The Israeli stock market closed higher on Sunday despite Iran's attack. Weekly market recap 15/2024

Geopolitical events over the weekend imply a mixed open on Wall Street, high chance for a recovery

In this series, I’ve been bringing out financial posts with the largest number of interactions from my feed on the X platform over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

Before we kick in with the posts, first let’s assess a potential market response for the next week due to Iran’s attack on Israel conducted on Saturday.

What we know is that Iran launched 185 drones, 110 ballistic missiles, and 36 cruise missiles at Israel on Saturday night. All drones were shot down by the Israeli air defense with the help of the US, UK, Jordan, and Saudi Arabia. Some ballistic missiles fell on Nevatim Airbase but caused only small damage.

After the attack concluded, Iran admitted that it had no plans to continue striking. Meanwhile, Israel considered their defense as a big win and Iran’s failure at the same time vowing to strike back at them in the next 24/48 hours. At this point, the US said that it would not participate in any offensive operations against Iran in response. Israel also made clear to the US that it is not planning for a significant escalation.

Right now, it looks like the US and its allies will try to de-escalate the situation as much as possible to avoid a full-scale regional war. From what has been said by Israel so far, it seems that the country does not also have in mind a large retaliation.

In effect, the Israeli stock market closed green on Sunday with major indices being up by ~0.30%.

The market session, though was quite volatile. The TA 35 index even dropped by 1.1% in the mid-day but eventually recovered all losses.

Cryptocurrencies are the other assets that have been trading over the weekend. On Saturday night, Bitcoin initially dropped by more than 9% but overnight it recouped some losses and as of the time of writing is down by more than 4%.

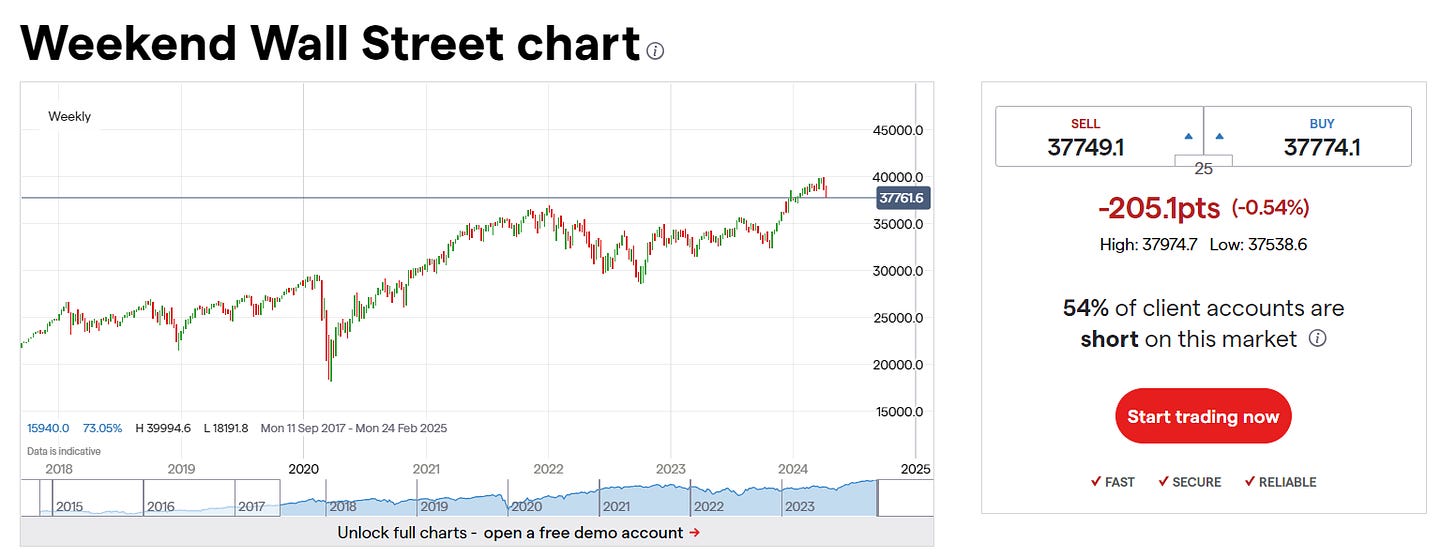

Apart from crypto trading, there's one other proxy for the stock reaction which can be looked at over the weekend - the Weekend Wall Street on the IG website. Currently, it shows a 0.5% drop in Dow Jones. That would also imply gold, oil, and VIX to gap up after the market reopens. However, it is not a perfect measure and due to low liquidity in the overnight session, it can very quickly recover.

The markets have discounted a lot of negative news on Friday and given that the overall tensions have been limited the assets reaction was fairly positive on Sunday. For instance, VIX volatility spiked by 16% on Friday (was up as much as 23% at intra-day highs) to the largest level since October 2023. Interestingly, the VIX moved as Google trends of "Iran", and "Iran Attack" exceeded October levels.

Still, we may expect some volatility in the next several hours, especially in oil, gold, and stocks. Nevertheless, if the developments toward de-escalation in the Middle East continue, we’ll see a market rally during the week.

Now let’s recap the weekly X posts.

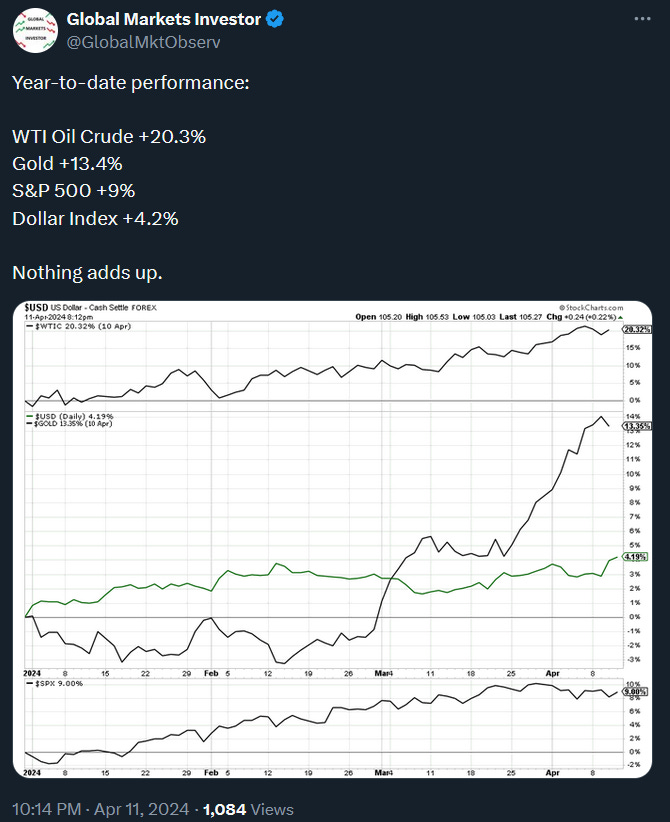

Weekly performance. In the below attachment, you can see last week’s performance of the major US indexes, the VIX volatility index, and Bitcoin. The most moves were seen on Friday when stocks plummeted more than 1% and VIX spiked. Overall, apart from gold, the risky assets have experienced a second negative week in a row. The second post below also shows how everything has been rallying year to date despite the strengthening US dollar which usually weighs on those assets.

In terms of the key events in the week ahead, there are US retail sales data due on Monday and Jerome Powell will speak on Tuesday. Additionally, ~50 S&P 500 companies are scheduled to report their quarterly earnings. Regarding the biggest markets’ risks besides geopolitical tensions, we should look at the dollar-yen currency pair (third post).

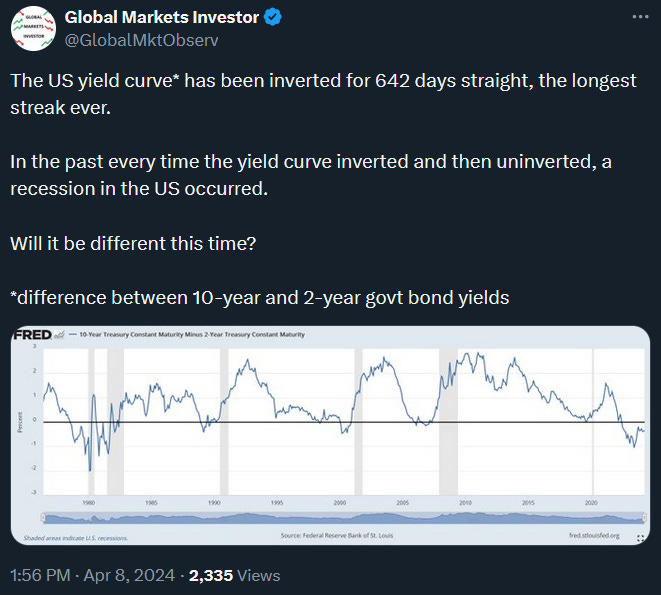

US yield curve. The difference between 10-year and 2-year government bond yields has been negative for more than 640 days, the most on record. In the past, once this relationship turned positive the recession in the US followed. This time, so far the economy has been supported by a massive federal budget deficit of ~$2 trillion last year with the debt rising $1 trillion every 100 days in June. Will this be able to avoid a recession?

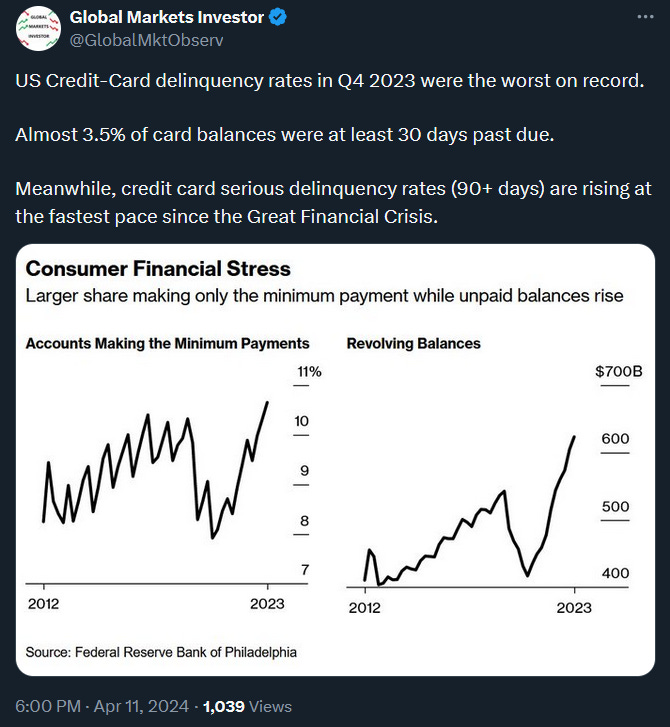

Speaking of a recession. There are more and more indicators that US consumers have been going through more financial trouble every month. Recently US Credit Card rates have ticked up to another record of 21.59%. Also, US credit card delinquency rates in Q4 2023 were the worst on record where 3.5% of card balances were at least 30 days past due. Below you can find the full analysis of the topic:

Financial conditions in the US and the monetary base. The monetary base is the total money that a central bank creates. This includes any money that is printed and in circulation as well as any money held in reserves at commercial banks. This base also includes money held in reserves by banks at the central bank. In the past year, despite the Fed’s balance sheet shrinking, the monetary base expanded by roughly $600 billion. Moreover, financial conditions are the easiest in two years, even as easy as before the rate hikes started. By this time the Fed raised rates by more than 5% and the opposite should happen. However, due to the banking crisis in March 2023, the Fed has again started to indirectly increase liquidity within the financial system. As the availability of funding within the economy has increased, the economy somewhat rebounded and inflation uptick has also followed. Overall, this does not look like a restrictive policy.

Lastly, speaking about inflation, let’s bring up a little summary which can be seen in the below post. If that rebound in inflation continues we may not see any rate cuts this year by the Fed. That in turn will be a huge disappointment for the stock market. Full analysis under the link:

If you find it informative and helpful you may consider starting a premium subscription for under $0.50 a day, buying me a coffee, and following me on Twitter: