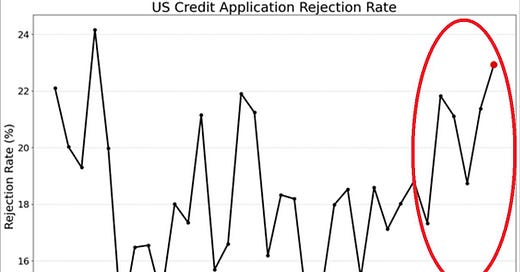

⚠️US credit rejection rates are skyrocketing

Rejection rates for or credit cards, mortgages, auto and other loans hit the highest level since 2015

Rejection rates for credit cards, mortgages, auto, and other loans spiked to 23%, the highest in 10 years. Moreover, the credit card limit increase rejection rate hit nearly 50%, the most on record.

It has rarely been so difficult to access credit in the United States.

There are likely a few reasons behind it. Interest rates are historically elevated (borrowing costs are high), consumers are already significantly indebted, and more Americans are falling behind on their existing debt (delinquency rates are rising).

Read more analysis about the US consumers below:

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter or Nostr:

Why subscribe?