Top 5 financial posts of the 5/2024 trading week

Summary of the trading week in 5 posts with the most interactions on X

In this series, I’ve been bringing out 5 financial posts of the week with the largest number of interactions from my feed on the X platform. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

Wednesday performance. Following the Fed’s decision to keep interest rates in the US unchanged and Powell’s conference stocks declined pretty significantly during that day. However, on Thursday and Friday, we saw a quick turnaround and massive gains in the stock market after Meta, Amazon, and Apple earnings as well as much better than expected US non-farm payrolls data.

The market is so euphoric data the cost of the S&P 500 downside hedging has been the lowest in a few years and almost the lowest in decades. It is also seen in VIX Volatility Index which has been trading at pretty low levels as well. Therefore, if anything material surprises the market negatively we’ll see a rapid spike in VIX.

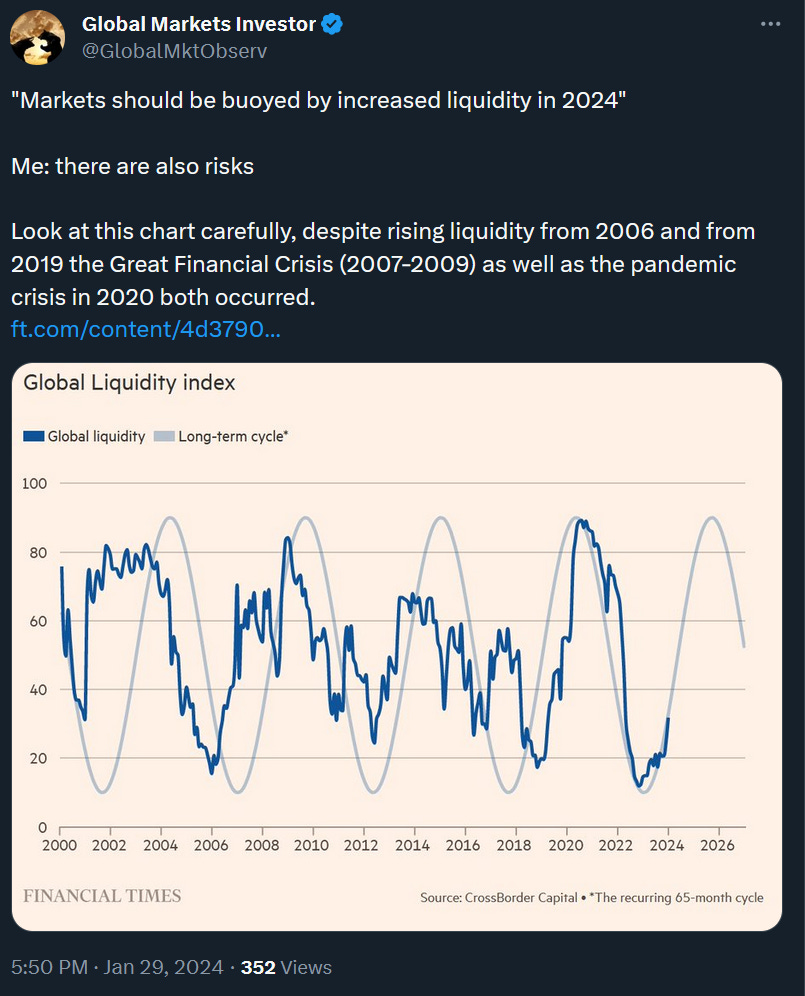

The chart below presents global liquidity cycles which in general have been driving the stock markets. The problem is that even if liquidity is ample it might not be enough to stop bear markets from occurring in case of significant adverse events such as the Great Financial Crisis or the pandemic lockdowns. Worth keeping that in mind.

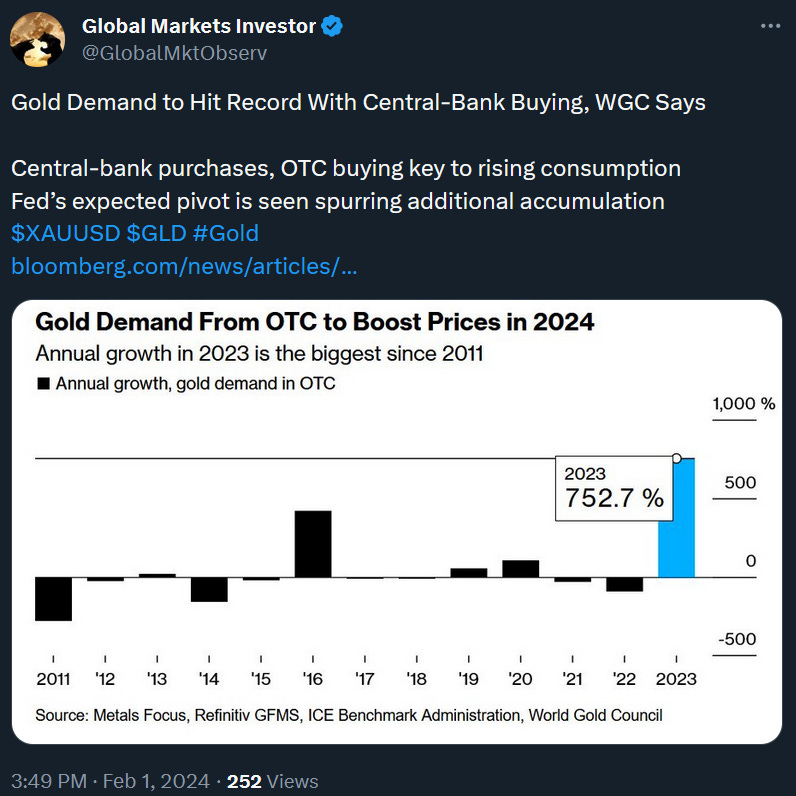

Gold demand has been rising due to world central bank purchases as well as Over-The-Counter (OTC) transactions. As a reminder, OTC transactions are physical gold purchases outside of exchanges.

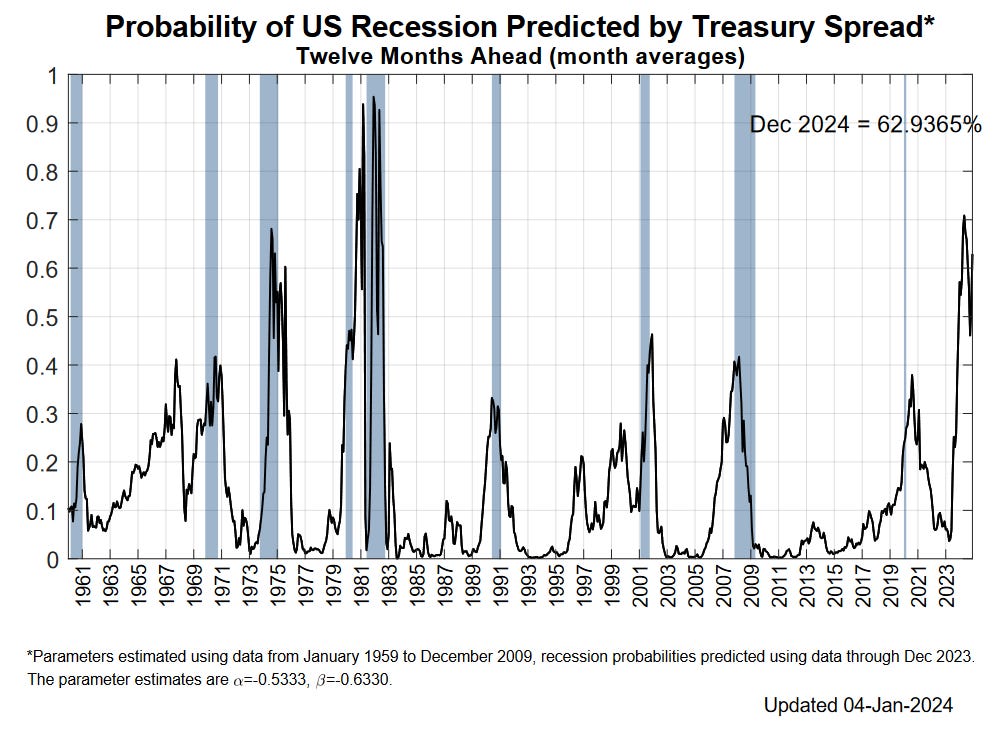

One of the most popular recession indicators - the US Government Bonds Yield Curve (Treasury Spread between 10-year bond yield and 3-month bill yield) is pointing to a 63% probability of a recession in the US occurring. within 12 months

If you find it informative and helpful you may consider buying me a coffee and follow me on Twitter: