Top 5 financial posts of the trading week 8/2024

Summary of the trading week in 5 posts with the most interactions on X

In this series, I’ve been bringing out 5 financial posts of the week with the largest number of interactions from my feed on the X platform. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

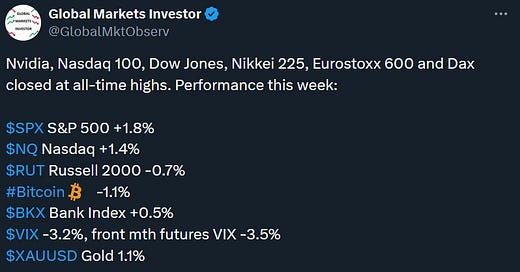

Weekly performance. In the attached tweet you can see last week’s performance of the major US indexes, VIX volatility, Bitcoin, and gold. The S&P 500 increased by almost 2% with Nvidia being up 9% after beating earnings and guidance expectations. Going forward, the Fed's preferred inflation gauge Core PCE price index (excluding energy and food costs) is expected to accelerate in January (data due on Thursday). While the famous 3-month and 6-month annualized metrics of the index are forecasted to jump to 2.4% and 2.6% - above the Fed's 2% long-term target.

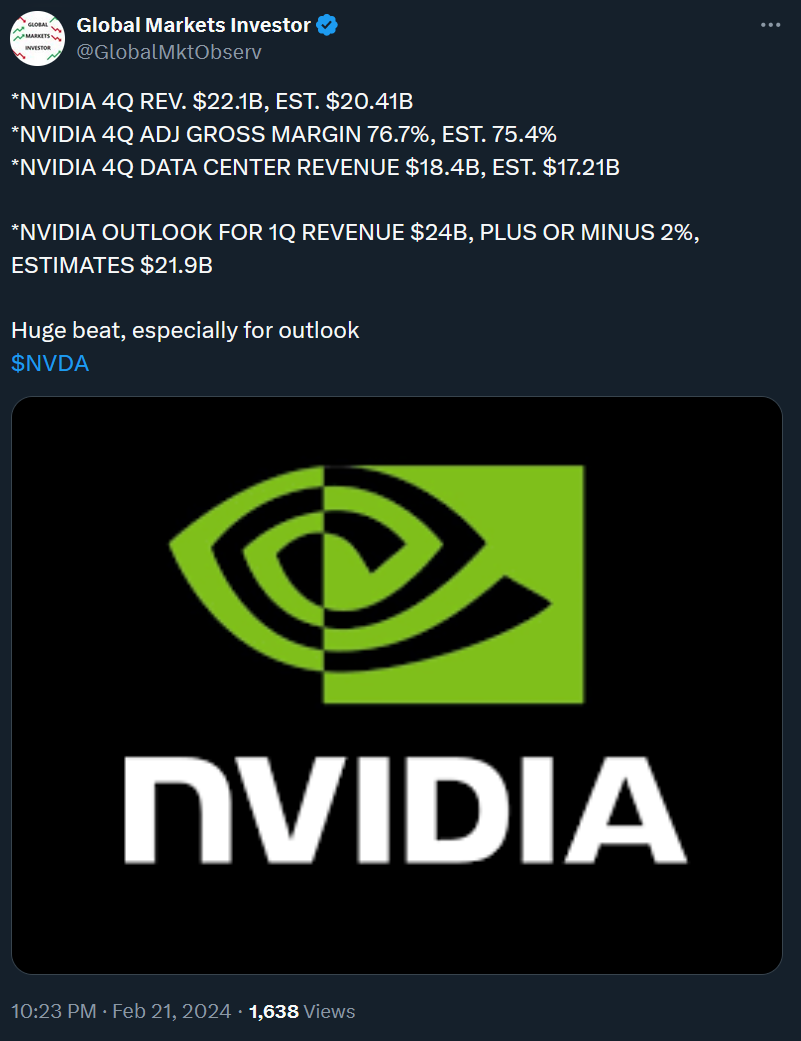

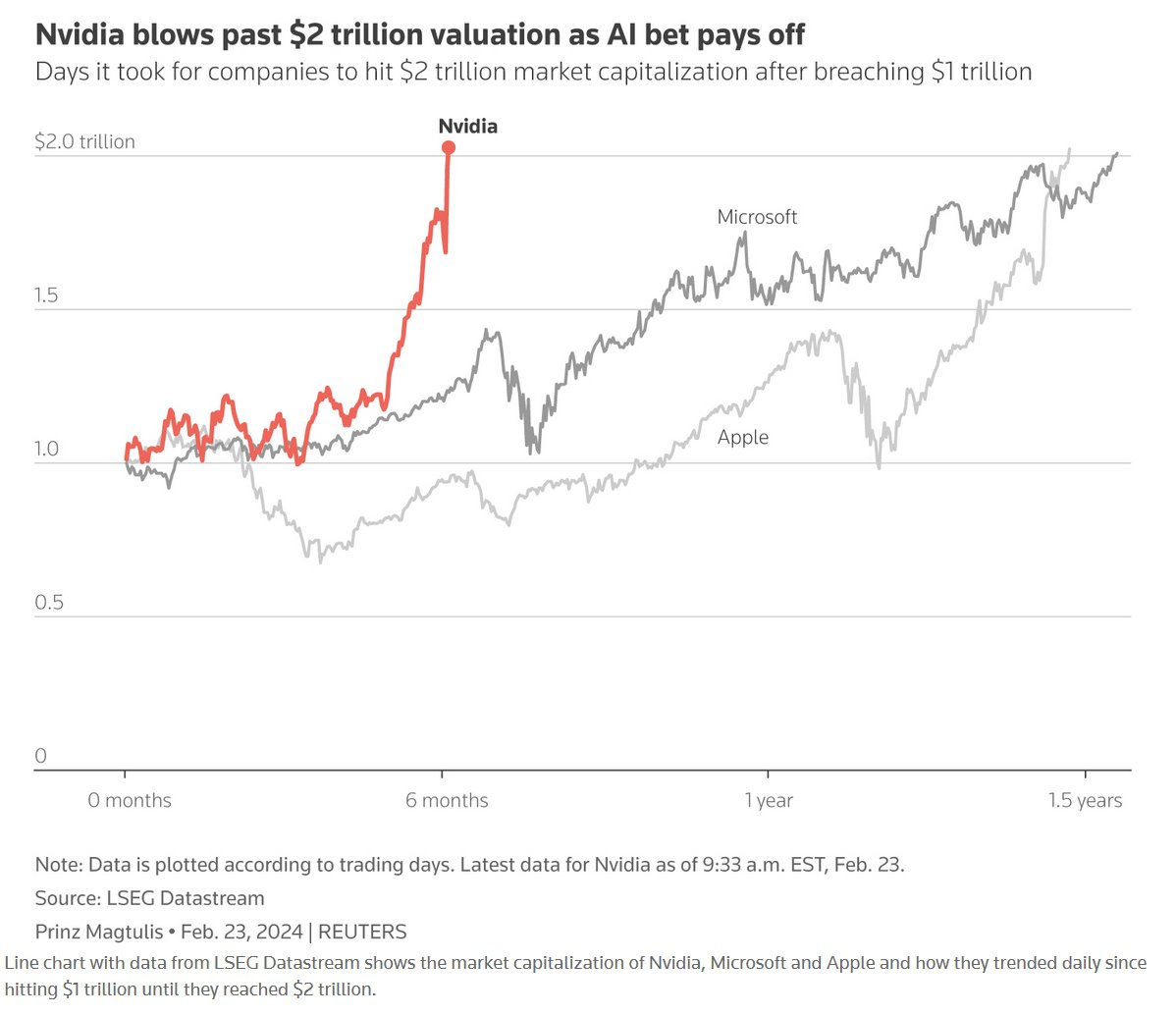

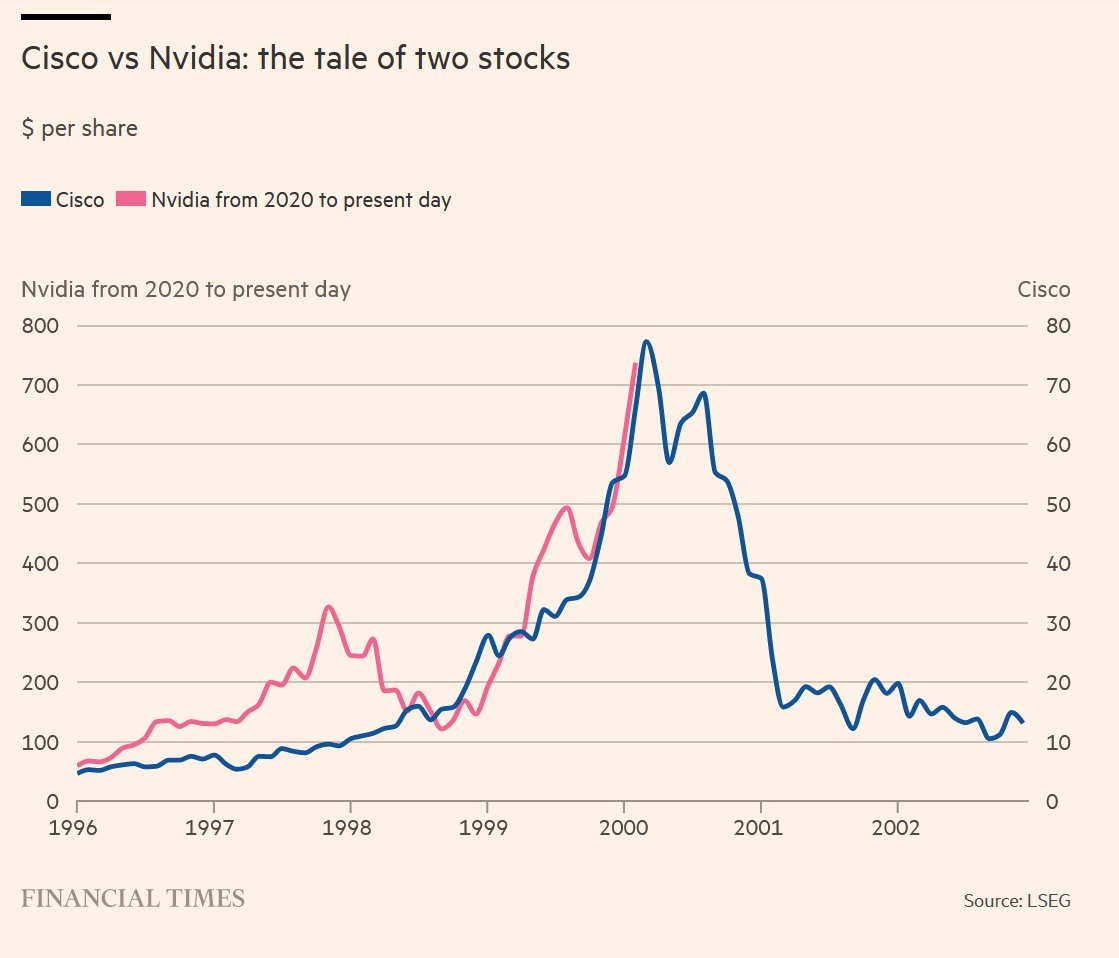

Nvidia quarterly earnings. The chip manufacturer has beaten Wall Street expectations for the 4th time in a row. More importantly, the company’s revenue outlook was $2 billion higher than average estimates. Shares are up more than 240% over the last year. Nvidia's market capitalization has risen from $1 trillion to $2 trillion in around eight months - the fastest among U.S. companies and in less than half the time it took tech giants Apple and Microsoft. It is now the third largest company in the US after above mentioned Apple and Microsoft. Will the company continue its leading performance in the years ahead or it is the next Costco? Time will tell.

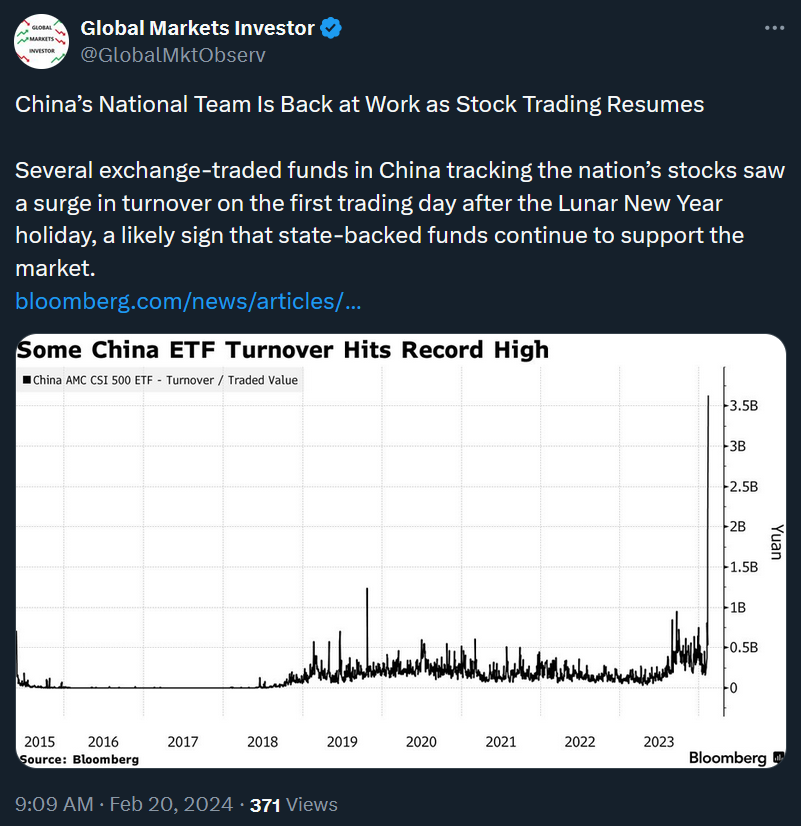

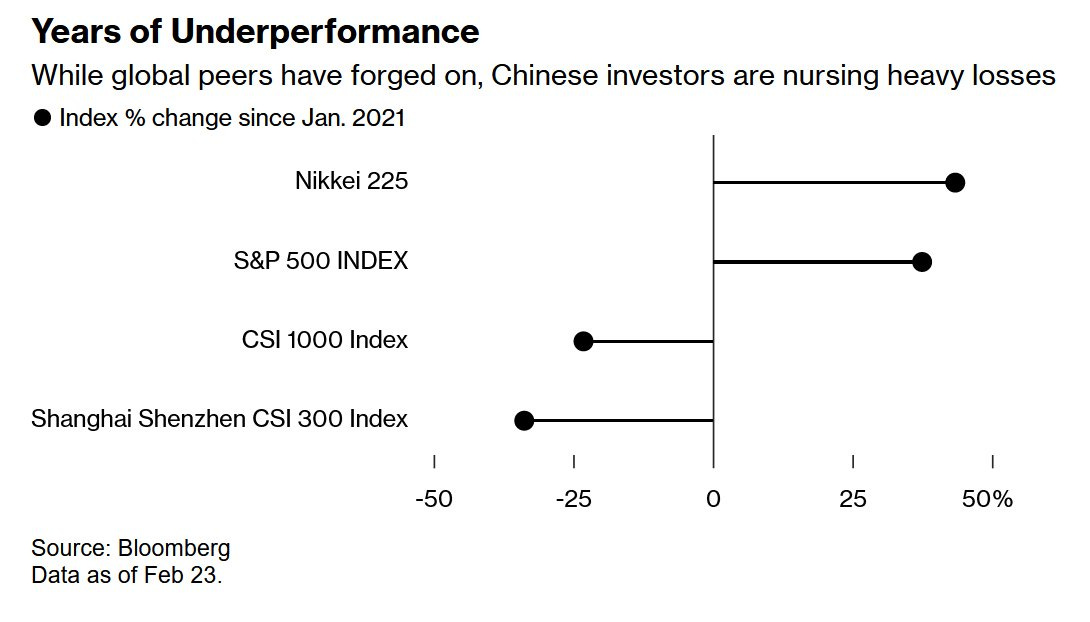

Chinese authorities are trying hard to reverse the falling stock market trend. It looks like state-backed funds continue to support the Chinese market after years of underperformance.

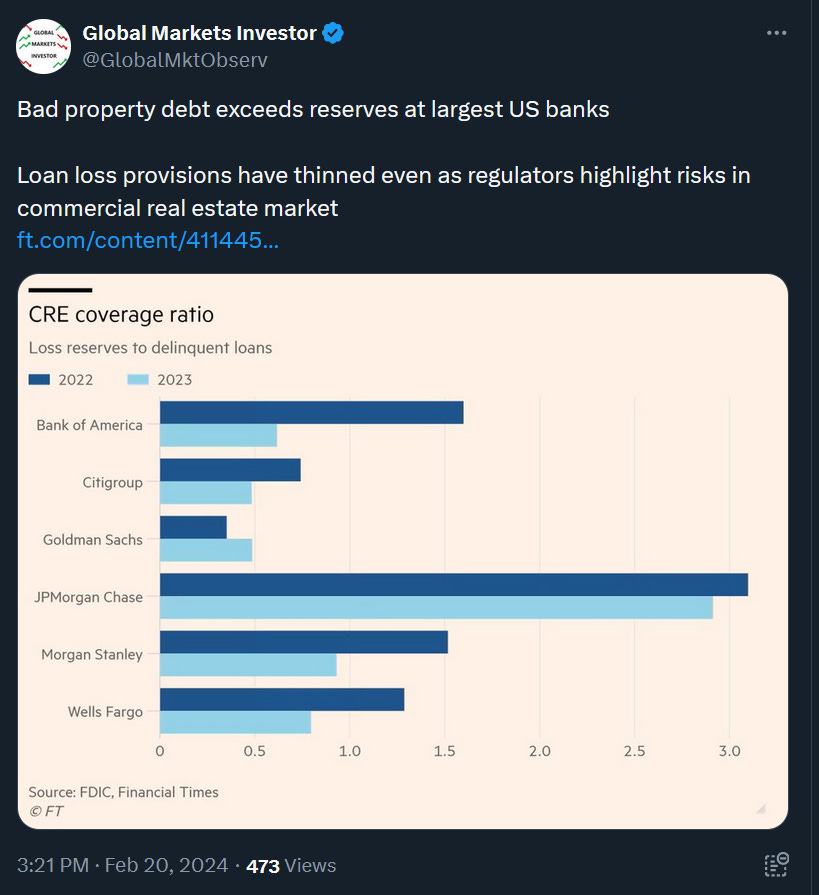

Financial Times reported that bad property debt at the largest US banks exceeds loss reserves collected. A loss reserve is an estimate of an institution’s liability from future claims it will have to pay out while bad debt refers to loans or outstanding balances owed that are no longer deemed recoverable and must be written off. In other words, for all banks on the below list except for JPMorgan Chase the non-recoverable loans given for commercial real estate activities exceed the money which was put aside for this purpose. It is unhealthy for the banks’ financial performance.

Last week, the 10-year US government bond yield briefly touched a new 2024 record of above 4.3% while many investors were focused on Nvidia. This week’s PCE inflation data may provide some further direction for the yields. If any significant grind-up occurs it could spark some sort of trouble for small-cap stocks, gold, and even big tech. Worth watching.

If you find it informative and helpful you may consider buying me a coffee and follow me on Twitter: