The Fed's preferred inflation metric (from the CPI report) spiked to above 8%

The chance of the Fed cuts this year rapidly abates

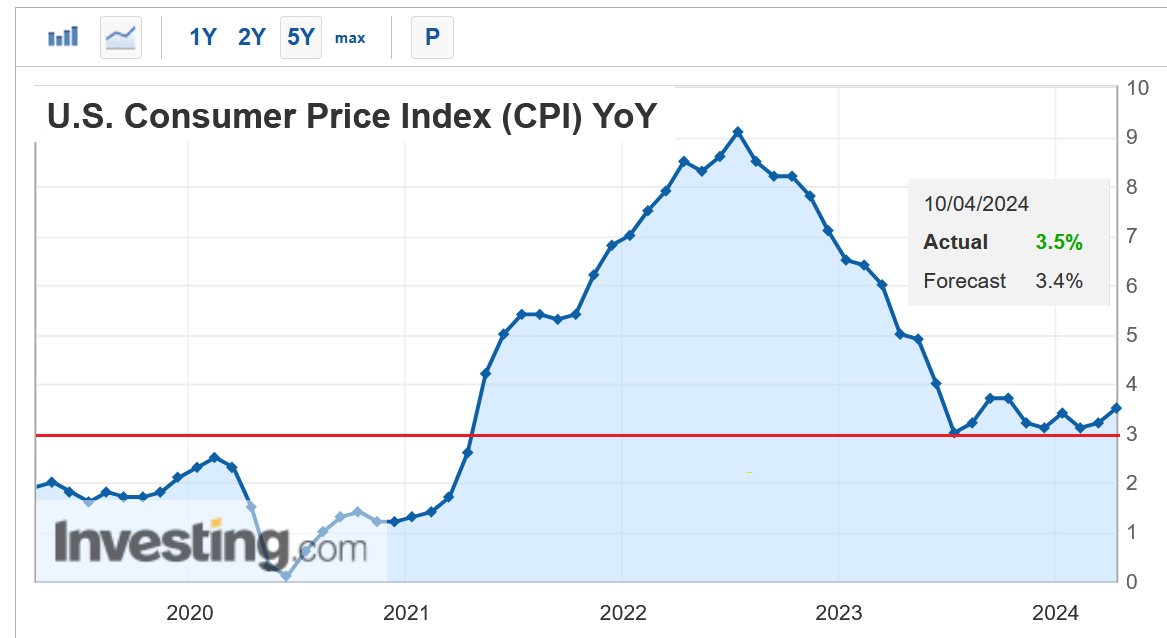

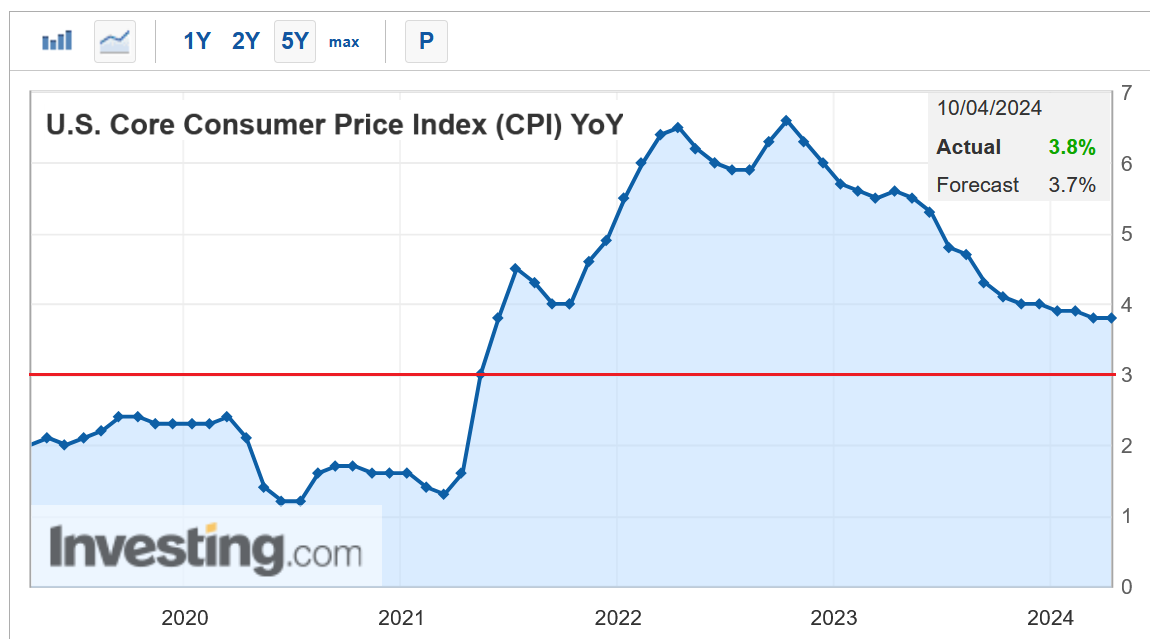

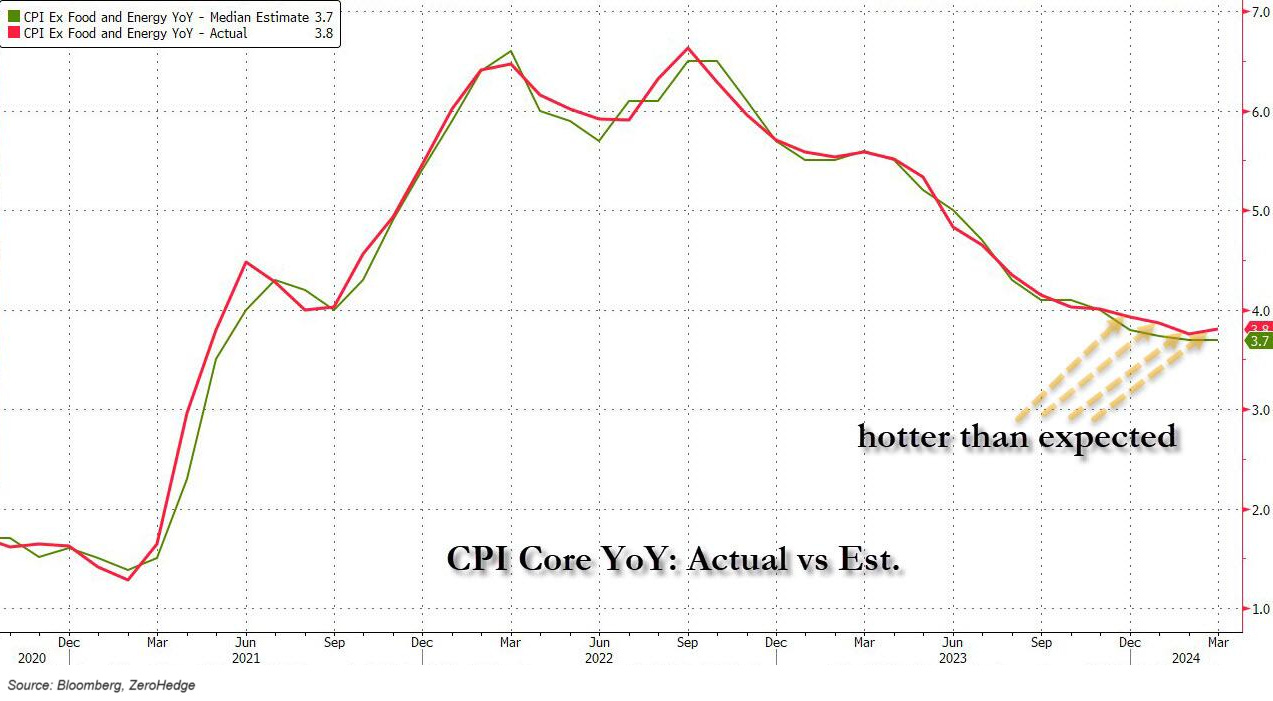

On Wednesday, April 10 the BLS released CPI inflation data for March which again beat economists’ expectations. The headline inflation rate rose to 3.5%, above expectations of 3.4%, and Core CPI inflation to 3.8%, above expectations of 3.7%.

This is the 36th consecutive month with inflation at or above 3% and the 2nd straight monthly increase.

Core CPI inflation (excluding food and energy) has a similar story, sitting just below 4% for the last four months, almost double the Fed’s target

Moreover, this was the fourth month in a row when inflation beat expectations.

One can say, that this is just 3-4 months of the data and there are still two inflation releases before the Fed’s key June meeting and three releases before July. That argument could calm the market’s initial negative reaction in the upcoming weeks. However, when we dig more into the data, the overall picture is extremely concerning.

FED’S PREFERRED INFLATION METRIC (FROM THE CPI REPORT) IS ABOVE 8%