell 2000 (small caps) was up by 4.2%

- VIX index fell by 27%

- WTI Crude Oil rose by 2.3%

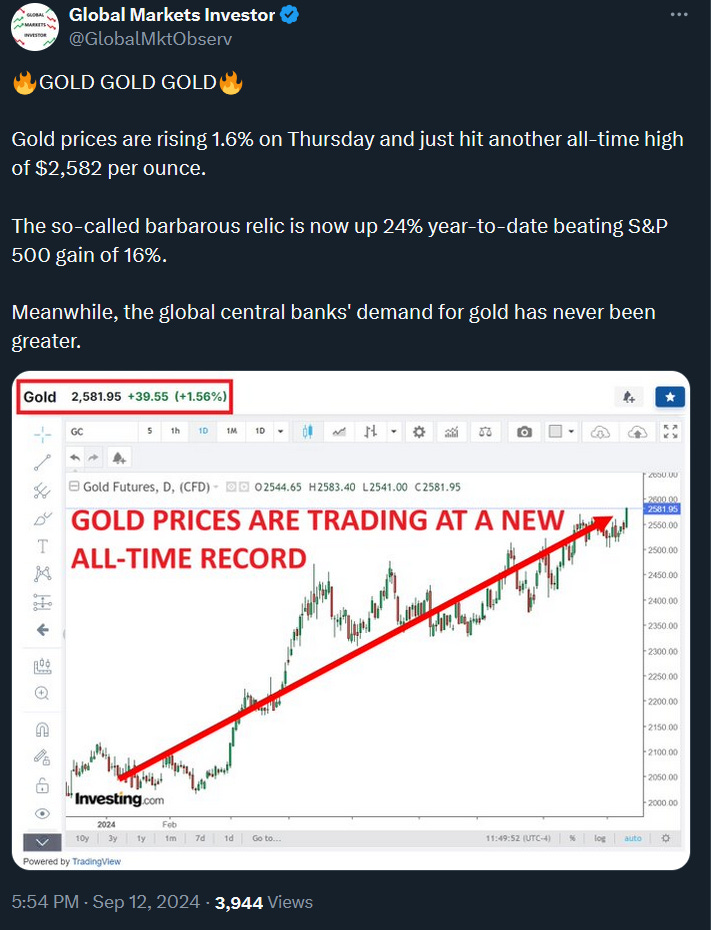

- Gold was up by 3.4%

- Bitcoin rallied 10%

For the trading week ending September 20, key events are:

- US Retail sales for August on Tuesday

- US Building Permits for August on Wednesday

- Federal Reserve Interest Rate Decision and Chair Powell Press Conference on Wednesday

- US Existing Home Sales for August on Thursday

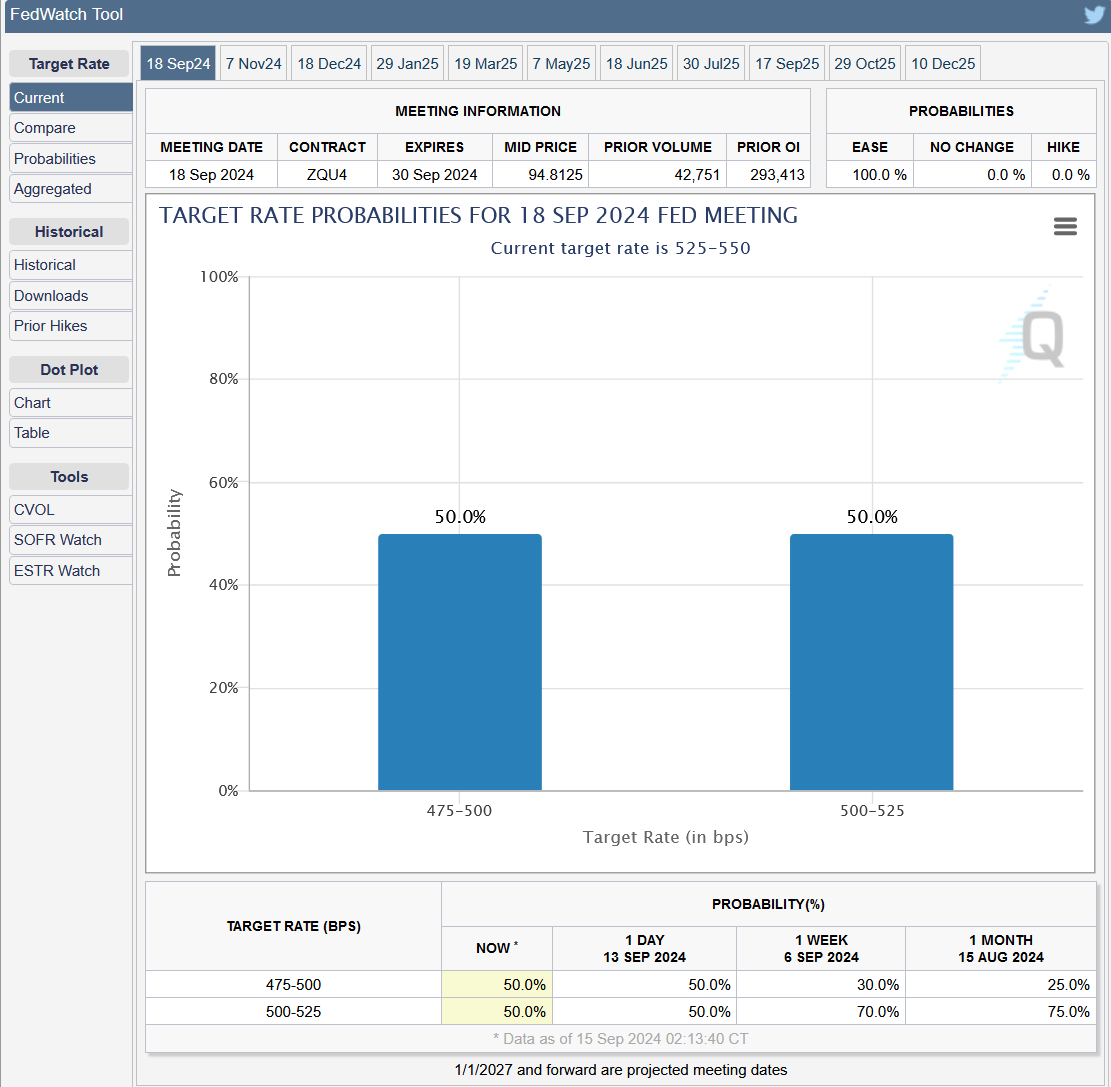

The key focus will be on retail sales and the Federal Reserve which will cut rates for the first time since March 2020. The big question is whether the reduction will be 0.25% or 0.50%. The market is currently seeing a 50% chance for both scenarios. In other words, nobody knows nothing. This is truly unprecedented. No matter the outcome, a lot of market participants will be disappointed. As I wrote before, I would be leaning toward a 0.50% cut given Powell’s last speech and deteriorating job market data.

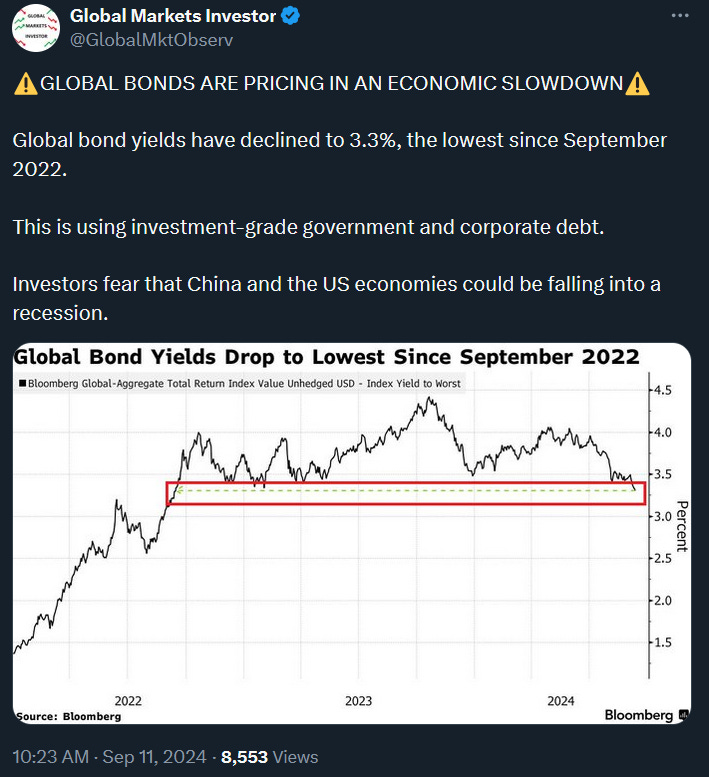

2) US bond market is pricing in a high probability of a recession.