Top 5 financial posts of the trading week 11/2024

Summary of the trading week in 5 posts with the most interactions on X

In this series, I’ve been bringing out 5 financial posts of the week with the largest number of interactions from my feed on the X platform. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

Weekly performance. In the below attachment you can see last week’s performance of the major US indexes, the VIX volatility index, Bitcoin, and gold. After higher-than-expected CPI and PPI inflation data in the US last week, the US stocks held pretty well and ended the week slightly lower with Small Caps (Russell 2000) underperforming. Going forward, this week will be very intensive in terms of the market-moving events with the most important - the Fed meeting coming up on Wednesday.

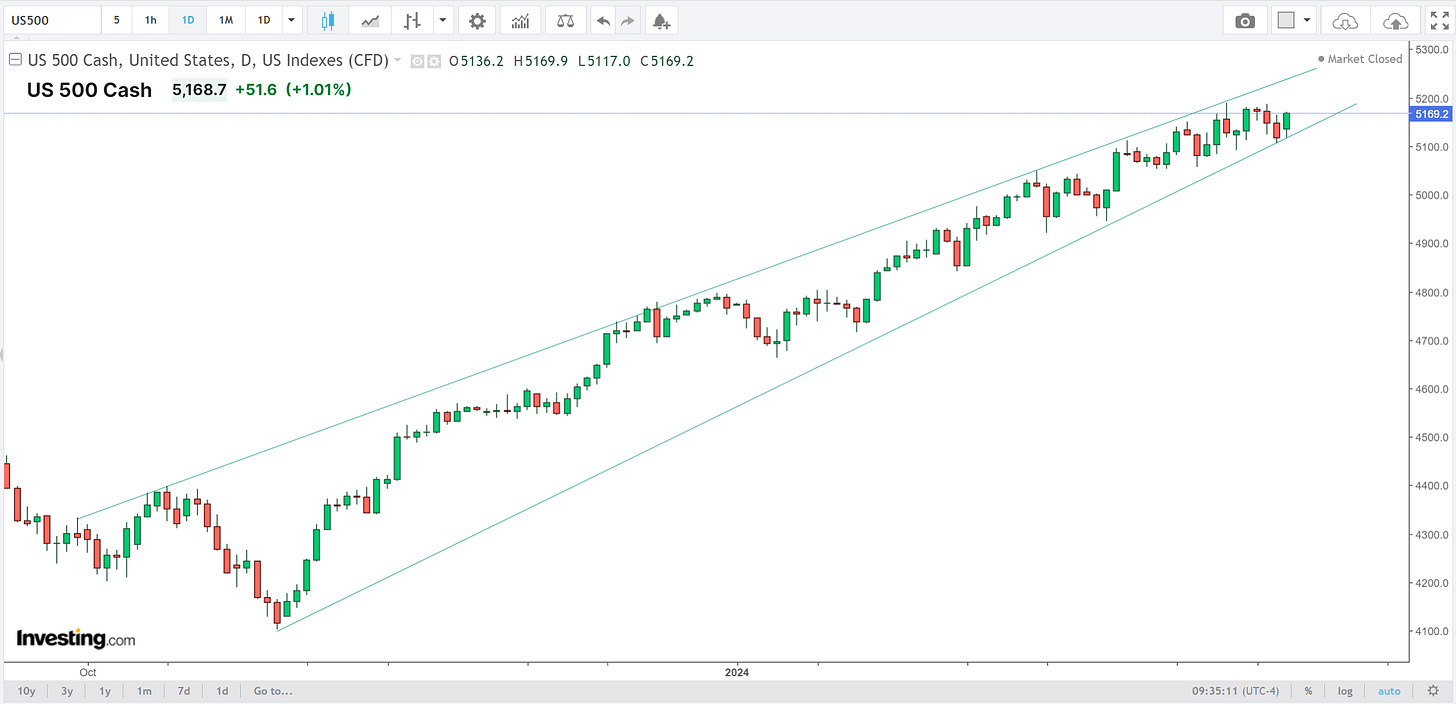

Last week, a lot of attention (as usual) had the S&P 500 index performance, and more importantly, the wedge pattern it has been holding for the last several months. At the time of writing, the S&P 500 futures are up +1% and it looks like the wedge has not broken down yet.

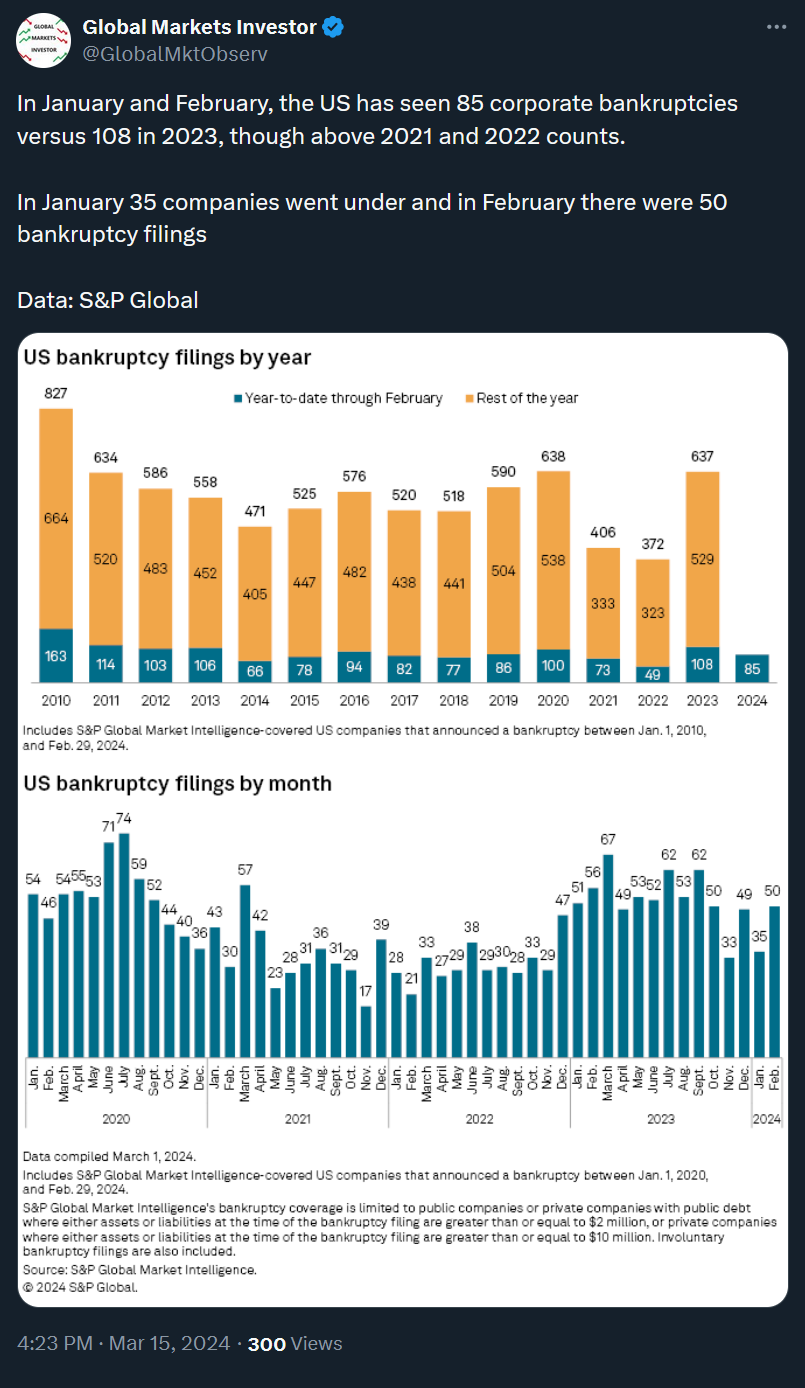

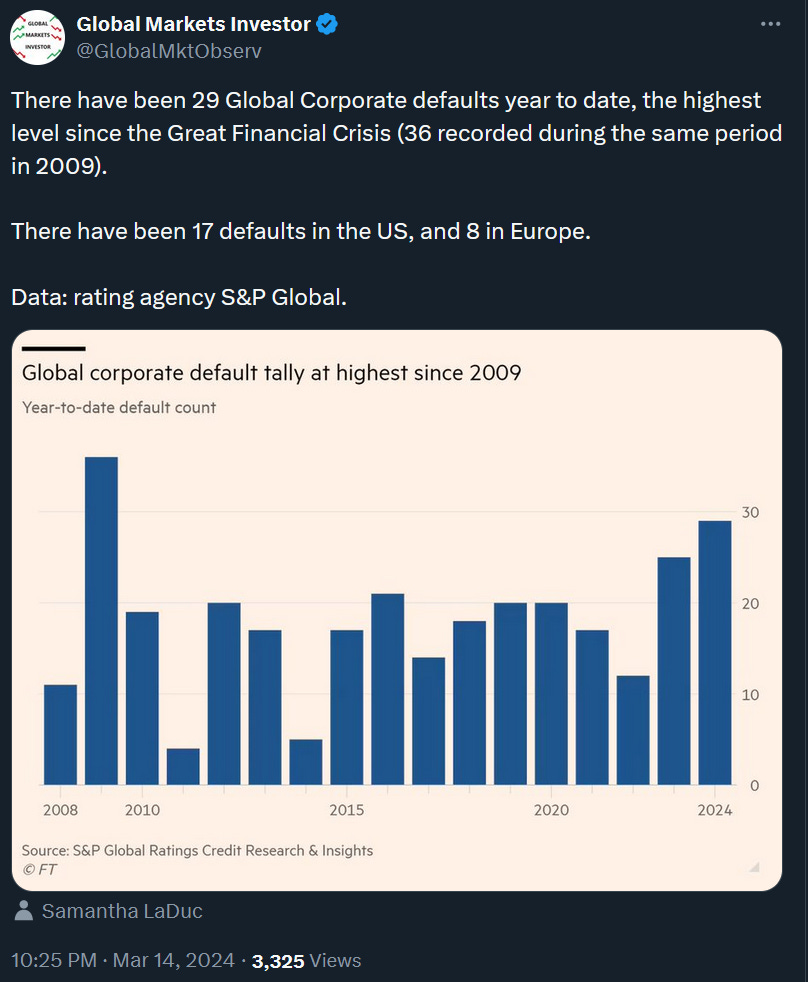

Notable bankruptcy filings update. In the US there were 85 bankruptcies in February and January, lower than in 2023. When looking at even larger corporates, there have been 29 global defaults year to date, the highest since the Great Financial Crisis.

