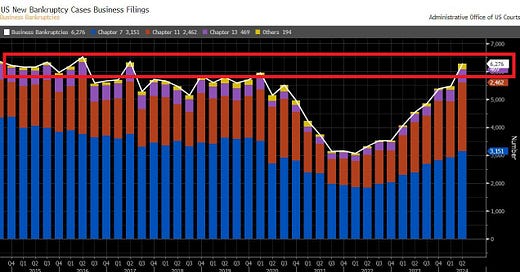

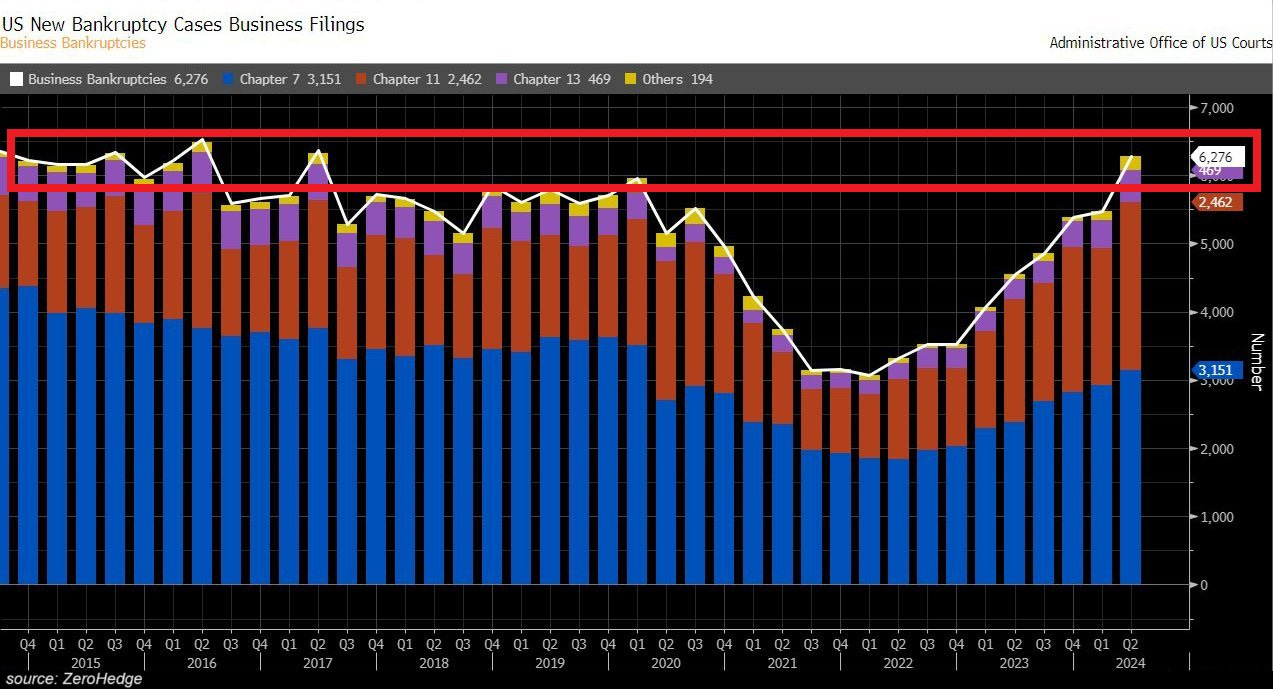

US BANKRUPTCIES have been rising at the fastest pace since the Great Financial Crisis

New bankruptcy cases in the US jumped to 6,276 in Q2 2024, the highest level since Q2 2017

The number of bankruptcies in the US jumped by nearly 40% year-over-year in Q2 2024 to 6,276 cases, the highest level in 7 years. Over the last 3 years, bankruptcy filings have doubled rising at the fastest pace since the Great Financial Crisis of 2007-2009.

Chapter 11 filings hit 2,462, the most in 13 years. A Chapter 11 filing involves court-supervised reorganization and allows a company to stay in business and restructure its finances and operations.

Chapter 7 cases also called liquidation bankruptcy reached 3,151, the most since the COVID crisis. In a Chapter 7 bankruptcy, the assets of a business are liquidated to pay its creditors.

Chapter 13 filings and others reached 469 and 194, respectively. In the Chapter 13 case, the debtor agrees to repay at least a portion of their debts over a three- to five-year period under court supervision.

This does not look like a soft landing and provides another recession signal. More analysis regarding the US economy can be found in the below articles:

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter:

Why subscribe?