The S&P 500 is just 0.8% from its all-time high. Weekly market recap, trading week 19/2024

Summary of the trading week in several posts with the most interactions on X

In this series, I’ve been bringing out financial posts with the largest number of interactions from my feed on the X platform over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

That was a pretty quiet week in markets after the previous really intensive one. Following the Fed meeting and the US non-farm payrolls data release for April, markets have been continuing their upside move. The full analysis of the recent job market data can be found below:

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

After a rough first three weeks of April, US stocks have finished green for the 3rd consecutive week which we expected to occur in the previous week’s piece. The S&P 500 is now just 0.8% from its all-time high. Notably, US banks have rallied for 4 straight weeks and broke up through some important technical levels. Finally, the VIX index has sunk to its lowest level since January 2024.

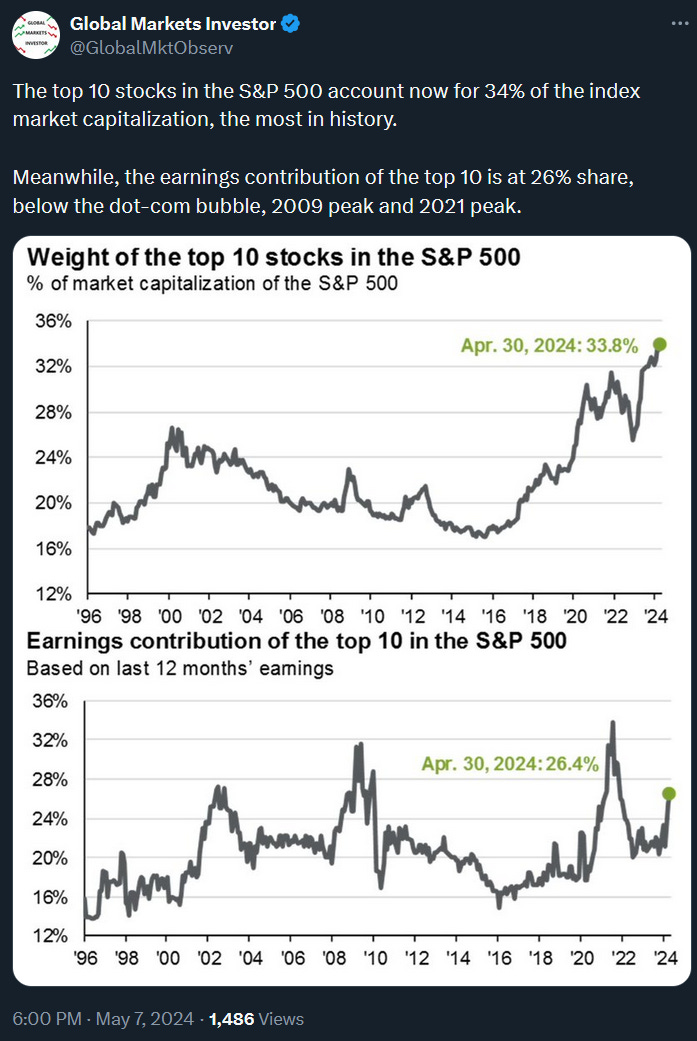

Besides, the stock market concentration has been further increasing. Now top 10 S&P 500 stocks account for 34% of the market capitalization of the index, the most in history. Is the US stock market in a bubble? Read the details below:

Also, gold has finally ended green after two weeks of declines.

For the trading week ending May, 17 key events ahead are:

- Fed Chair Powell Speech and US PPI Inflation on Tuesday

- US CPI Inflation and Retail Sales on Wednesday

- 9 Fed Speeches

- 3-5% of the S&P 500 companies’ earnings

US inflation data will be key for this week. Namely, much higher-than-expected readings can trigger the market sell-off. Data in line or lower than expected will make stocks and gold continue marching higher with US bond yields declining.

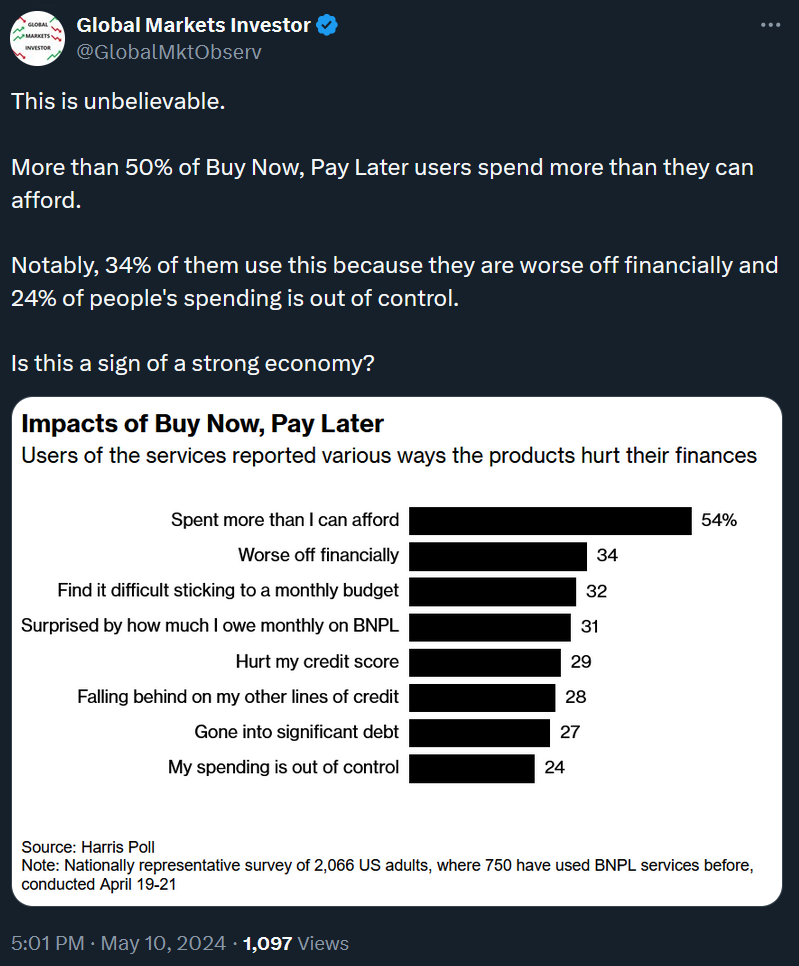

2) Buy Now, Pay Later frenzy. According to the Harris Poll of 2,066 US adults, where 750 have used BNPL, 54% of them spend more than they can afford.

34% use this because they are worse off financially and 24% of people's spending is out of control.

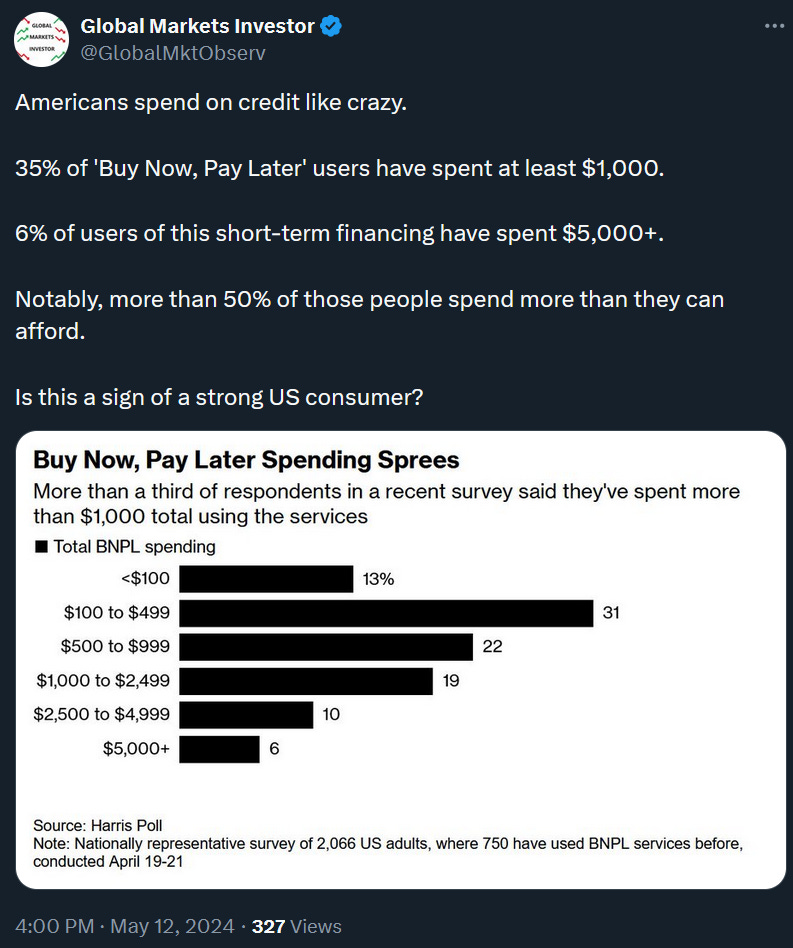

Interestingly, 55% of 'Buy Now, Pay Later' users have spent at least $1,000 in total so far.

Is the US consumer falling into more debt a healthy sign of the economy? The full analysis is under the below link:

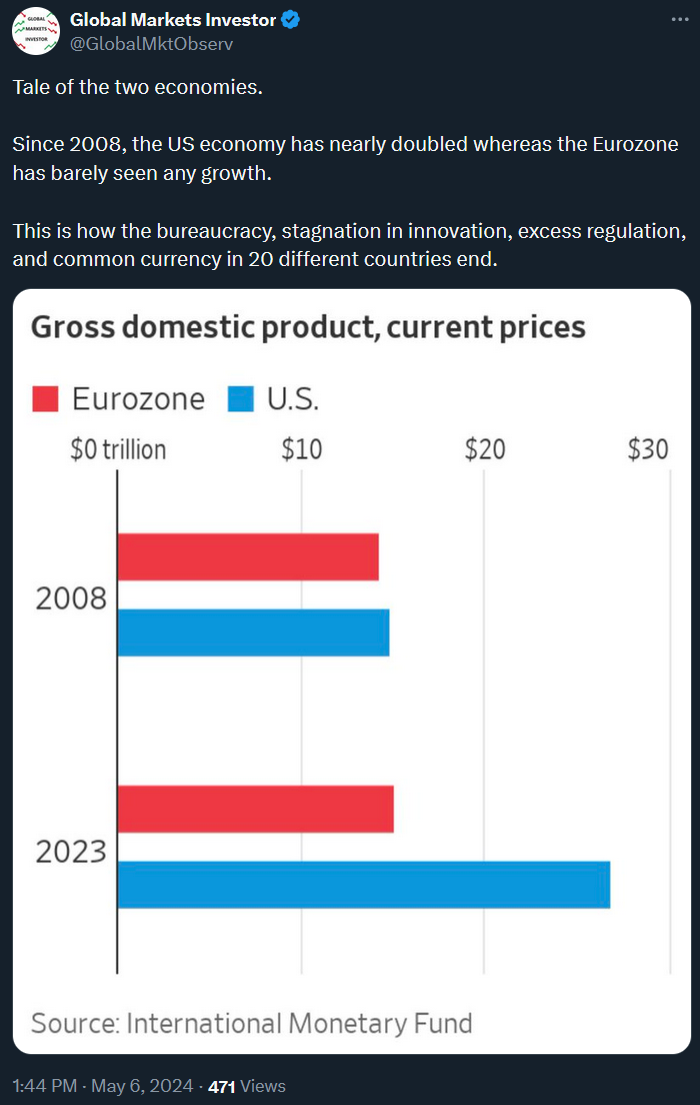

3) Tale of the two economies and stock markets - continuation. Since 2008, the US economy has grown by almost 100%. On the other hand, the Eurozone GDP has barely seen any growth (economic stagnation).

Furthermore, since 2009, the S&P 500 has outperformed the main Eurozone stock market index by more than 4 TIMES.

This is how the bureaucracy, stagnation in innovation, excess regulation, and common currency in 20 different countries end. Expect more US outperformance in upcoming years.

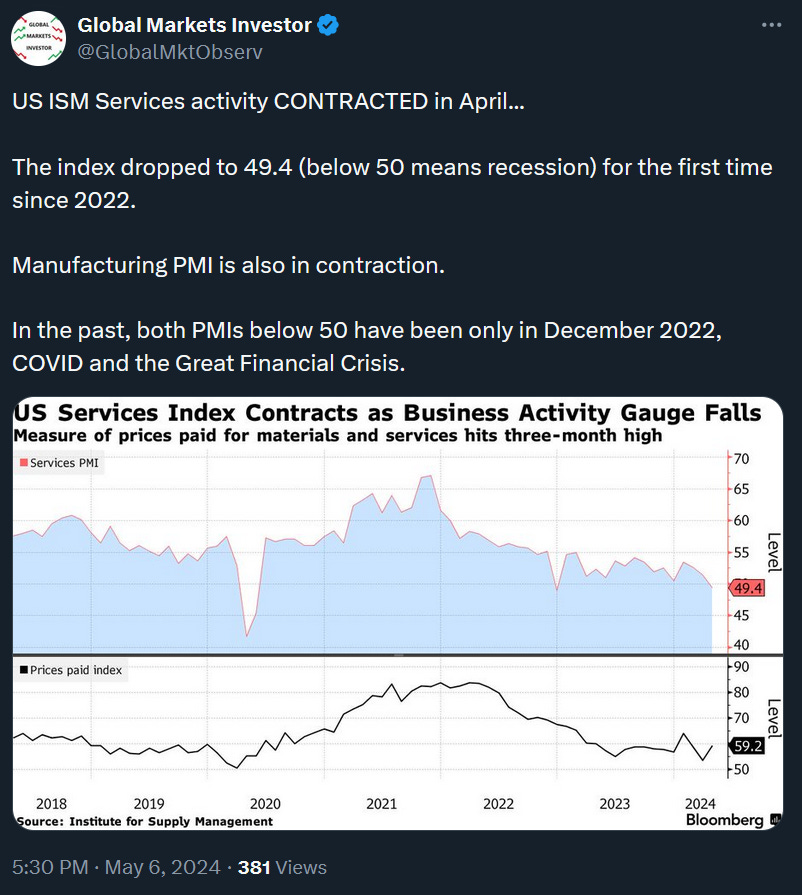

4) Some signs of US economic deterioration. In April, both the US ISM Services and ISM Manufacturing PMIs indexes were below 50, meaning services and manufacturing industries activity contracted.

This was the first time since December 2022.

In the past, outside of December 2022, such an occurrence has been seen only during the COVID crisis and the Great Financial Crisis of 2007-2009.

If the data will continue to show a weakness like that the US economy may indeed fall into a recession. May data will be key to watch.

5) Japanese wages have been falling for 2 years STRAIGHT. Japanese real (adjusted for inflation) wages declined by 2.5% in March despite rising nominal earnings.

This trend has already lasted for 24 consecutive months.

In other words, prices in Japan have been consistently outpacing wage increases, making Japanese people poorer on average every day.

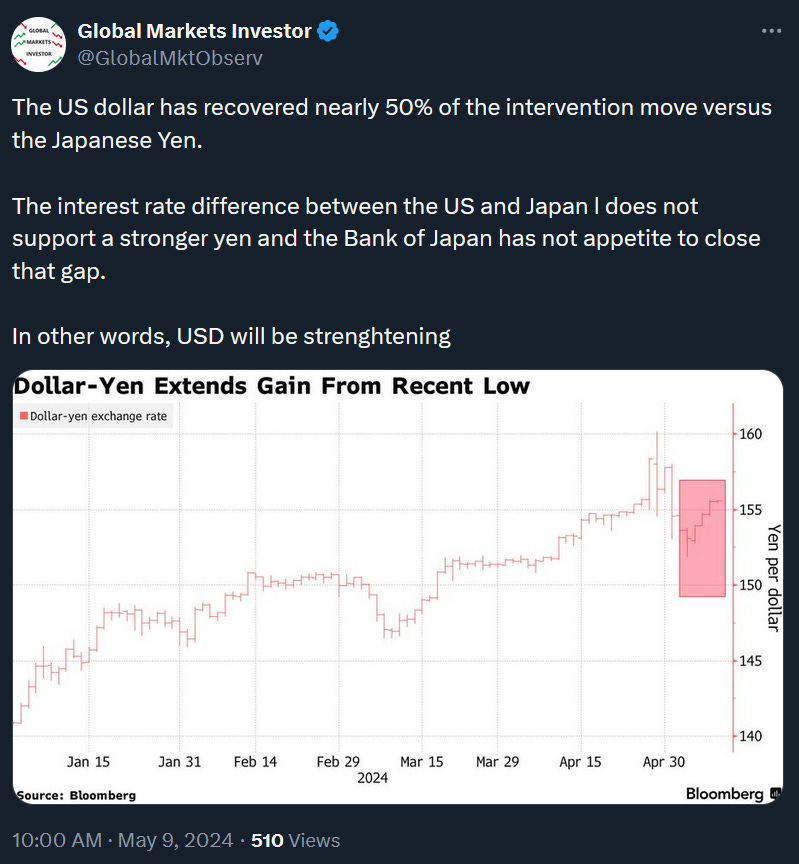

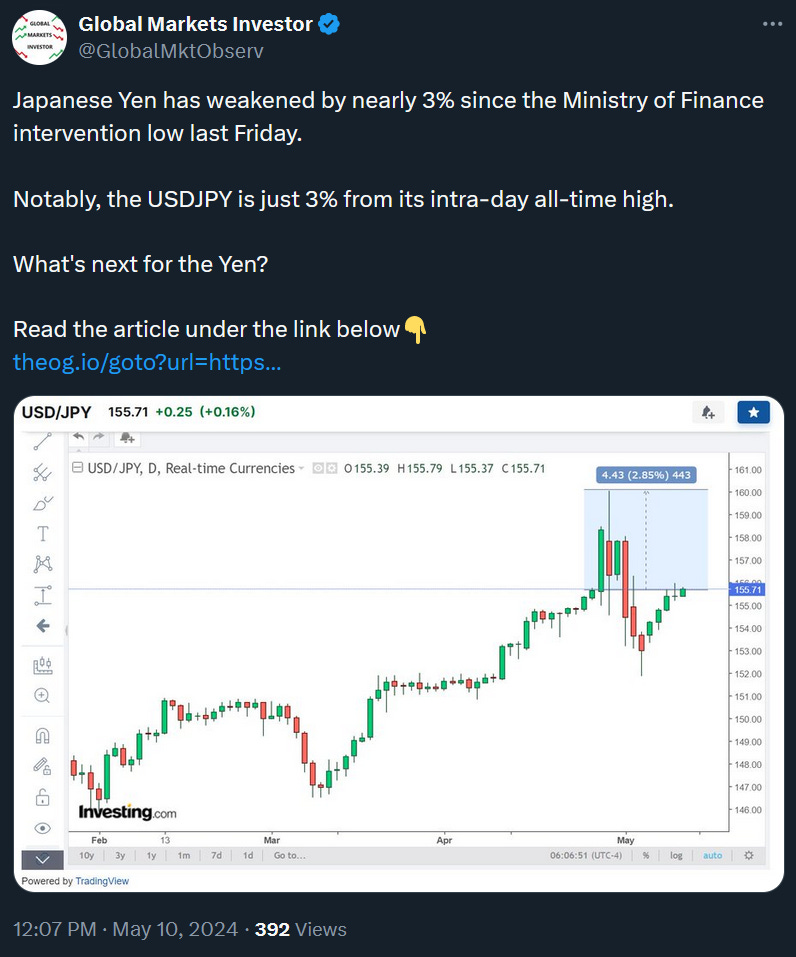

Meanwhile, the US dollar has recovered nearly 50% of Japan’s Ministry of Finance interventions move versus the Japanese Yen.

More about the Yen developments and what’s next for the Yen in the below summary:

If you find it informative and helpful you may consider starting a premium subscription or buying me a coffee, and following me on Twitter:

Why subscribe?