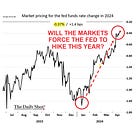

The Federal Reserve flip-flopped again in December

The world's largest central bank overreacts to the lagging economic data.

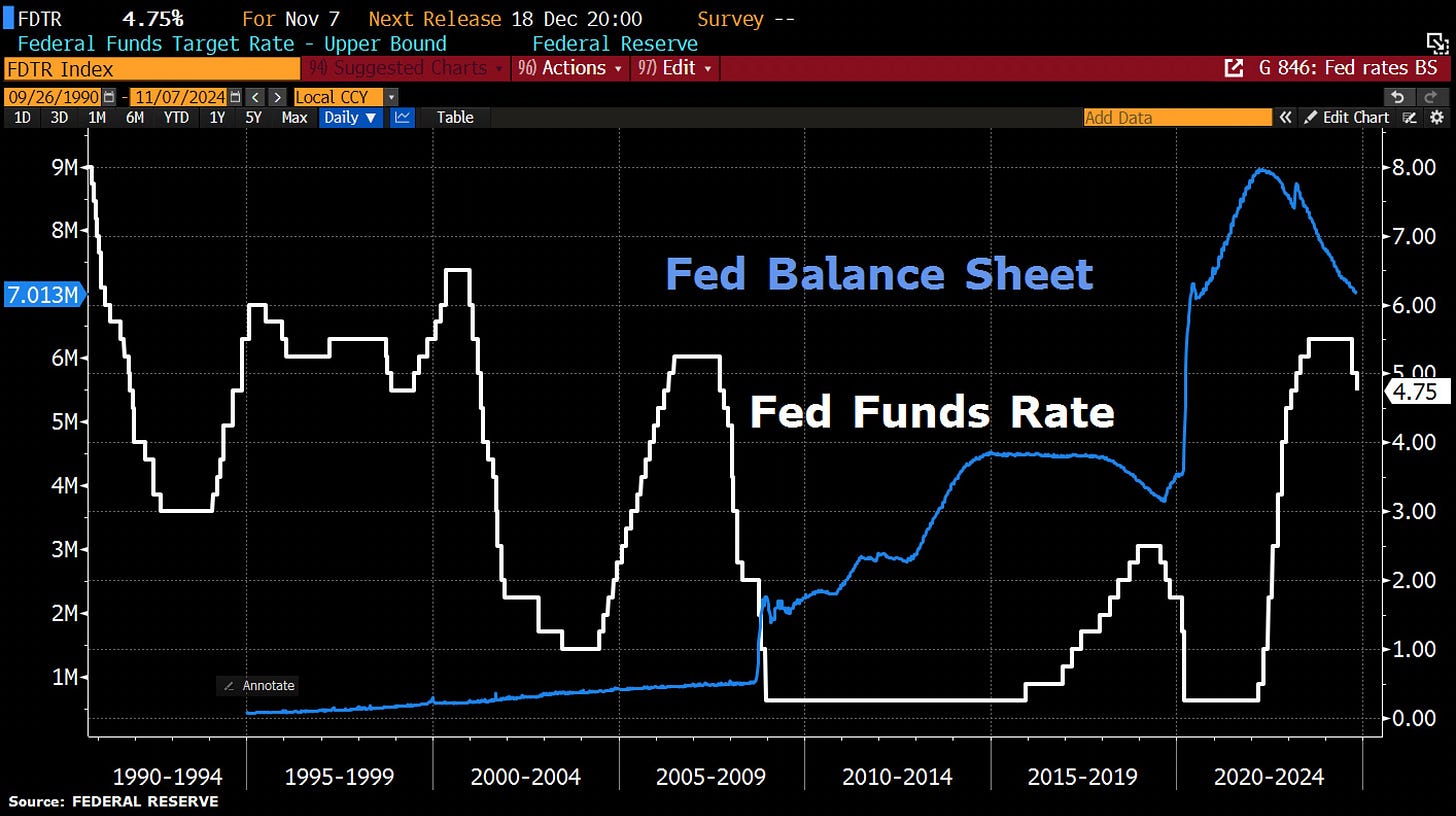

The Fed cut rates by 0.25% on Wednesday as expected bringing its benchmark rate down to 4.50%. This marks the third consecutive rate reduction after 0.50% in September and 0.25% in November.

Cleveland's Beth M. Hammack was the only one who dissented in favor of no rate cut, the first dissent by a regional bank president since June 2022. This was caused by inflation concerns.

The key takeaway from the event is that the Fed is worrying that it will take longer than expected to bring the inflation rate back down to 2%.

More details about the meeting, the Fed Chair Jerome Powell Press Conference, and the market reaction can be read in the subsequent sections.

If you would like to read previous 2024 meetings summaries, here is the list of them:

US CENTRAL BANK’S FORECAST OF INTEREST RATE PATH AND THE ECONOMY HAS MATERIALLY CHANGED