The global economy awaits the most coordinated easing since the Great Financial Crisis

World central banks' interest rate cut cycle is coming

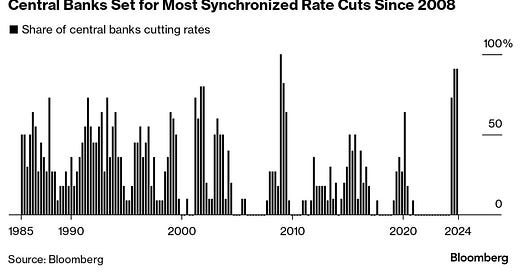

According to Bloomberg data, 10 out of 11 major central banks are expected to slash rates in the second half of this year, the most in 16 years. The list of the 11 countries includes the United States, India, New Zealand, the United Kingdom, Canada, Australia, Norway, the Eurozone, Sweden, Switzerland, and Japan. As shown in the below chart, 91% of them are projected to cut interest rates in 2H 2024.

In the last 40 years, there was only one occurrence when all 11 were reducing borrowing costs. That was during the midst of the Great Financial Crisis in 2008. This time, the only exception is the Bank of Japan which in March raised rates for the first time in 17 years, ending the negative rates era.

What might be the potential market consequences if those predictions materialize?

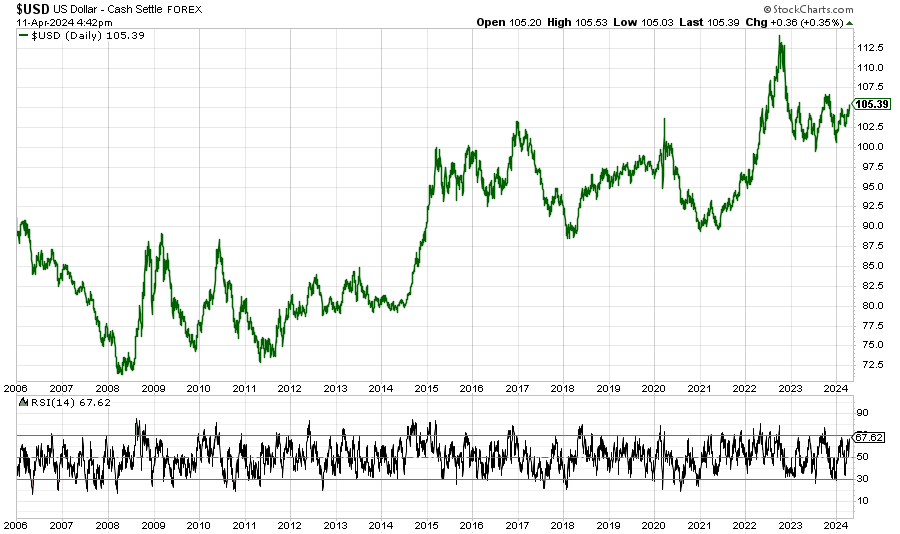

This synchronized interest rate-cutting cycle could further fuel the upside in the US dollar. The dollar index is already trading at the highest level since November 2023.

As a reminder, most of the dollar index is euro but some other currencies also have an impact:

Euro (EUR), 57.6% weight

Japanese yen (JPY), 13.6% weight

Pound sterling (GBP), 11.9% weight

Canadian dollar (CAD), 9.1% weight

Swedish krona (SEK), 4.2% weight

Swiss franc (CHF), 3.6% weight

Additionally, if we go back to 2008, the last time when such a coordinated central bank action happened then we may see that the US Dollar Index rose by 21% since the bottom marked in the mentioned year.

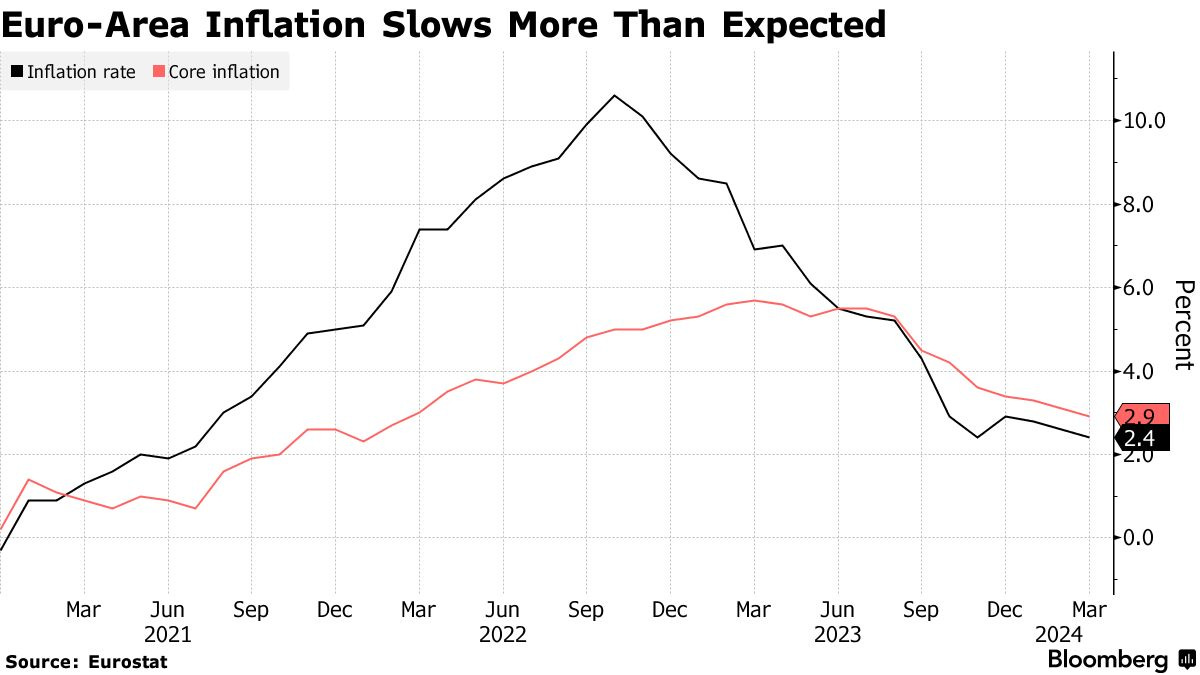

It also looks like the Fed will be one of the lasts into the rate-cutting party as the recent inflation data has been hotter-than-expected and also considering the relative economic strength in the official data. For instance, Eurozone inflation has been declining faster than in the US. See the recent inflation data analysis in the below article.

If you find it informative and helpful you may consider starting a premium subscription for under $0.50 a day or buying me a coffee, and following me on Twitter: