Top 5 financial posts of the trading week 9/2024

Summary of the trading week in 5 posts with the most interactions on X

In this series, I’ve been bringing out 5 financial posts of the week with the largest number of interactions from my feed on the X platform. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

Weekly performance. In the attached tweet you can see last week’s performance of the major US indexes, VIX volatility, Bitcoin, and gold. US stocks reached new all-time highs again following the Fed’s preferred inflation metric (core PCE index) coming in line with economists’ expectations as well as worse than expected US manufacturing data (markets usually react positively to bad economic news in expectations of more interest rate cuts). The S&P 500 has been up in 16 of the last 18 weeks. That hasn’t happened in more than 50 years Since 1950 this also had a place in June 1957, August 1958, March 1964, March 1971, and March 2024. If this continues for another week it will be 17 out of 19 positive weeks for the first time since 1964. Finally, Bitcoin increased by more than 20% last week passing $65,000 for the first time since Nov. 2021.

Gold performance. Yellow metal prices increased by almost 3% last week as US government bond yields (especially the 10-year yield) dropped on weaker-than-expected economic data in the US and in line inflation data mentioned above. Going forward, it looks like gold may be marching above all-time highs of ~$2,150 per ounce unless the 10-year US government yield rapidly increases. Interestingly, gold nominated in euros has already reached a new record.

More market voices are arguing that the Fed will not cut rates in 2024 while the central bank as well as the market expect three reductions. This is a pretty significant shift in the narrative given that in December the market was pricing in almost 7 cuts. I made an article about what could happen in the markets if the Fed does not cut this year.

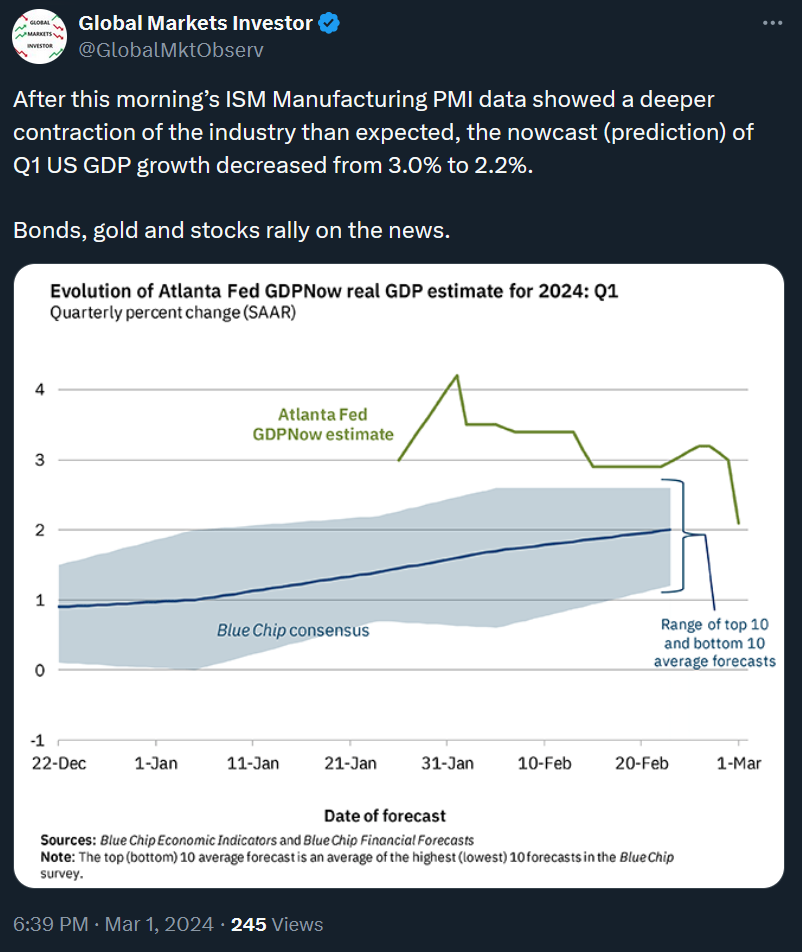

The Federal Reserve Bank of Atlanta provides its US GDP quarterly growth forecast (nowcast - not an official prediction) update every few days based on the already released economic data. The recent estimate came on Friday and currently expects 2.2% growth in the first quarter of 2024, down from 3% previously. There’s still the entire month before the quarter ends but it will be really interesting to see the final outcome sometime in 2Q.

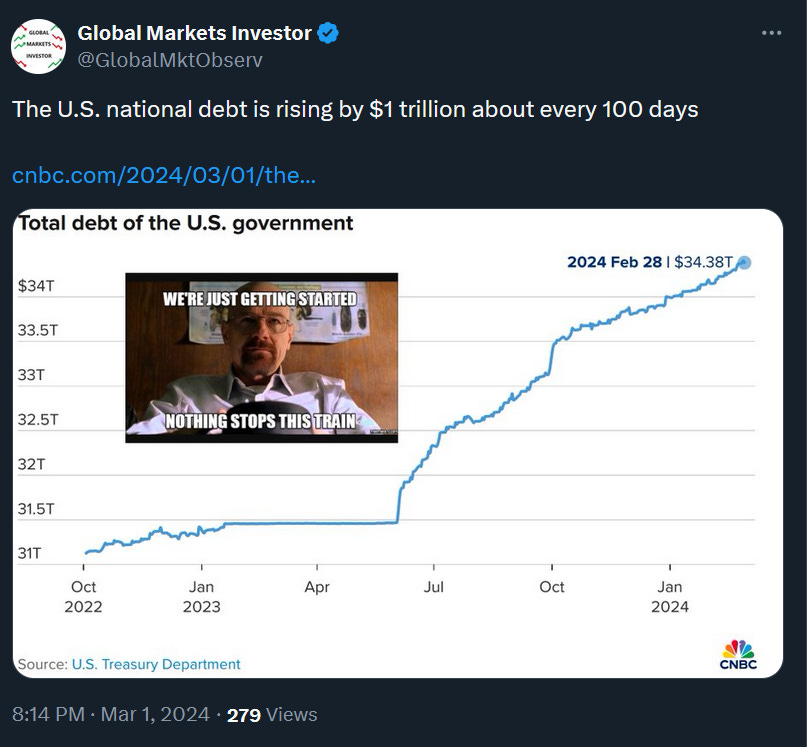

The US national debt reached roughly $34.5 trillion at the end of February, a new record. Since June, the last two $1 trillion jumps occurred in about 100 days according to CNBC. Moreover, in the last five years, for one unit of economic growth (GDP), the US government has created 1.71 units of debt. Over time, the US economy has been becoming less efficient and more indebted as it needs more units of debt to create 1 unit of GDP.

If you find it informative and helpful you may consider buying me a coffee and follow me on Twitter: