Top 10 US stocks valuation is now higher than during the 1990s Dot-Com Bubble

Is the stock market in a bubble again after 24 years since the last burst?

First of all, I would like to express my profound gratitude to all of you for subscribing to this content. The number of subscriptions and followers is close to 1,000! As a token of appreciation please find a 10% discount for an annual subscription. ONLY 5 DAYS LEFT!

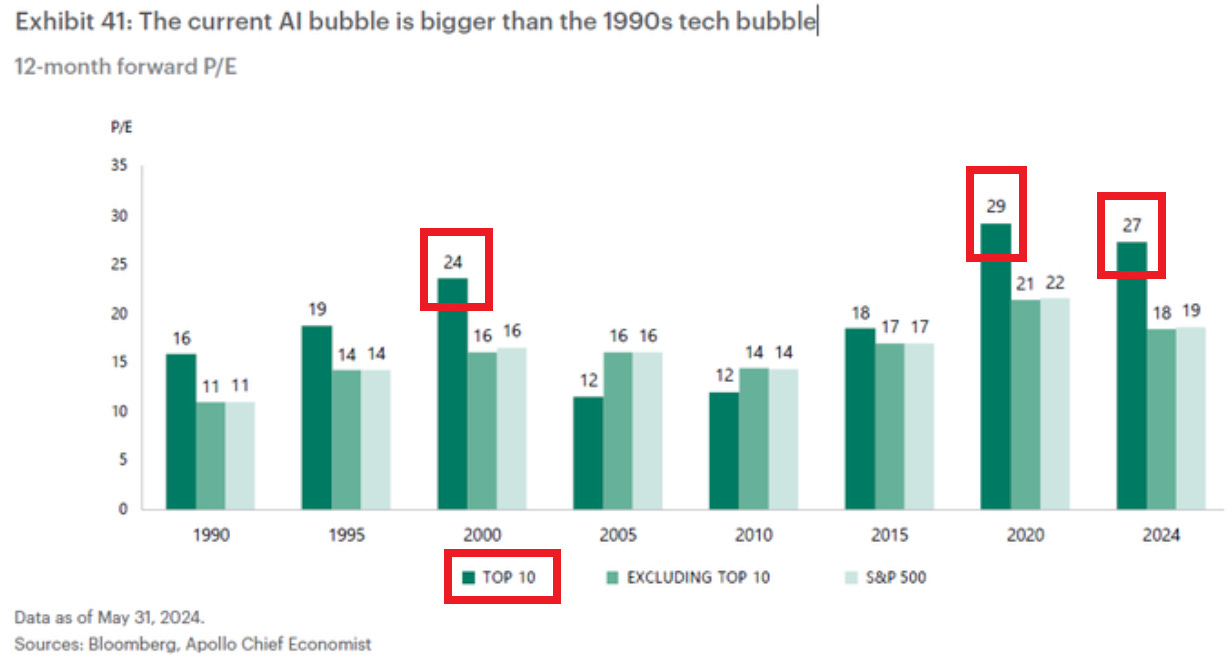

The forward Price to Earnings (P/E) ratio of the top 10 S&P 500 stocks combined is now 27x, the 2nd highest in at least 3 decades. It is only below 29x recorded before the COVID crash.

Valuations are even higher than in the 1990s Dot-com bubble when the top 10 saw 24x forward P/E.

As a reminder, the top 10 stocks account for almost 40% of the S&P 500 market capitalization. In other words, if they go up the S&P 500 goes up, if they start to correct then they will drag down the entire index with them.

Is the US stock market forming a new bubble or it is already in a bubble? How to invest in such an environment? You can read the full analysis below:

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), buying me a coffee, and following me on Twitter:

Why subscribe?