Top 5 financial posts of the trading week 7/2024

Summary of the trading week in 5 posts with the most interactions on X

In this series, I’ve been bringing out 5 financial posts of the week with the largest number of interactions from my feed on the X platform. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

Friday and weekly performance. The S&P 500 closed the day and the week negative finishing the streak of 14 weekly gains out of the last 15 trading weeks (best since 1972). It looks like the index has stalled around 5,000 and has been waiting for the next catalyst. It had some ups and downs moves last week due to higher-than-expected CPI and PPI inflation prints in the US. Going forward, Federal Reserve Meeting Minutes are due on Wednesday which will be the most important event of this week. There are also S&P Global Services PMI data on Thursday from which the key investors’ focus will be on the US data.

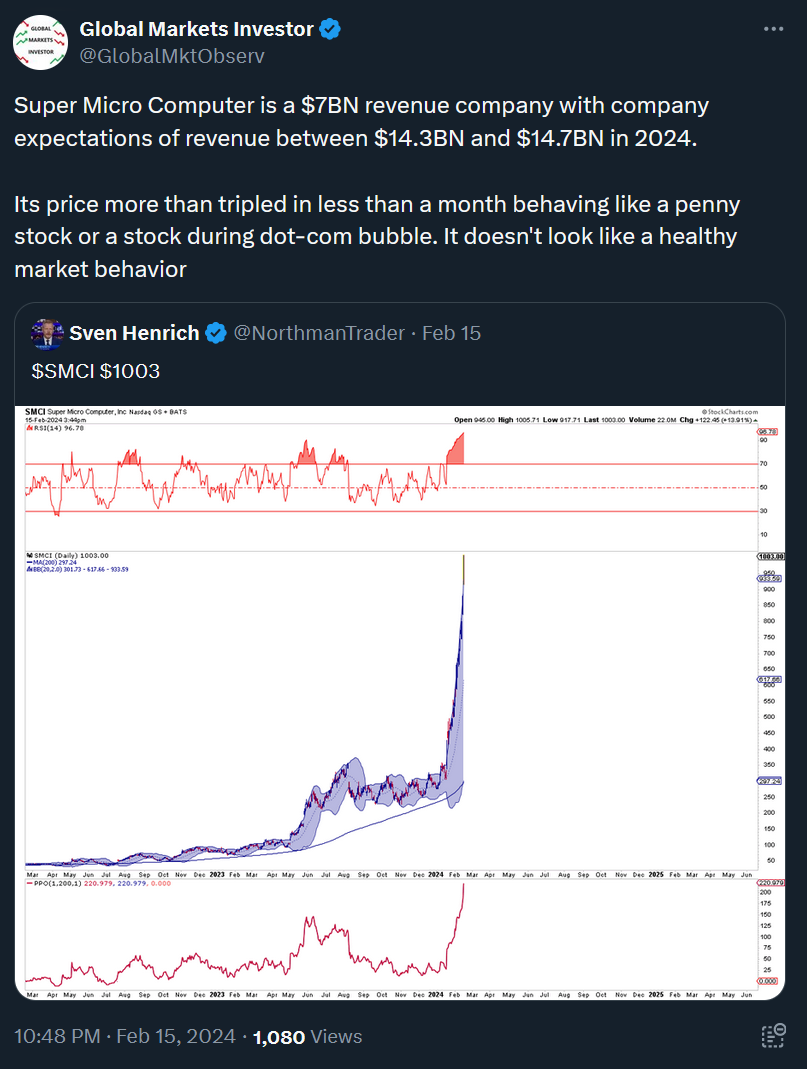

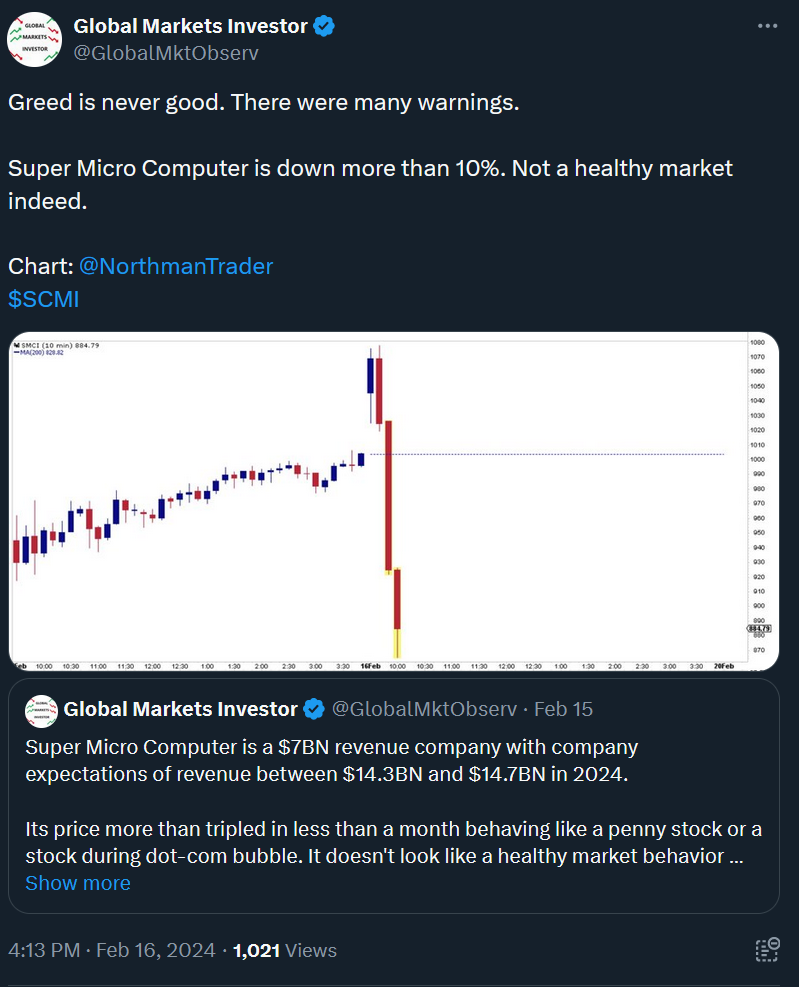

On Thursday I posted a warning about the Super Micro Computer (Ticker: SCMI) stock behavior. It has more than tripled in less than a month and till last Friday its chart looked vertical. We did not have to wait too long for a big disappointment. The following day the stock dropped by 20%, showing a similar pattern to the GameStop frenzy back in 2021 (though both companies are completely different). This is a great lesson showing that the stock of even a company with great prospects may go too far and when realization comes then many inexperienced or greedy investors feel the pain.

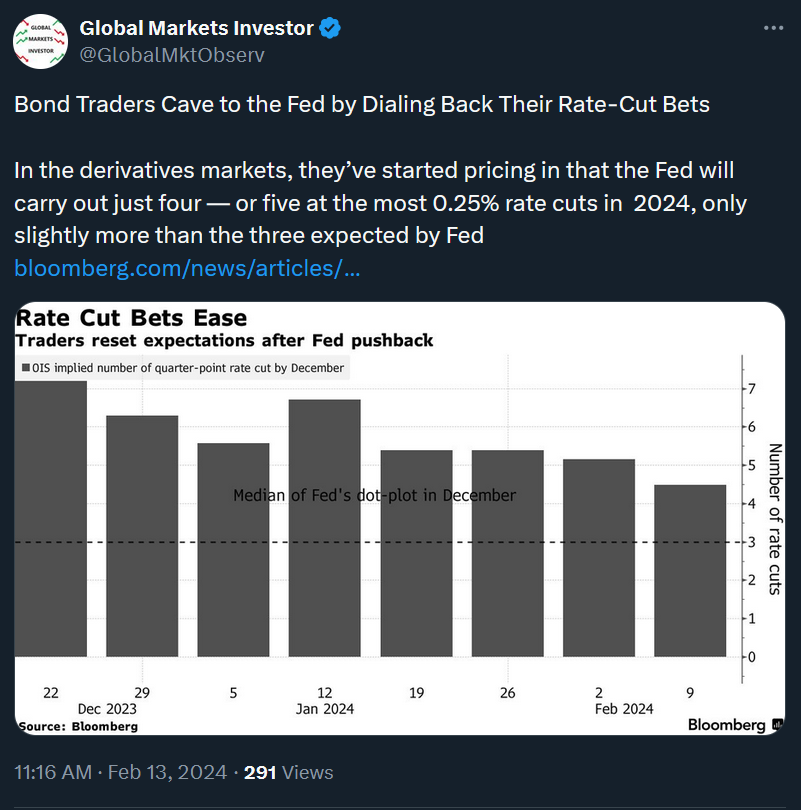

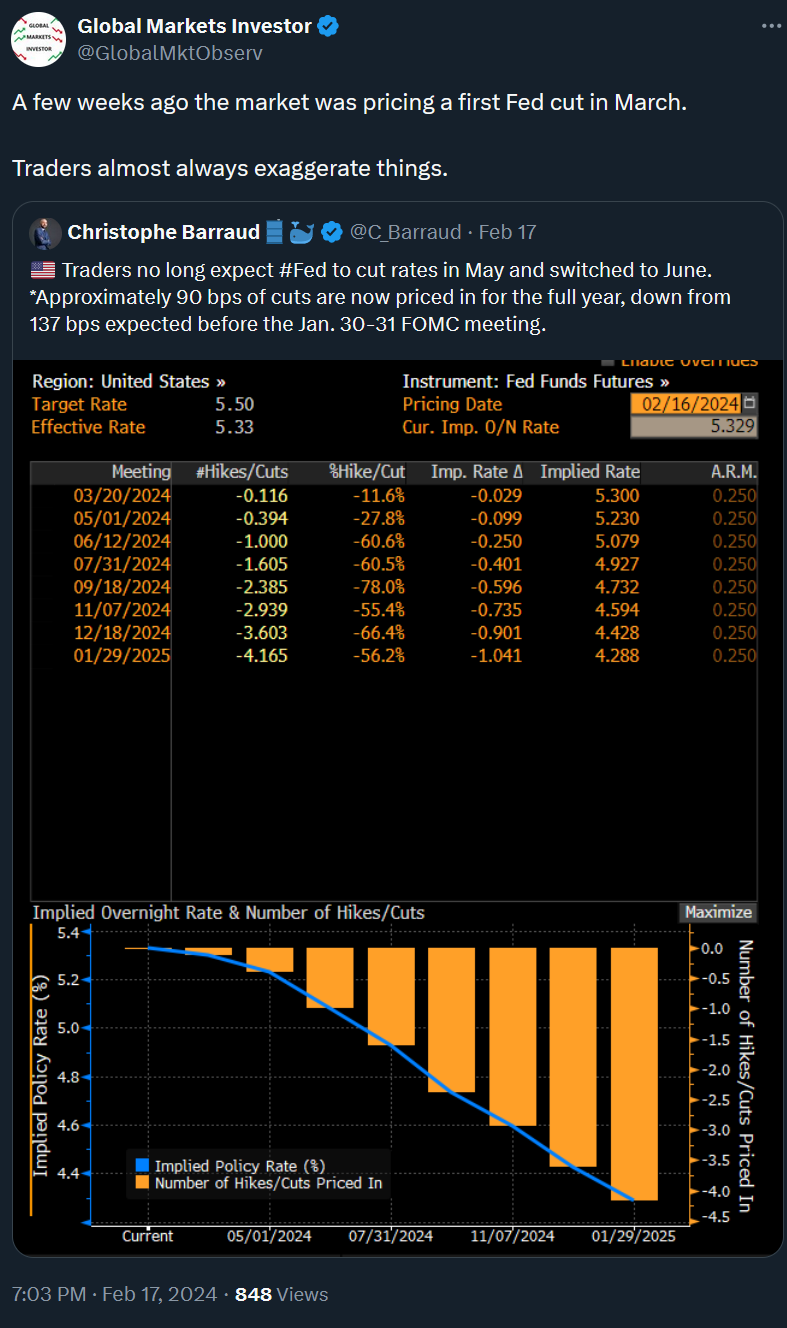

Fed’s interest rate cut expectations have been falling quite quickly. As you can see on the first chart below, markets had been pricing slightly more than 7 interest rate cuts for 2023 by the Fed. They now expect roughly 90 basis points of cuts (less than 4 reductions of 0.25%) with the first one happening in June. This is due to better-than-expected economic (official headlines) data and higher-than-expected inflation prints. If inflation gets sticky for longer, that might provide even more headaches for markets and the Fed.

Some market watchers, analysts, and economists have even started to see some chance that the Fed’s next move will be a rate hike. Former Treasury Secretary Lawrence Summers said last week that “There’s a meaningful chance — maybe it’s 15% — that the next move is going to be upwards in rates, not downwards,” “The Fed is going to have to be very careful.” If that materializes then stocks and bonds may tank pretty meaningfully. It is an important risk to consider when looking ahead.

From the economic standpoint, the most engagement last week got the news headlines about Japan and the UK which officially fell into a recession after reporting their 4Q 2023 GDP. Following this, I summarized all major economies’ economic growth in my last article:

If you find it informative and helpful you may consider buying me a coffee and follow me on Twitter: