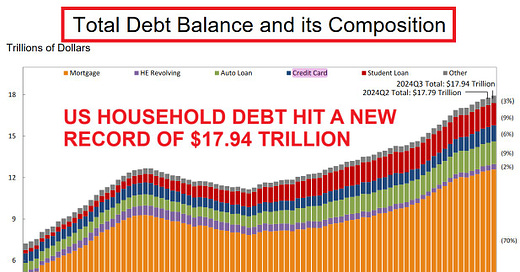

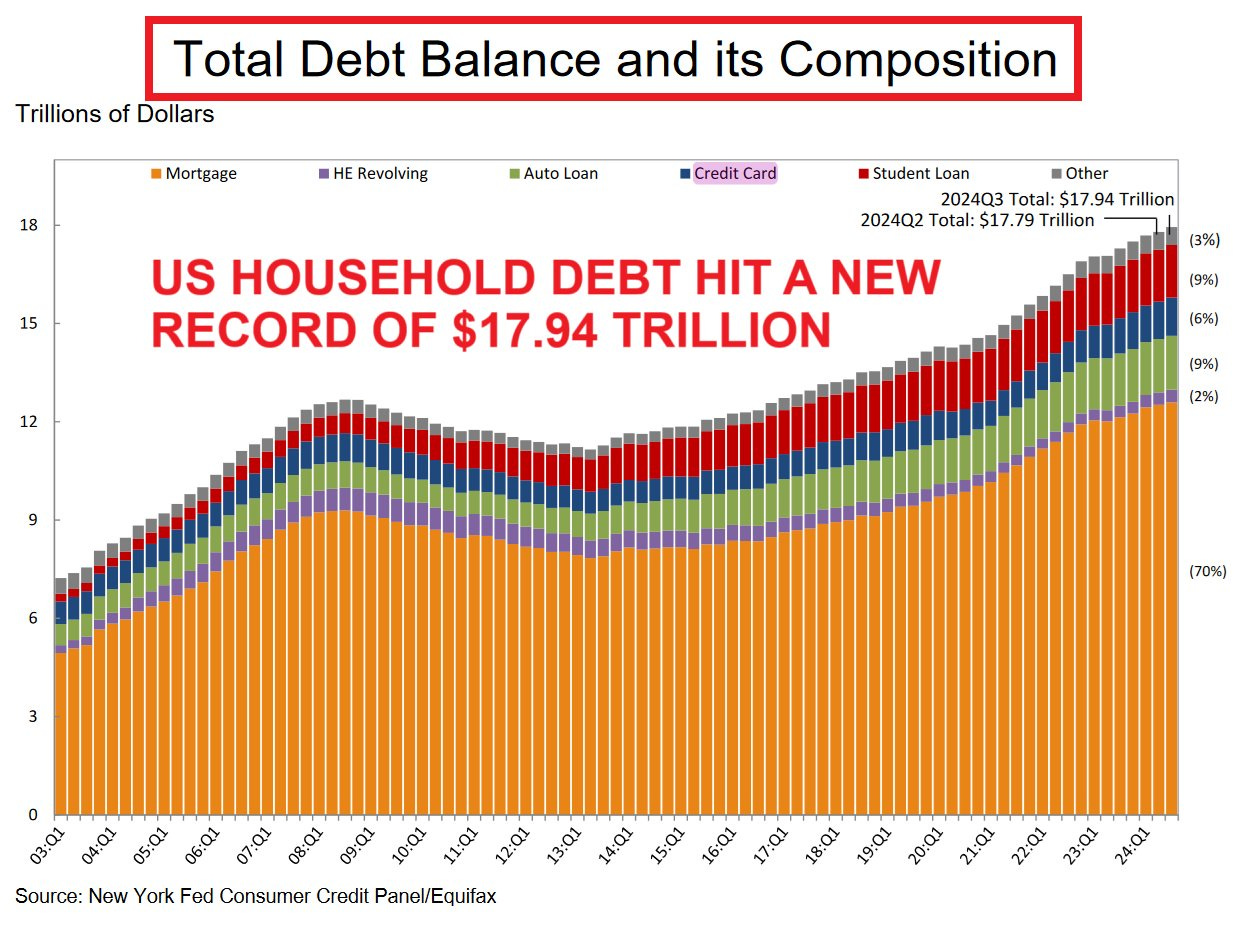

US household debt hit a new record of $17.94 trillion in Q3 2024.

What is the true shape of the US consumers' finances?

US household debt rose by $147 billion in Q3 2024 and reached an all-time high of $17.94 trillion.

Household debt has increased by $778 billion over the last 12 months.

Breaking by categories, the mortgage debt surged by $75 billion last quarter and reached an all-time record of $12.59 trillion.

Subsequently, credit card debt rose by $24 billion to a record $1.17 trillion.

Student and auto debt soared by $21 billion and $18 billion, to all-time highs of $1.61 trillion and $1.64 trillion, respectively.

This is a pretty concerning trend as it seems Americans are trying to fight record-rising prices with debt. The below analysis digs into more data about US consumers' financial shape and tries to answer how stressed are households in the world's largest economy.

CREDIT CARD DEBT AND AUTO LOAN DELINQUENCIES ARE RISING AT A CRISIS PACE