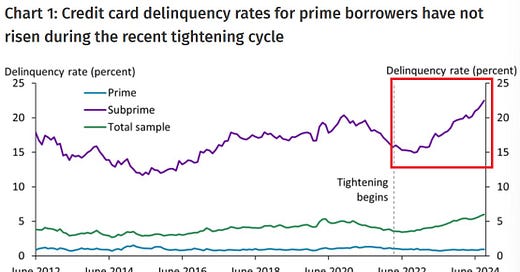

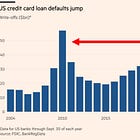

US credit card serious delinquency rates for subprime borrowers rose to 22% in Q3 2024, the highest in at least 12 years. They have risen by 7 percentage points over the last 2 years.

These consumers account for ~23% of the consumer credit market, according to Fed.

This is another evidence of struggling consumers, especially the bottom-income bracket. Elevated interest rates and record prices are behind the weakness.

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter or Nostr:

Why subscribe?