US economic growth disappoints with hotter-than-expected inflation in Q1 2024. Microsoft and Google beat earnings expectations.

Fed's preferred PCE inflation data due on Friday is even more important and should overwhelm Thursday's developments.

That was a crazy day in the financial markets. First of all, in the morning the US Bureau of Economic Analysis released US GDP data for Q1 2024 along with its Personal Consumption Expenditure (PCE) index or the so-called PCE inflation.

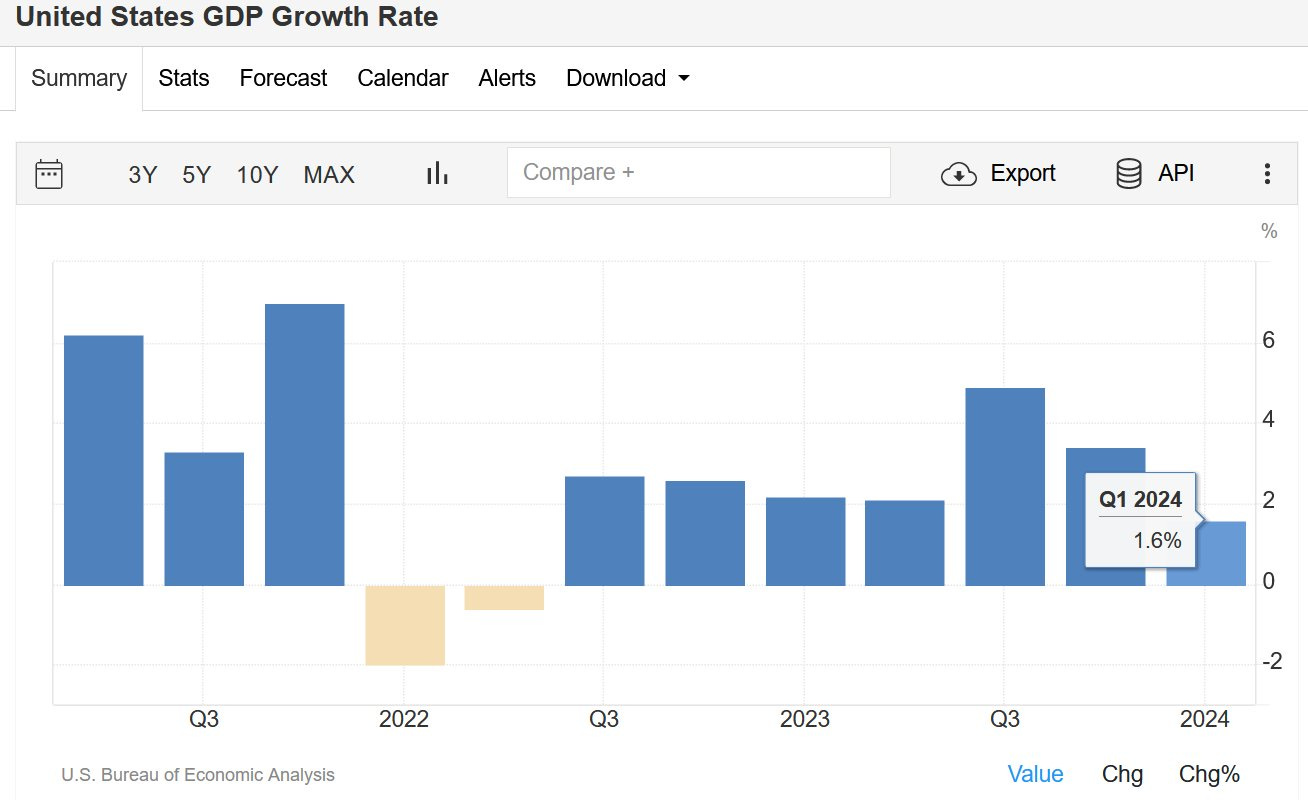

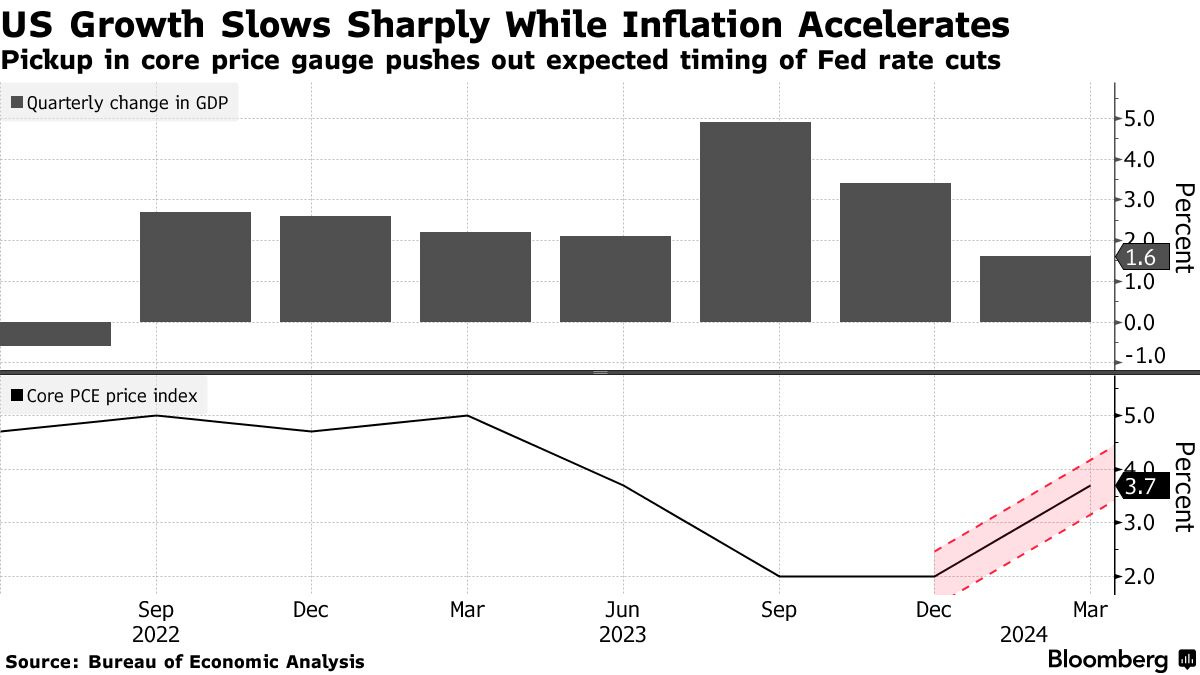

The US economy grew by only 1.6% quarter-over-quarter in Q1 2024, which was below average economists’ estimates of 2.4% growth.

That was a really significant miss versus expectations.

By comparison, the world's largest economy grew by 3.4% in Q4 2023.

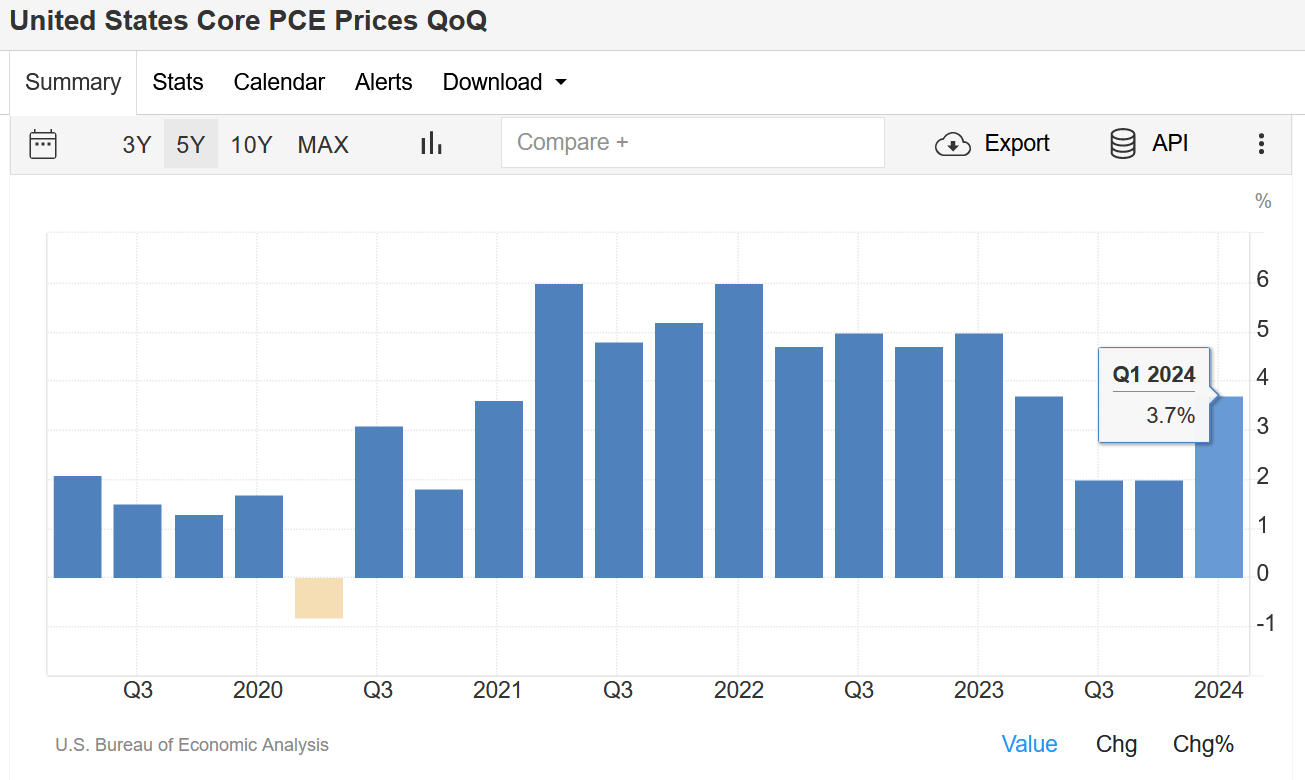

More importantly, however, the PCE inflation for Q1 came much hotter than expected, spurring the markets. PCE prices were up 3.4% quarter-over-quarter above the 2.9% expected versus 1.8% in Q4 2023.

Moreover, the Core PCE (excluding energy and food) prices were up 3.7% quarter over quarter from 2% occurred in Q4 2023, above the 3% estimated by economists.

In effect, stocks started to plummet with US government bond yields and VIX spiking at the same time. The initial reaction was clear - this is the worst outcome for the Fed, slowing growth and accelerating inflation. The below excerpt shows the first market response:

Furthermore, the 10-year Treasury yield jumped to the highest level since October 2023 and ended the session at these levels.

As it was not enough, the market started pricing only one rate cut this year and pushing it to November/December Fed meetings while putting more probability into a rate hike. More about the chances of a Fed’s rate hike this year was explained in the below piece:

As the trading session lasted, stocks began to rebound as the S&P 500 tried to defend the key 5,000 points level. Ultimately at the close, the main US stock index was down only by 0.5%, recovering from an almost 1.5% decline. The 5,000 threshold has been defended.

As you can see, that was a volatile session. Nevertheless, the Volatility index VIX ended up by only 2% as nothing has happened.

GOOGLE AND MICROSOFT EARNINGS RELEASES

After the close, 2 of the Magnificent 7 companies reported their earnings - Google and Microsoft. In short, both companies firmly exceeded Wall Street expectations, triggering their stocks to spike.

Google beat revenue and earnings expectations whilst announcing an additional $70 billion buyback authorization. The company also declared a $0.20 dividend for the first time ever.

1Q revenue came at $67.59 billion, above the $66.07 billion estimated

1Q Advertising revenue was $61.66 billion above the $60.18 billion estimated

1Q Earnings per share was $1.89 above the $1.53 expected

As a result, the stock skyrocketed by more than 12% in the after-hours trading and will reach a new all-time high if it lasts when the market reopens on Friday.

Microsoft also beat expectations and reported Q3 sales of $61.86 billion versus $60.87 billion estimated.

The company recorded strong Q3 cloud revenues of $35.1 billion versus an estimated $33.93 billion.

Other segments also came above forecasts:

Productivity and Business Processes Q3 revenue was $19.57 billion, above the estimated $19.54 billion

More Personal Computing Q3 revenue is $15.58 billion, above the estimated $15.07 billion

Intelligent Cloud Q3 revenue was $26.71 billion, above the estimated $26.25 billion

“Microsoft Copilot and Copilot stack are orchestrating a new era of AI transformation, driving better business outcomes across every role and industry," said Satya Nadella, chairman and chief executive officer of Microsoft.

AI-driven revenue is what large investment funds and investors want to see. As a result, the stock price jumped by more than 4% in the after-hours trading.

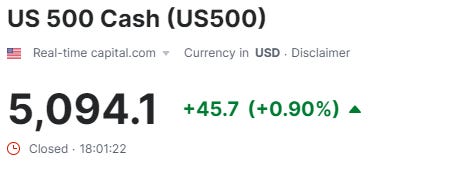

Those two companies’ earnings results helped the S&P 500 index futures to jump to +0.9%, ~100 points above the key 5,000 level.

FOCUSING ON THE BIG PICTURE

At first glance, things look quite promising. And when we consider the above developments, the US stocks should find a better footing in the next few days. The big test, however, is on Friday when the Fed's preferred PCE inflation will be released at 8.30 AM ET. This is what matters the most.

If inflation data disappoints again and comes significantly above expectations, we may see a larger drop than the current ~5% drawdown in the S&P 500 until the Fed meeting due May 1.

On the flip side, if it comes in line or below expectations, the market will likely continue the rally. This data release is really crucial for markets in the weeks ahead.

To find out what to expect from Friday’s inflation release see the below article:

If you find this informative and helpful you may consider starting a premium subscription for under $0.50 a day or buying me a coffee, and following me on Twitter:

Why subscribe?