Top 5 financial posts of the trading week 13/2024

Summary of the trading week in 5 posts with the most interactions on X

In this series, I’ve been bringing out 5 financial posts of the week with the largest number of interactions from my feed on the X platform. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

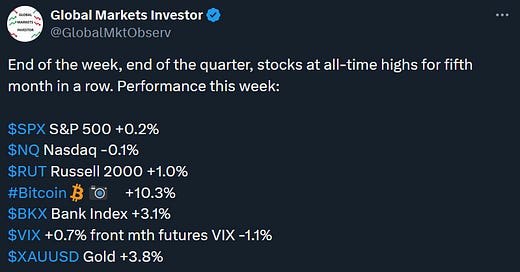

Weekly performance. In the below attachment, you can see last week’s performance of the major US indexes, the VIX volatility index, and Bitcoin. That was a shorter, low-volume week due to the Good Friday holiday in the US. Nevertheless, the US stocks were able to finish the week slightly higher, posting one of the best quarters in years and the fifth month of gain in a row. Notably, Gold and Bitcoin also performed well this week, advancing by 4% and 10%, respectively. From the most important events this week, we have Fed Chair Powell speaking on Wednesday as well as US non-farm payrolls coming on Friday.

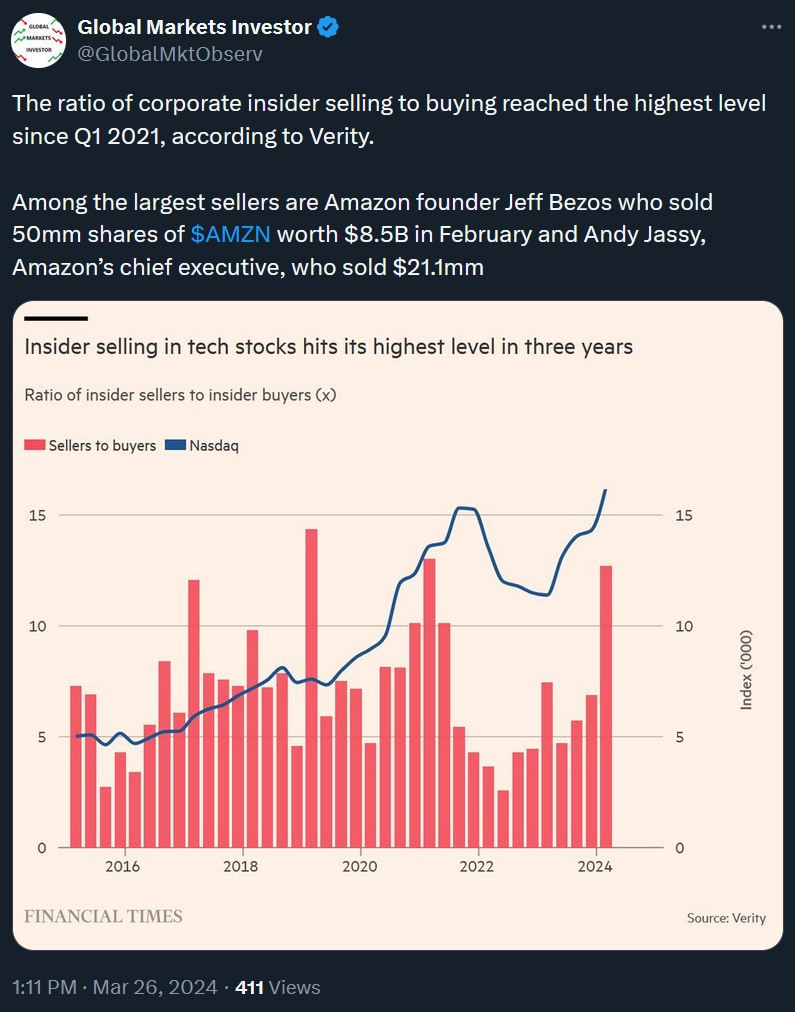

According to the Verity and Financial Times data, the corporate insider stock selling levels in relative to buying are at the highest since Q1 2021.

