Top 5 financial posts of the 2/2024 trading week

Summary of the trading week in 5 posts with the most interactions

In this series, I will be bringing out 5 financial posts of the week with the largest number of interactions from my feed on the X platform. I am aware that not everybody uses X regularly so I thought it could bring some value to your analysis and investment process.

Trading week recap. Large-cap stocks including Tech ended the week green with Tesla, Energy, Utilities, and Bank stocks underperforming. Interestingly, small caps (Russell 2000 index) fell slightly and stayed below 2,000 points. Also surprisingly for many, Bitcoin fell after the approval of 11 spot Bitcoin Exchanged Traded Funds.

According to a Federal Reserve Bank of Philadelphia study, US credit-card delinquency rates have risen above pre-pandemic levels, reaching a decade high. This is a sign of consumer spending’s ongoing weakness.

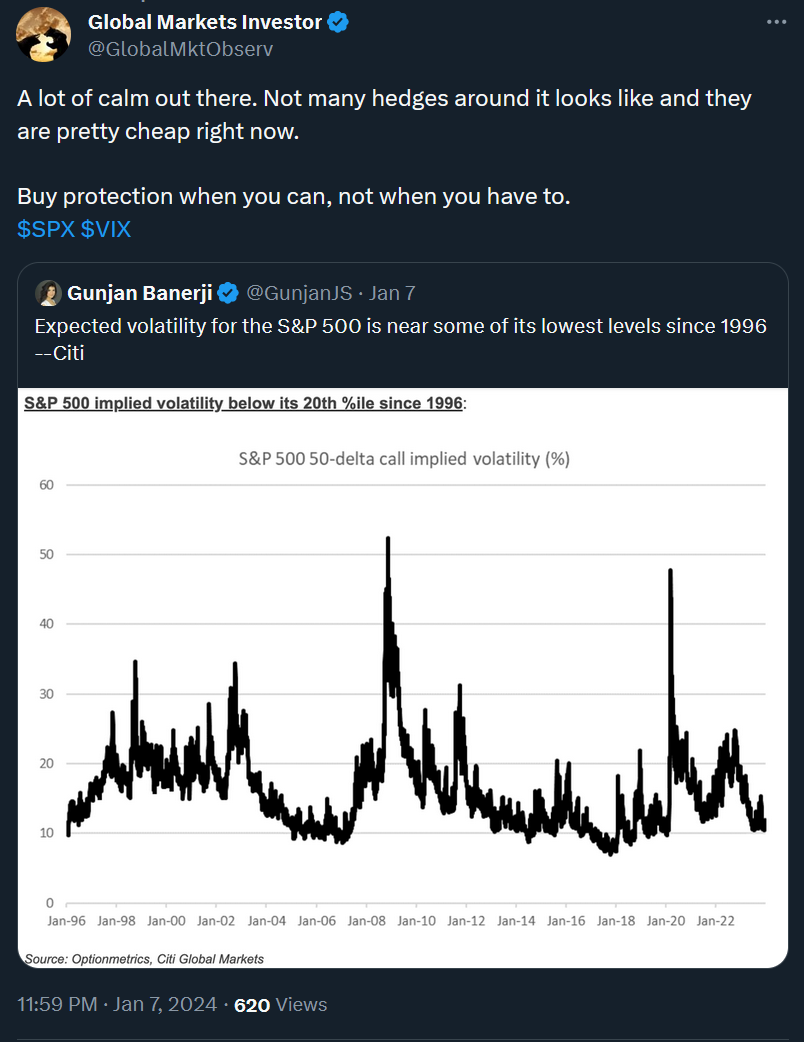

The S&P 500 expected volatility measured by options is at the lowest level since early 2020. Stock market hedging is quite cheap right now if you need protection for your long positions. Moreover, the VIX Volatility index might be quite sensitive in the next few weeks to any negative news.

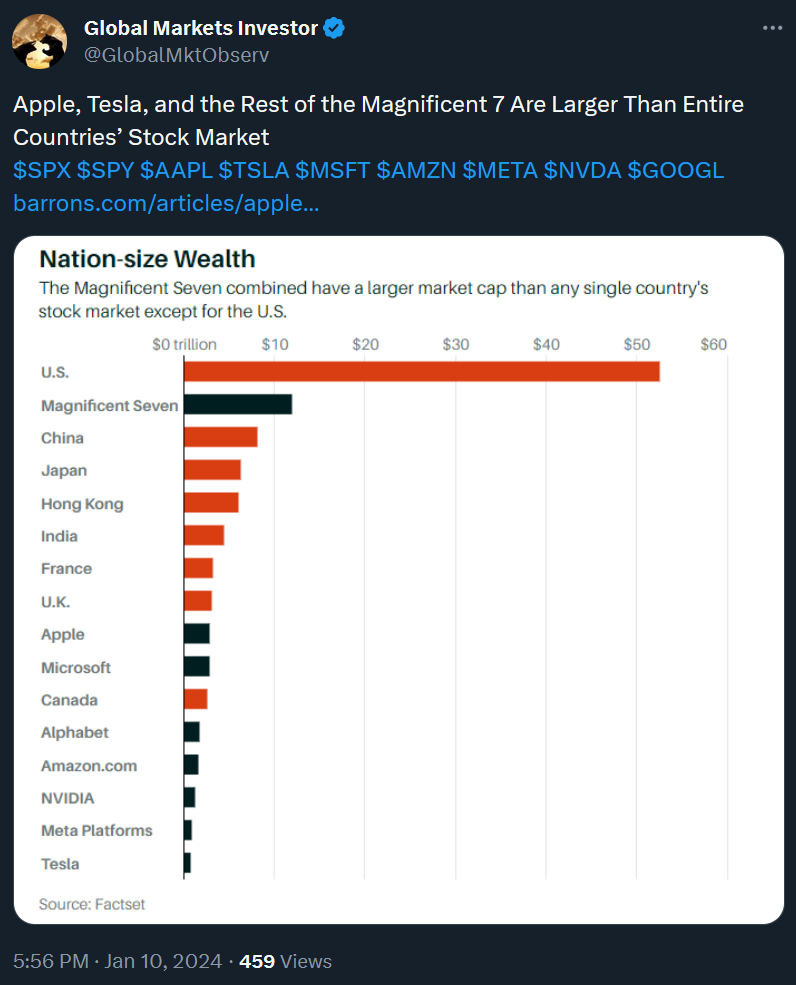

The Magnificent Seven (Amazon, Apple, Google, Meta, Microsoft, Nvidia, and Tesla) market capitalization is larger than any single country’s stock market size except for the United States. As a reminder, the US stock market accounts for more than 42% of the world equity markets.

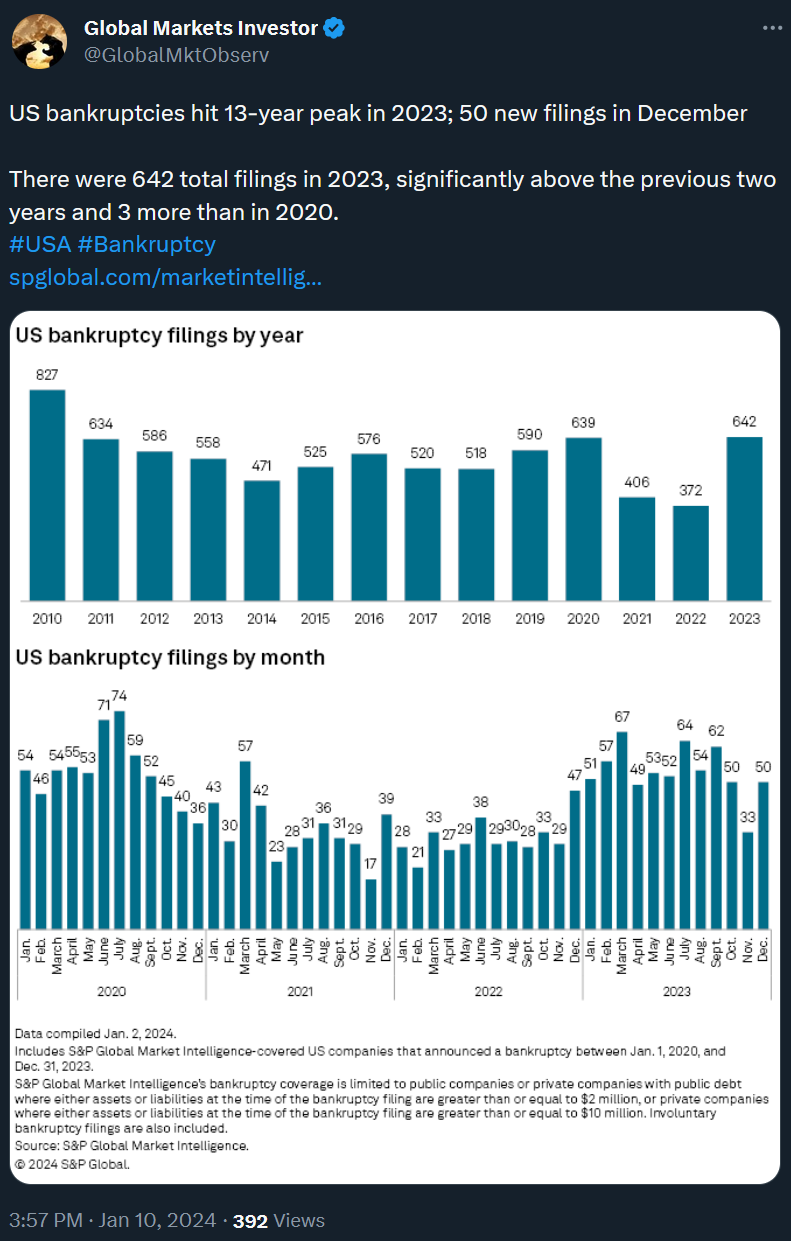

In 2023, there were 642 bankruptcies in the United States, the most since 2010. This is a concerning trend happening in the US economy, especially considering the fact that over the last 20 years, such a large number of bankruptcies have only been seen during the last two recessions.

If you find it informative and helpful you may consider buying me a coffee and follow me on Twitter: