The Fed should have cut rates on Wednesday

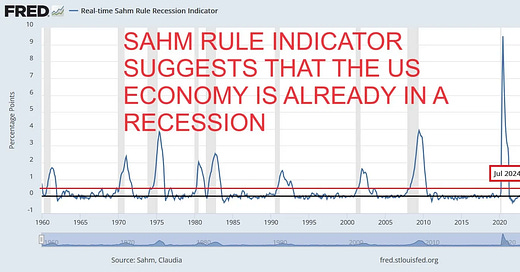

The US central bank is heading for the 3rd policy mistake in just three years while the markets have sold off.

Before you proceed with reading, please note that more timely US labor market data can be found in the below pieces:

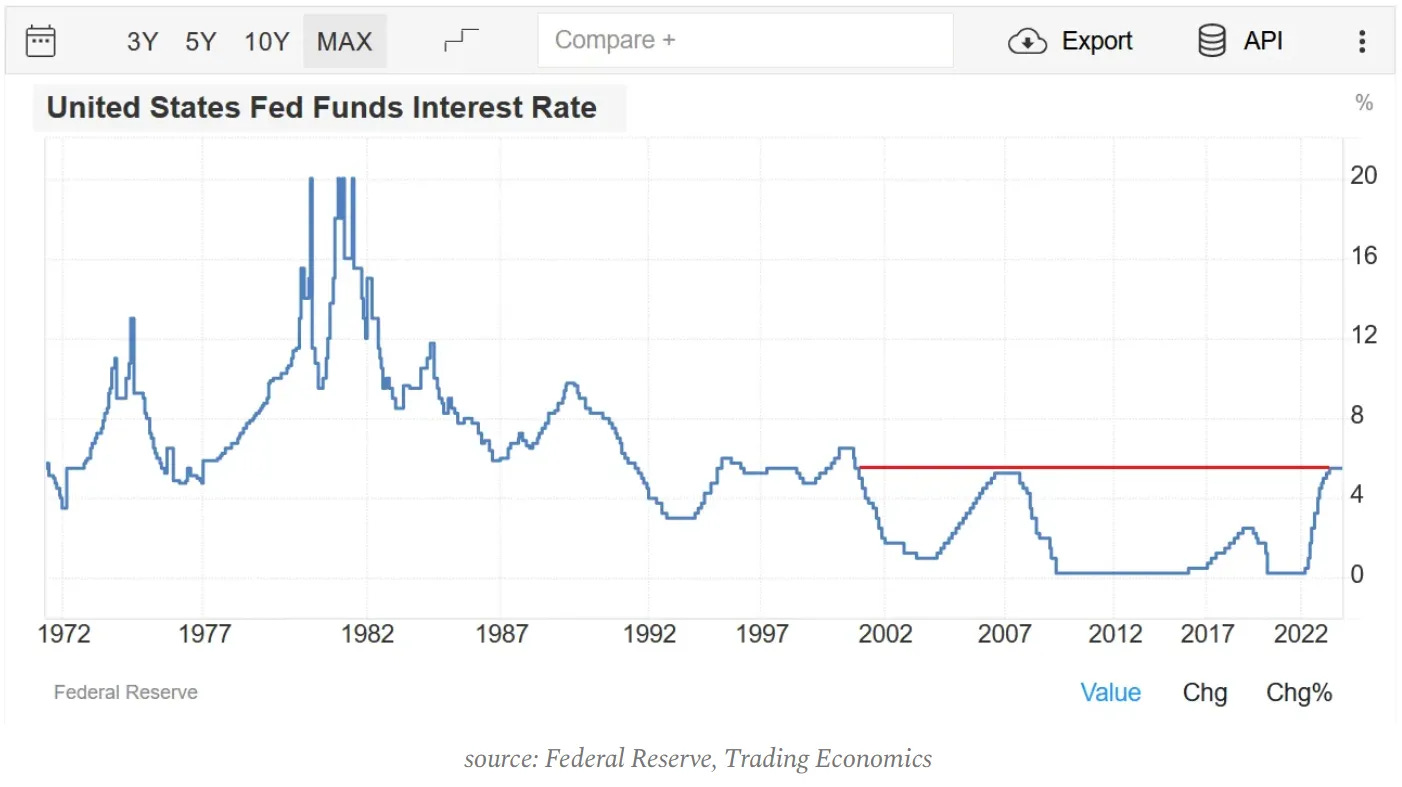

On Wednesday, July 31, the Federal Reserve left its interest rates unchanged in a range of 5.25%-5.50% for the 8th straight meeting reiterating that there will be no cuts until they are confident that inflation is heading to a 2% long-term target.

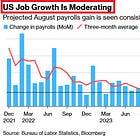

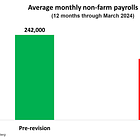

The Fed’s press release also highlighted that inflation has eased but remains “somewhat elevated” while they are focusing on risks on both sides of the dual mandate - pursuing the economic goals of maximum employment and price stability. Interestingly, they noted that the unemployment rate in the US has moved up but still remains low.

At this point, if you would like to refresh what had happened at the previous meetings and compare to the above statements, you can see the last 4 recaps below:

Overall, the press release did not bring anything spectacular. The real show took place during the Chair Powell conference and two days after. Time to summarize the most important developments of the last few days and how they impacted financial markets.

FEDERAL RESERVE CHAIRMAN JEROME POWELL CONFERENCE SUMMARY