Top 5 financial posts of the 6/2024 trading week

Summary of the trading week in 5 posts with the most interactions on X

In this series, I’ve been bringing out 5 financial posts of the week with the largest number of interactions from my feed on the X platform. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

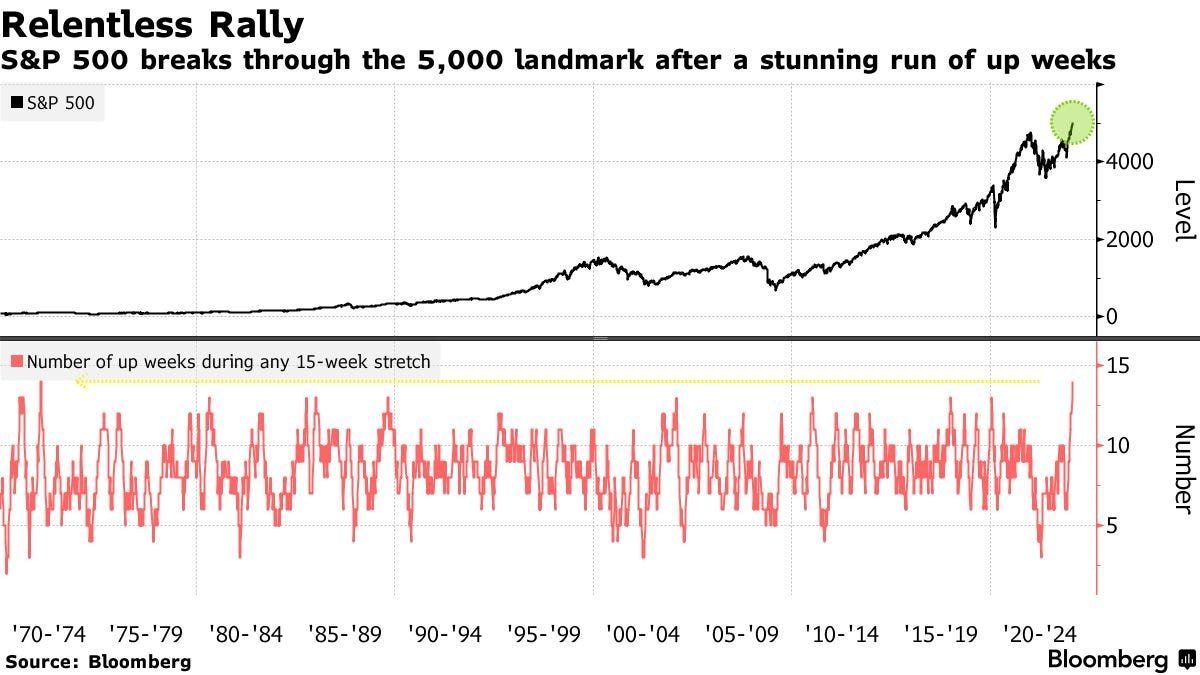

Friday and weekly performance. The S&P 500 closed the day and the week above 5,000 points for the first time ever, experiencing the 14th weekly gain out of the last 15. In terms of weekly gains, this is the best streak since 1972. Looking at other assets, Bitcoin has again crossed $48,000, trading at the highest level since the 11 Bitcoin ETFs launch. Going forward, the most market-moving events for the week ahead will be January US CPI Inflation data on Tuesday and the US Retail Sales data on Thursday.

China is going through significant economic problems. From the producer’s perspective prices have been falling for the last 16 months in a row due to weak demand. Consumer prices have also been going through a period of deflation, though for a few months shorter. Chinese stock market has somewhat rebounded in recent days. It will be interesting to see when the Middle Kingdom’s economy follows.

AI frenzy continues, but only in a number of stocks. Nvidia stock has been rising so fast it has already breached the worth of the entire Chinese stock market. The company has reached roughly $1.78 trillion in market capitalization. It is truly incredible and certainly not sustainable in the long term.

On Friday, investors’ eyes were on the annual US CPI inflation revisions as this is one piece of data the Fed Chair Jerome Powell has been watching closely in the past few years. It turned out to be a non-event, non-market-moving news. The BLS reported on Friday that it revised the monthly CPI increase for December lower to 0.2% from 0.3%. The Core CPI was unrevised at 0.3%. Moreover, November's CPI increase was revised higher to 0.2% from 0.1%, while October's 0.1% increase was left unchanged.

In the past 3 months, the CBOE VIX Volatility index has been trading at really low levels versus the last 2-3 years. The recent such period of calmness has been seen in October 2018, just before the so-called Volmaggedon when in a matter of weeks, the VIX spiked above 35 points triggering liquidations of some short volatility funds and the market sell-off. It does not have to happen again this time but any adverse event such as a much higher-than-expected inflation print on Tuesday may cause the VIX to rapidly move up and stocks to correct.

If you find it informative and helpful you may consider buying me a coffee and follow me on Twitter: