The S&P 500 closed above 5,300 for the 1st time in history. Weekly market recap, trading week 20/2024

Summary of the trading week in several posts with the most interactions on X

In this series, I’ve been bringing out financial posts with the largest number of interactions from my feed on the X platform over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

After 20 weeks of free market recap, I decided that only the 1st post from this series would be available without a paywall. These analyses utilize nearly 10 years of professional experience at investment firms, banks, and firms supporting retail investors as well as the knowledge of financial markets in order to provide top-notch content which is even rare to spot among the most regarded financial institutions in the world.

By following these posts you get much better practical and filtered insight regarding markets than from the famous paid platforms such as Bloomberg, Financial Times, and Market Watch as well as than any college would ever be able ever provide. $15 a month is a very low price and it is less (or comparable) than the cost of outstanding books about finance such as The Intelligent Investor by Benjamin Graham or Lords of Finance: The Bankers Who Broke the World by Liaquat Ahamed.

There are a lot of things to unpack this week as almost every major asset has seen significant moves. Before we kick off with the weekly performance, you can find below the analysis of how to invest in US stocks when the S&P 500 is near or at all-time highs and your time horizon is medium to long-term (1-2 years+):

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin. There were so many market moves that it would be better to list them all below (also see X attachments underneath):

- The S&P 500 finished the week above 5,300 points for the 1st ever and is just ~15 points from its all-time closing high. During the week it has hit its 23rd all-time high this year.

- Dow Jones closed above 40,000 points for the 1st time in history.

- Russell 2000 (small caps) is the only major index that did not make a new high last week.

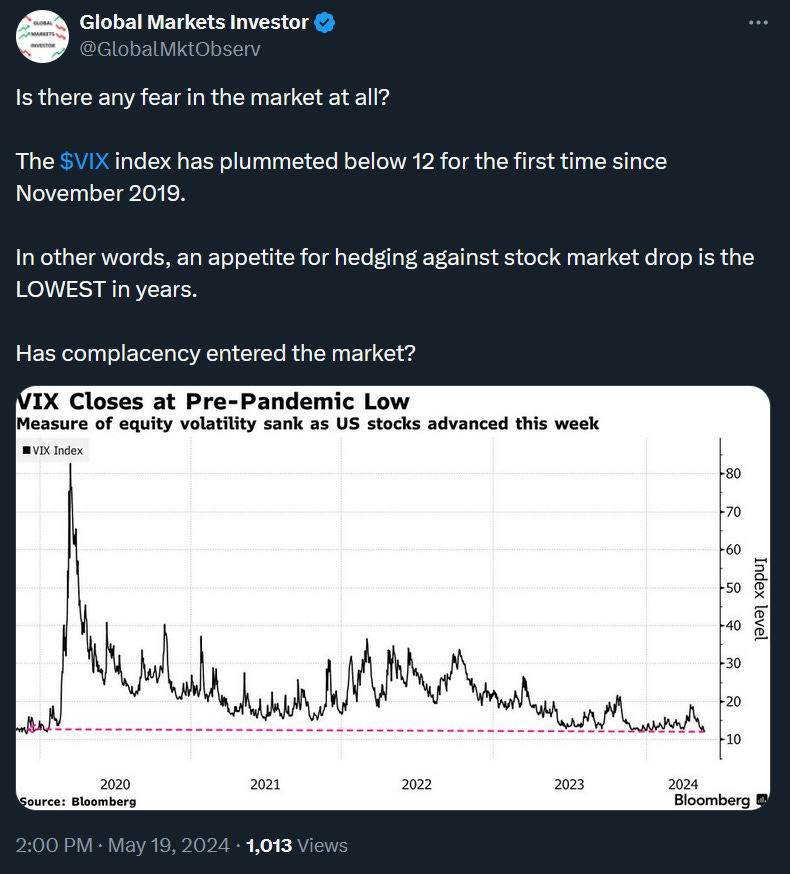

- VIX dropped below 12, the lowest close since November 2019.

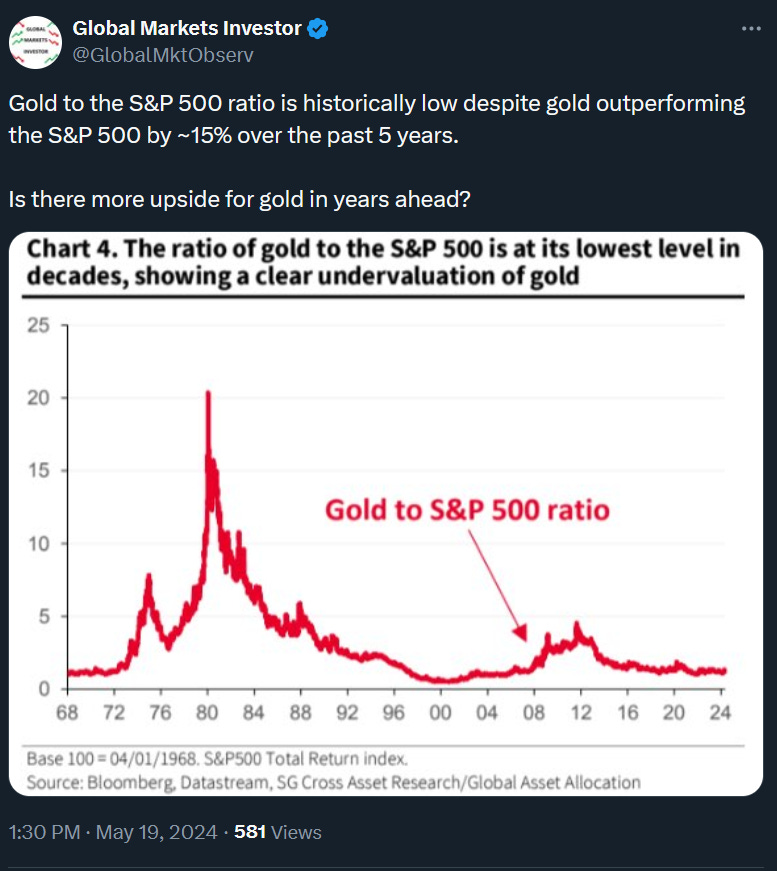

- Gold closed above $2,400 for the 1st time ever.

- Copper reached new all-time highs of above $5 per pound.

- Silver smashed through $30 for the 1st time since 2013.

- World stocks reached a new record.

- European stocks hit an all-time high.

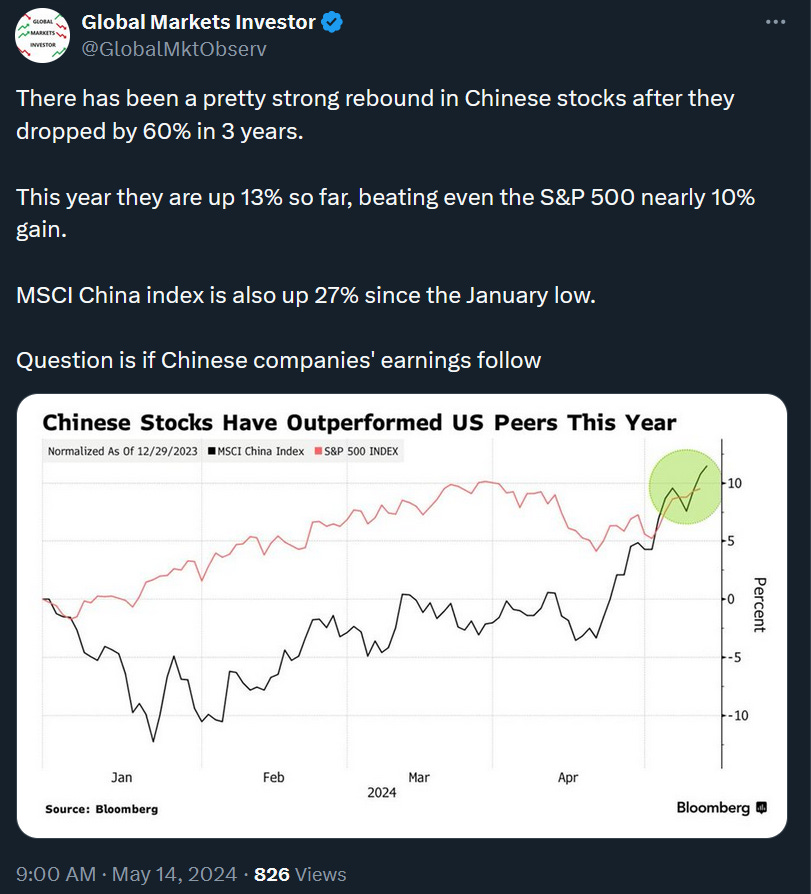

- Chinese stocks have outperformed the US so far this year.

- 14 out of 20 largest stock markets in the world have hit or are near the all-time records.

For the trading week ending May, 24 key events ahead are:

- Fed Meeting Minutes on Wednesday.

- Nvidia Q1 2024 earnings (Fiscal quarter ending April) on Wednesday after market close - quick recap in the last post attached below.

- 18 Fed speeches.

Nvidia’s release will be key, especially the company’s outlook. For the 2Q 2024, Wall Street analysts project earnings growth of more than 120% and almost 100% revenue growth. If the company issues a better forecast than that we will see the stock continue rallying.

2) US consumer debt update. Last week the New York Fed released a US consumer