‼️US stock market has been driven by just a handful of stocks

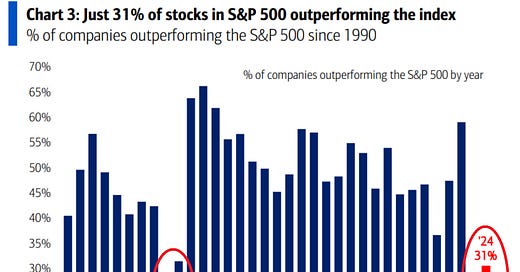

Only 31% of the S&P 500 firms have outperformed the index year-to-date.

57,100 - this is the number of views of this content over the last 30 days. This is pretty impressive how fast the overall reach has been growing here and on social media. Unfortunately, inflation has also been rising. The best ways to fight this are investing in financial markets and growing business and its profits.

This is why prices for NEW paid subscribers will go up from the 1st of January 2025 to $19.99 a month and $199 a year. This is still below the pricing of most creators and a decent price for the amount and quality of research you receive. You can secure the current (old) pricing below before December ends.

Only 31% of the S&P 500 firms have outperformed the index year-to-date. In other words, 31% of companies gained more than 27% and 69% have had a return lower than that.

This also marks the second straight year with such a low participation after 29% recorded in 2023. Over the last 70 years, this happened only once, in the 1998-1999 Dot-Com Bubble.

To put this into perspective, the long-term average of this metric has been ~50%.

This means the overall stocks' participation in the S&P 500 rally has been pretty weak. To put this differently, less than a one-third number of companies have been driving the market gains.

Stock market concentration has rarely been greater. More on this topic in the below articles:

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter or Nostr:

Why subscribe?