US stock market recorded modest gains while volatility remains elevated. Weekly market recap, trading week 40/2024

Summary of the trading week using the most popular posts from the X platform

In this series, you can find financial markets posts with the largest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

Last week was dominated by the US labor market data. There is so much to digest which goes beyond the main headlines that another comprehensive piece related to the topic will be released next week. Apart from that, oil prices and the volatility index VIX saw notable spikes over the last few days most likely related to the Middle East tensions.

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 was up 0.2% and hit its 43rd all-time high this year.

- Nasdaq index increased by 0.1%

- Dow Jones rose 0.1%

- Russell 2000 (small caps) was down 0.8%

- VIX index surged 11%

- WTI Crude Oil rallied 9.2%

- Gold was up 0.1%

- Bitcoin fell by 5.4%

For the trading week ending October 11, key events are:

- NVIDIA AI summit on Monday

- Fed Meeting Minutes on Wednesday

- US CPI Inflation data for September on Thursday

- US PPI Inflation data for September on Thursday

- 19 Fed Speakers

- Q3 2024 earnings season kick-off

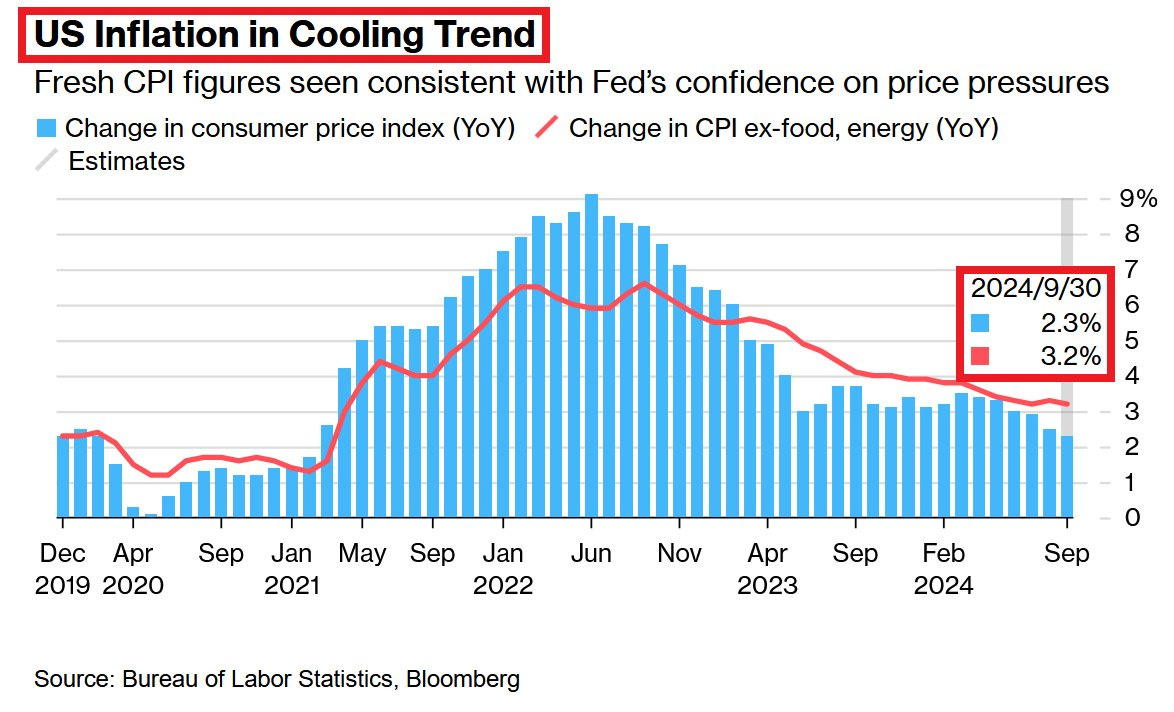

This week market participants will be particularly focused on US inflation data for September. It will be interesting to see whether the inflation rate continues to fall.

US CPI inflation is expected to rise 2.3% year-over-year in September, down from 2.5% last month. Core CPI (excl. food and energy) is anticipated to rise 3.2%, down from 3.3% in August.

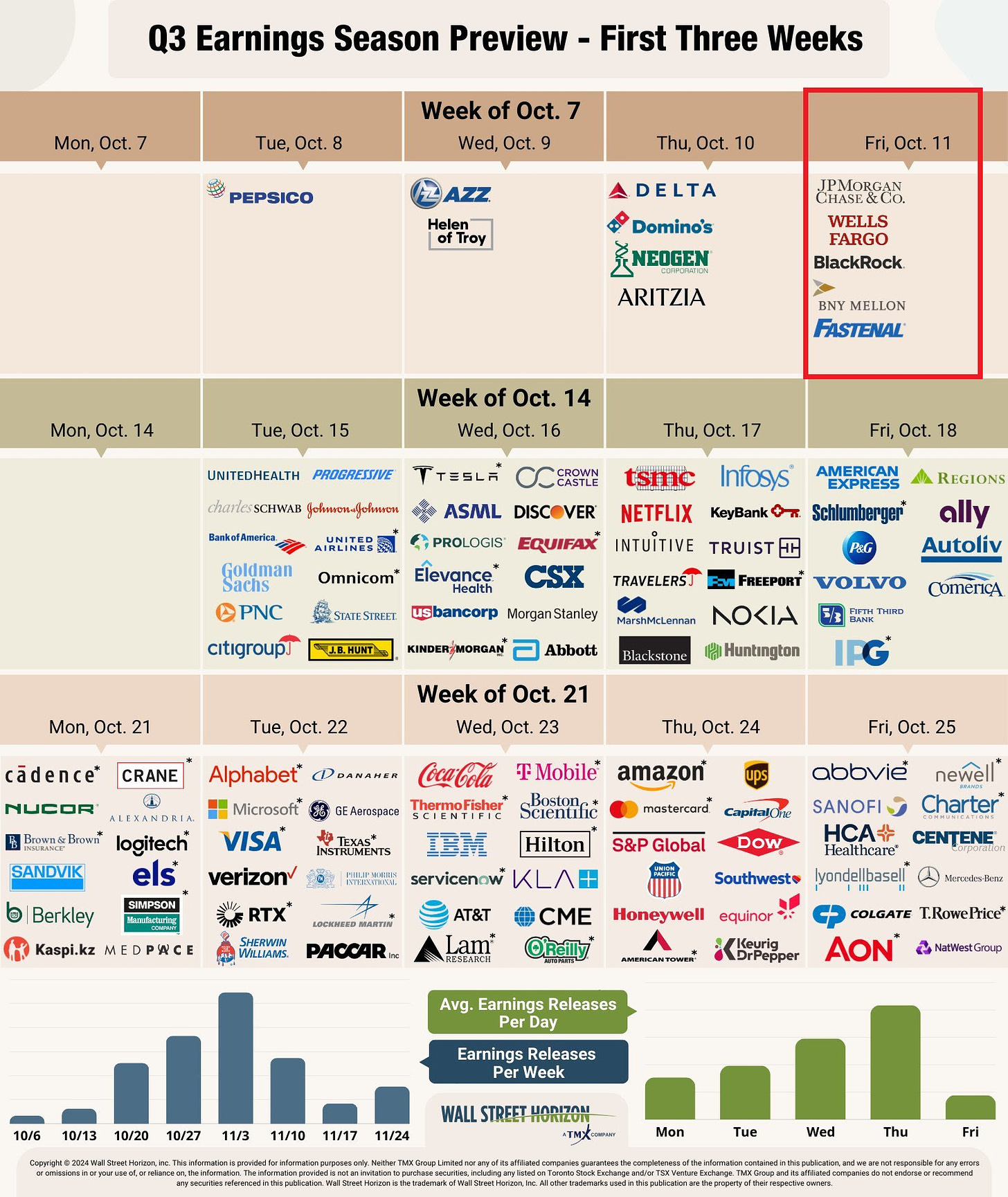

Q3 2024 earnings season also kicks off in the US. On Friday, a couple of large banks are scheduled to report their quarterly earnings. JPMorgan, $JPM, and Wells Fargo, $WFC, will be particularly interesting.

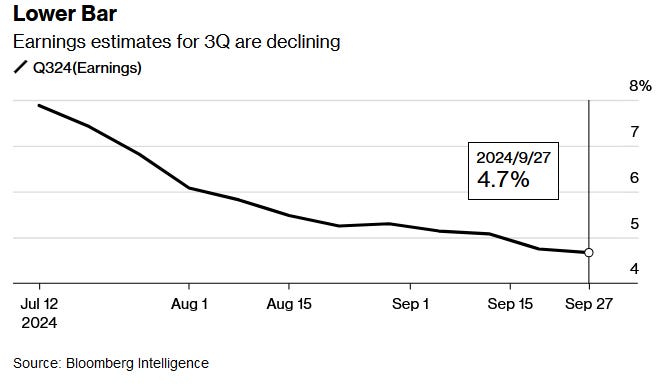

Interestingly, Wall Street analysts expect earnings growth of 4.7% year-over-year in Q3. These expectations have fallen from as much as 7.9% seen in July. Firms’ commentary around consumer demand and the economic environment will be key to watch.

2) Artificial Intelligence (AI) will likely only take over up to 5% of all jobs over the next 10 years.