According to the AAA Automobile Club, US pump prices are expected to hit $4 a gallon by the summer. Not really an encouraging sign for consumers as well as inflation watchers…

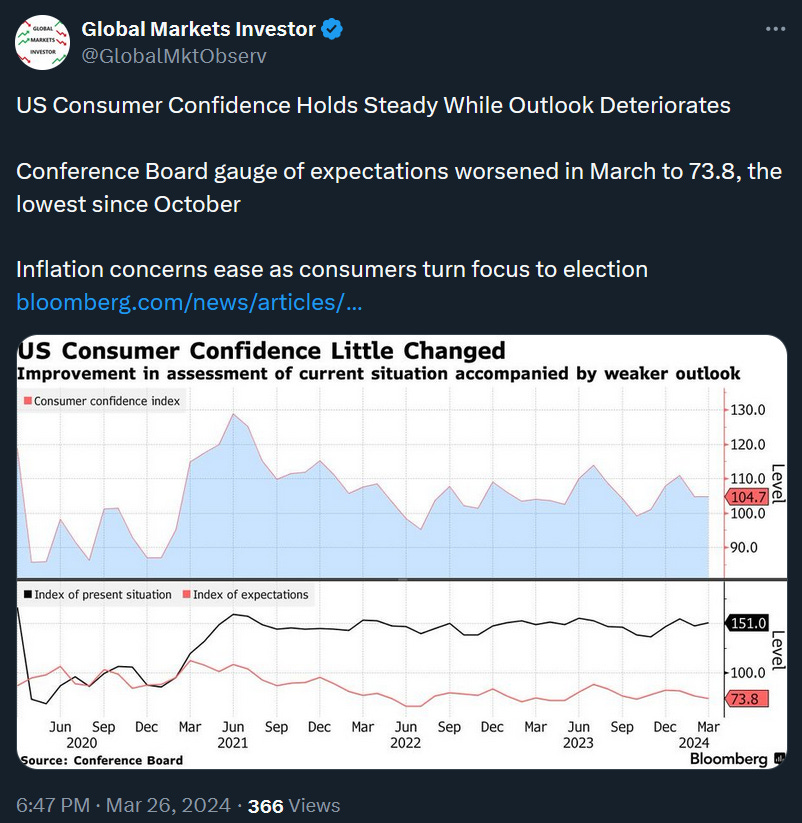

As the gas pump prices have been somewhat rising, the US consumer confidence held steady in March, though their expectations deteriorated. Overall, pretty mixed picture but nothing to worry yet.

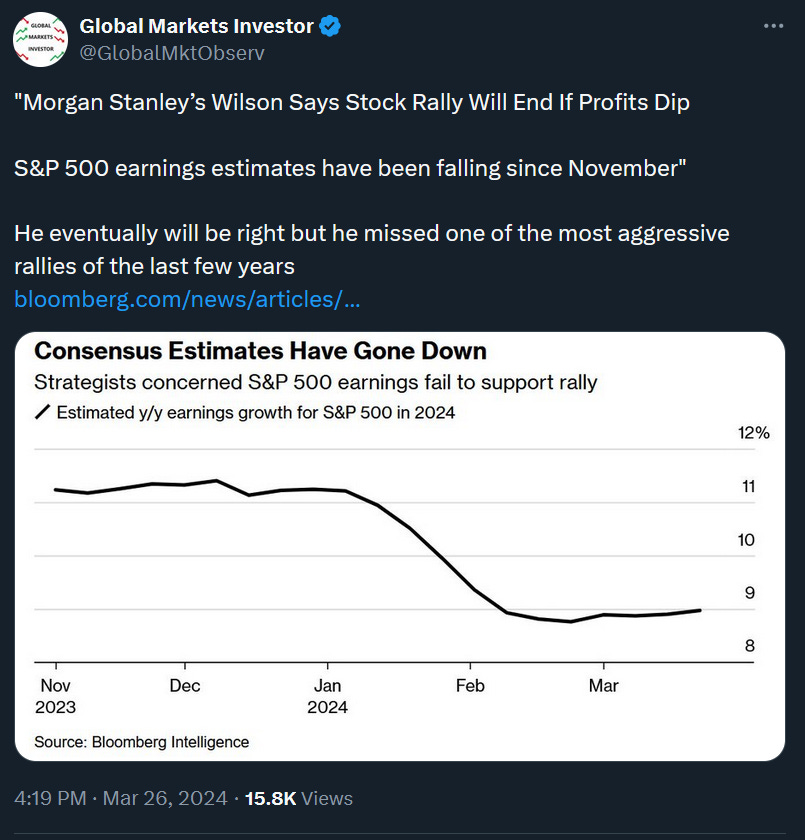

Finally, another bearish call from Morgan Stanley’s Mike Wilson who has been bearish on US stocks for most of 2023 and 2024. I wrote a piece about how Wall Street strategists’ targets perform versus reality if you are interested (see below).

If you find it informative and helpful you may consider buying me a coffee and follow me on Twitter: