The US labor market looks as if the economy is in a recession

Is the US economy heading into a prolonged slowdown? How will the markets react? Answers below.

This analysis was made in early May. Please note that some new data about the US labor market has been released thereafter. For the complete analysis please also read the below articles:

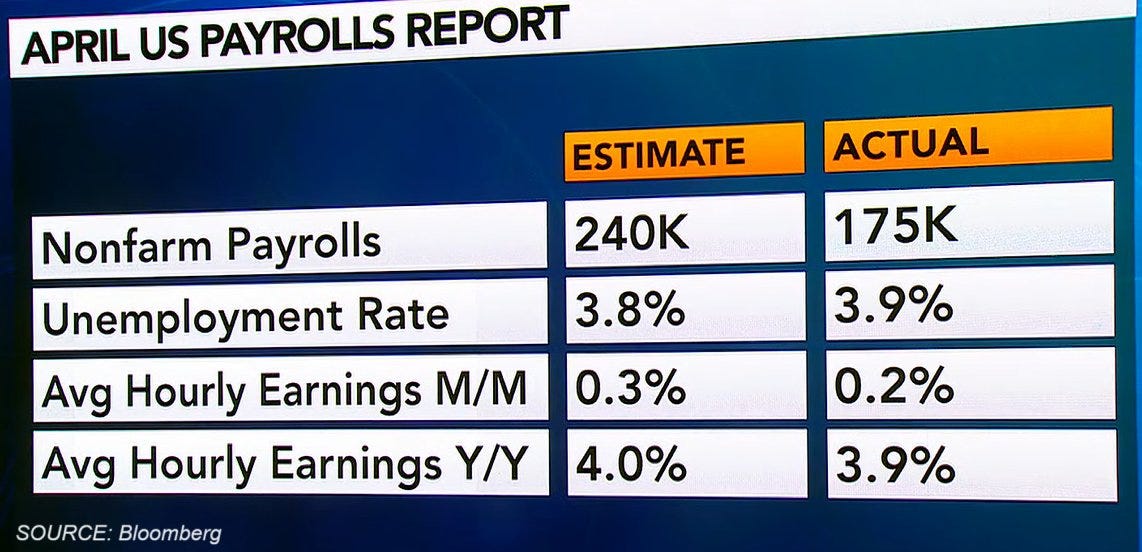

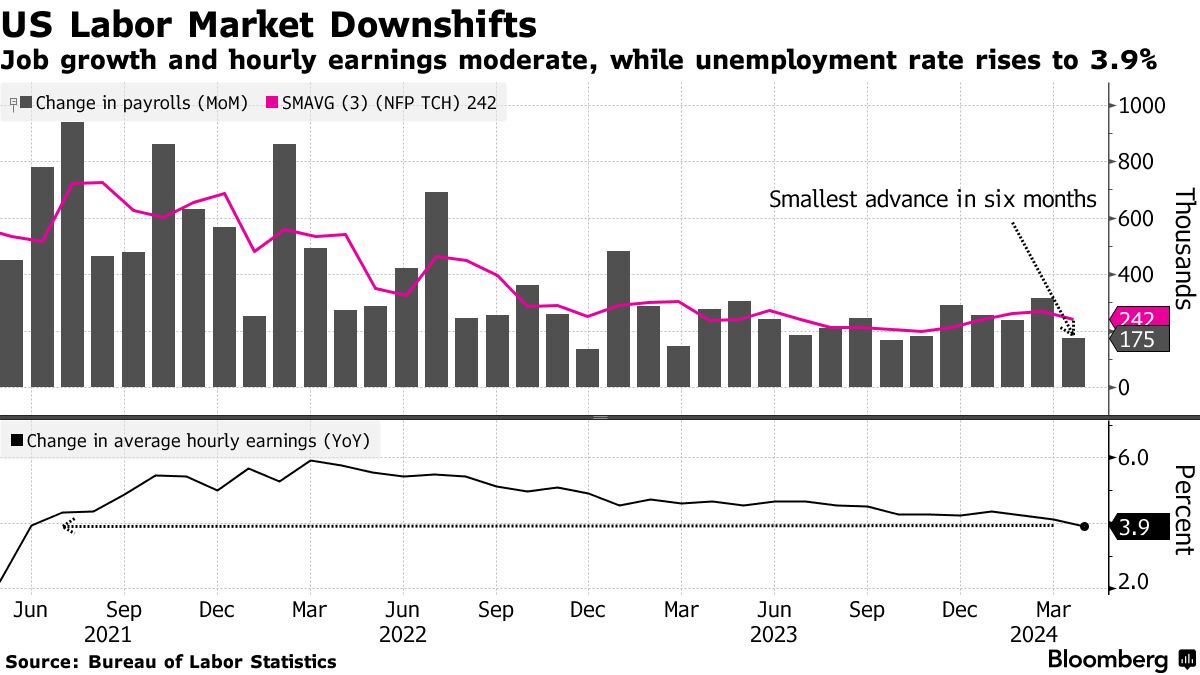

On Friday, May 3, the Bureau of Labor Statistics announced that the US economy created 175,000 new jobs in April, well below average Wall Street expectations of 240,000 and the smallest job addition in 6 months. Furthermore, the unemployment rate ticked up slightly to 3.9% from 3.8% in March, below estimates of 3.8%. Notably, the average hourly earnings also missed average projections by 0.1% on a year-over-year and month-over-month basis showing signs of cooling wage pressure. See the details below:

Overall, this data looks pretty solid and at first glance, does not provide any warning signs. Also, the stock market cheered the news on hopes of earlier cuts conducted by the Fed (more in the below piece):

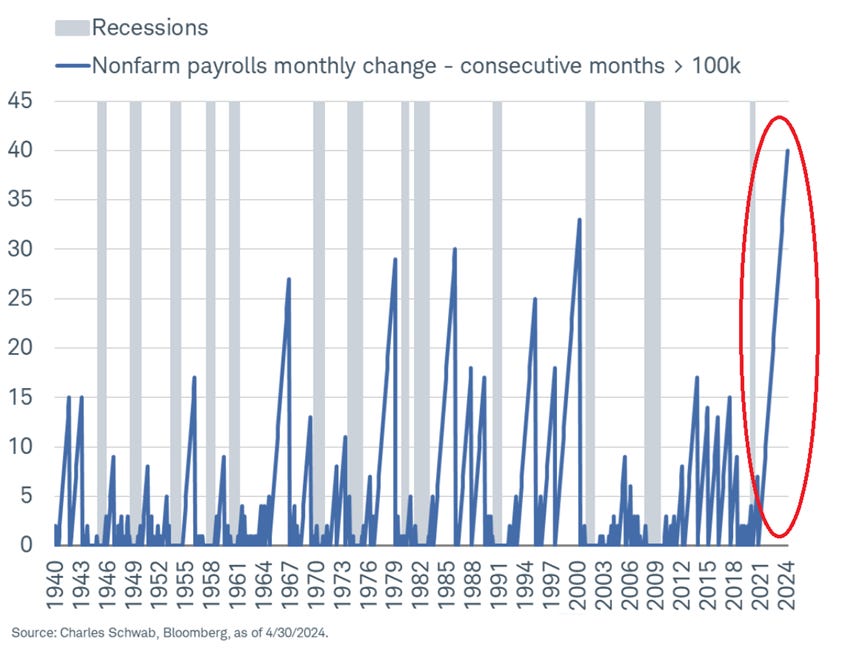

As it was not enough, the US labor market has also added over 100,000 jobs each month for 40 straight months, including monthly revisions. This is the best streak in history using official nonfarm payroll data. The reality, however, is completely different and the data is more convoluted than these simple statistics.

Having said that, this piece aims to reverse-engineer the entire US labor market data, goes beyond the financial media cheering headlines, and uncovers what is hiding under the surface. In essence, it is a more thorough continuation of the previous analysis of February and March data as well as the last 15 months’ data revisions. You can see the details below (no paid subscription needed):

Namely, this analysis goes through the April data and covers flashing red signals coming from the US labor market. It also deep-dives into the flawed methodology and reveals the true picture of the employment of the largest economy in the world.

It contemplates the Fed policy related to the job market, projects possible market reactions to the data, and the central bank decisions going forward, and answers the below questions:

1) Is the US labor market contracting?

2) How many revisions there have been so far in 2023 and 2024?

3) How flawed the current methodology of counting jobs is?

4) What is driving the headline jobs number?

5) How the data could affect the stock and bond markets as well as other asset classes?

6) How is this possible that the US economy is adding jobs on a net basis despite hundreds of thousands of job cuts?

7) How many layoffs the US economy has seen so far this year?

8) Has the world’s largest economy fallen into a recession?

REVISIONS SHOW THAT THE US LABOR MARKET IS CONTRACTING