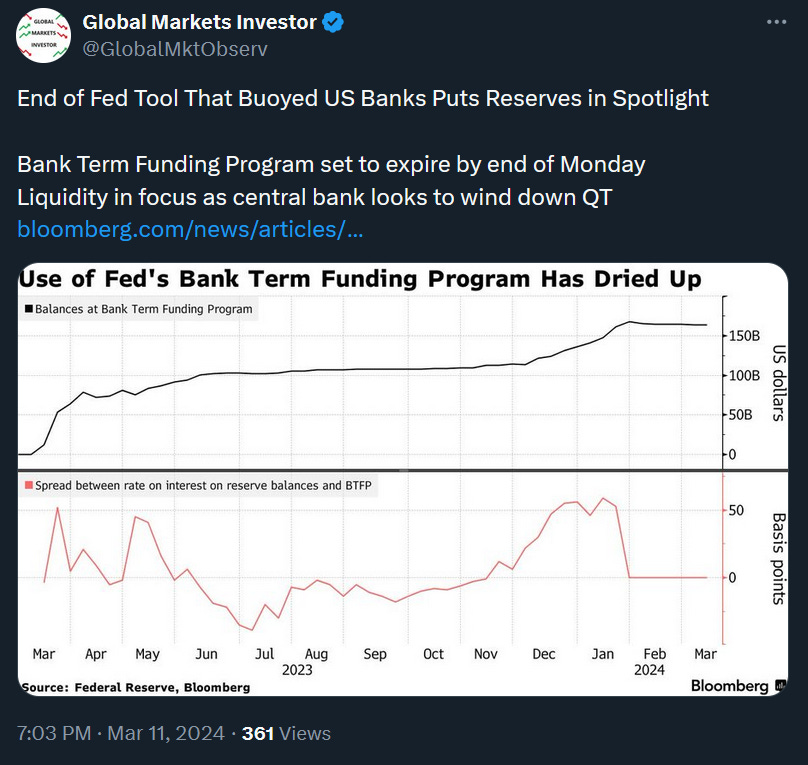

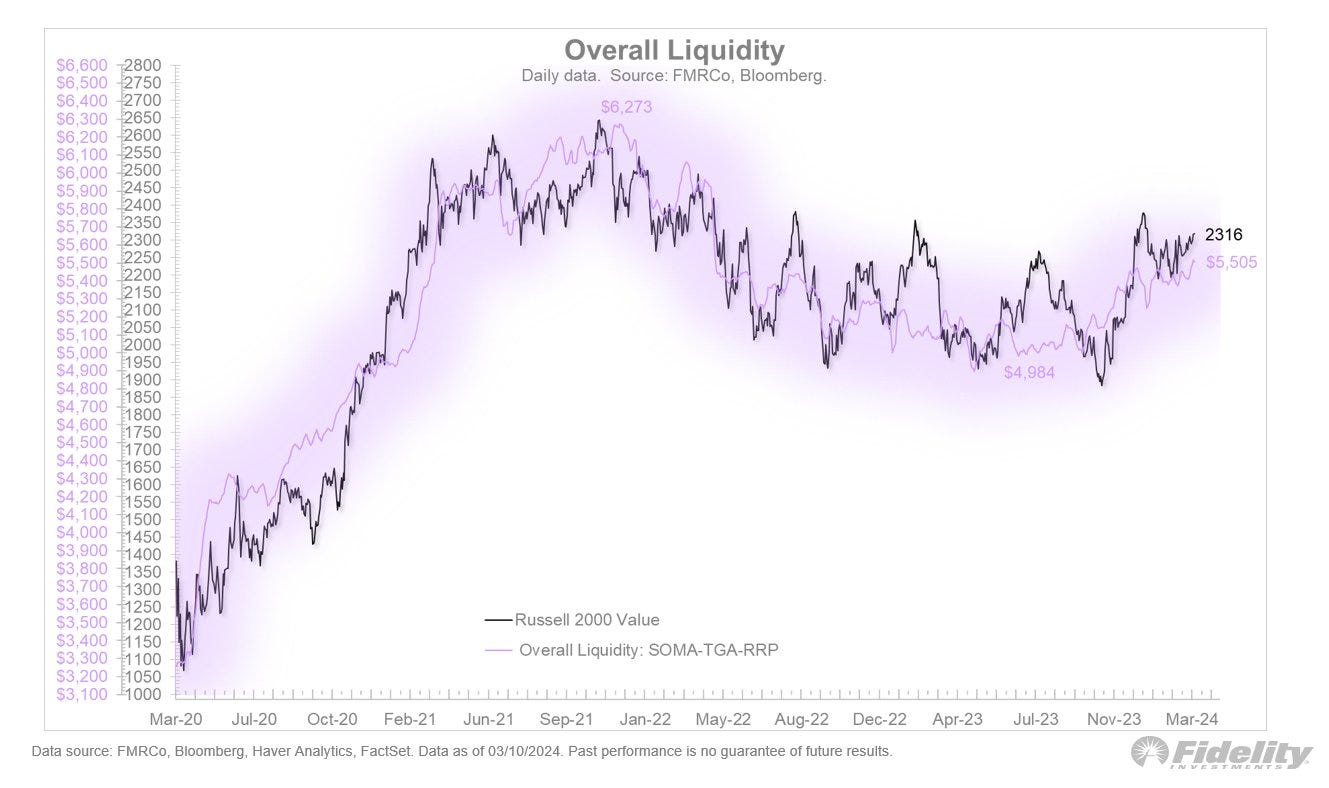

As liquidity has been the main driver in the markets (see second attachment below) it is key to be aware of the Fed’s recent program coming to an end. The so-called Bank Term Funding Program initiated in March 2023 has come to an end on Monday, March 11.

“Overall liquidity, as defined by the Fed’s balance sheet, less reverse repos (RRP) less the Treasury’s cash balance at the Fed (TGA), has been rising since mid-2023, taking stocks with it.” Jurrien Timmer, Fidelity

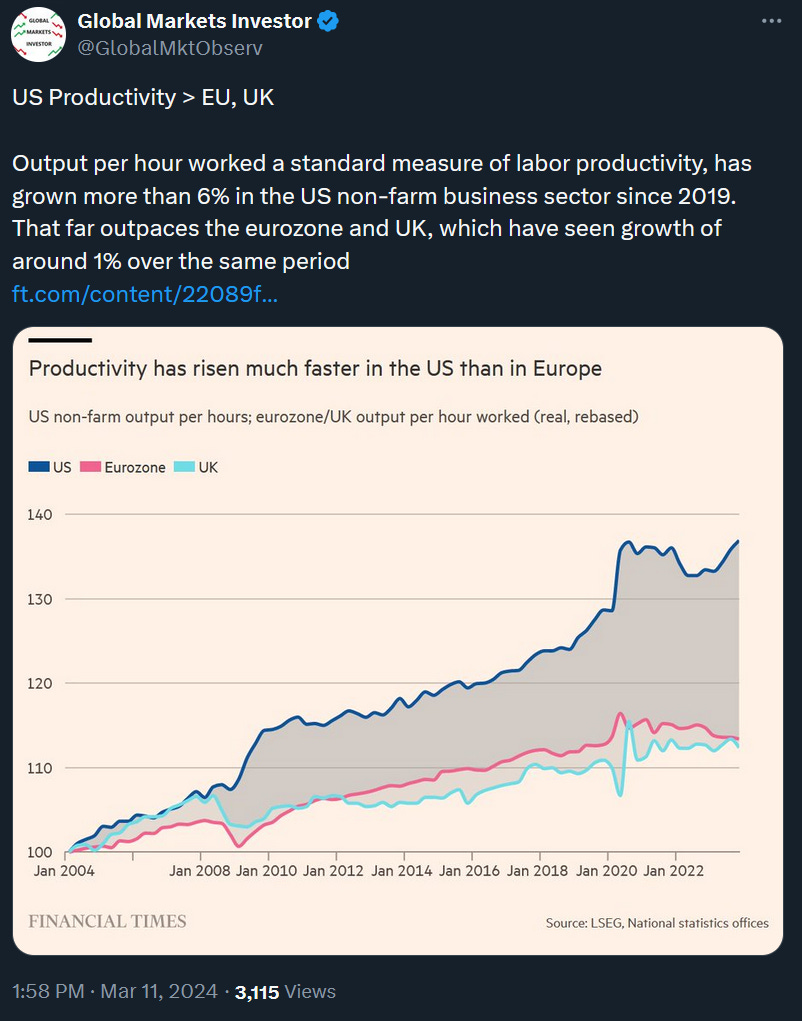

Productivity in the United States, European Union, and the United Kingdom. As per the Financial Times analysis below, the US productivity has risen much faster than in the Eurozone and the UK. The difference is clearly seen since the end of the Great Financial Crisis (2009). Looks like fragmentation in Europe, a slow fiscal policy response, and overregulation have led this economic bloc to a competitive crisis. It is also has been visible in economic growth - GDP numbers over the years.

If you find it informative and helpful you may consider buying me a coffee and follow me on Twitter: