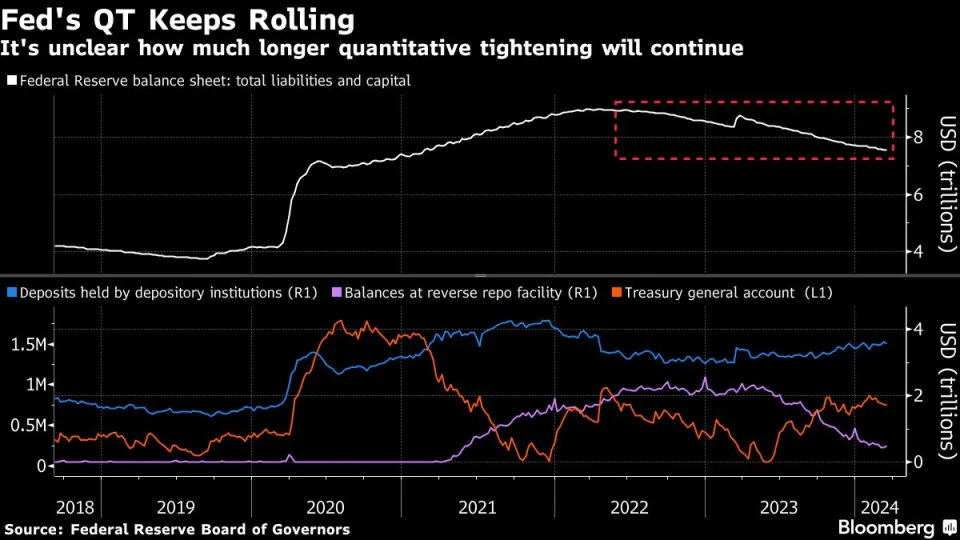

The Fed left rates steady as expected at 5.50%, stocks and gold at all-time highs

The central bank still sees 3 cuts in 2024 and expects to slow the pace of balance sheet reduction at some point

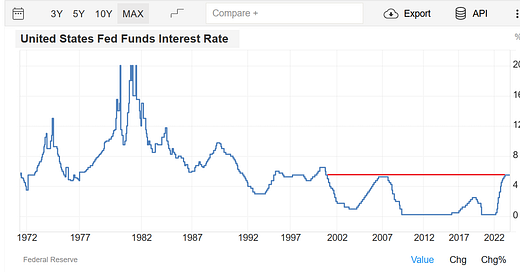

On Wednesday, March 21 the Fed unanimously decided to leave interest rates unchanged at a range of 5.25% to 5.5%, the highest since 2001, for a fifth consecutive meeting.

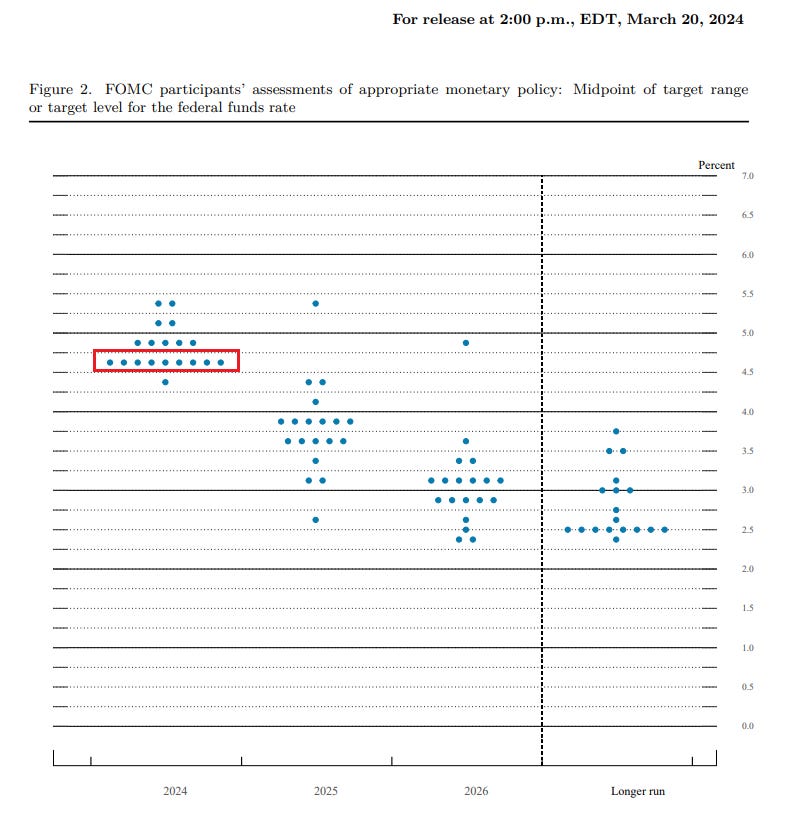

The FOMC (Federal Open Market Committee) members also reiterated that the Fed will continue shrinking its balance sheet by as much as $95 billion per month with some of them calling for slowing the pace at some point this year.

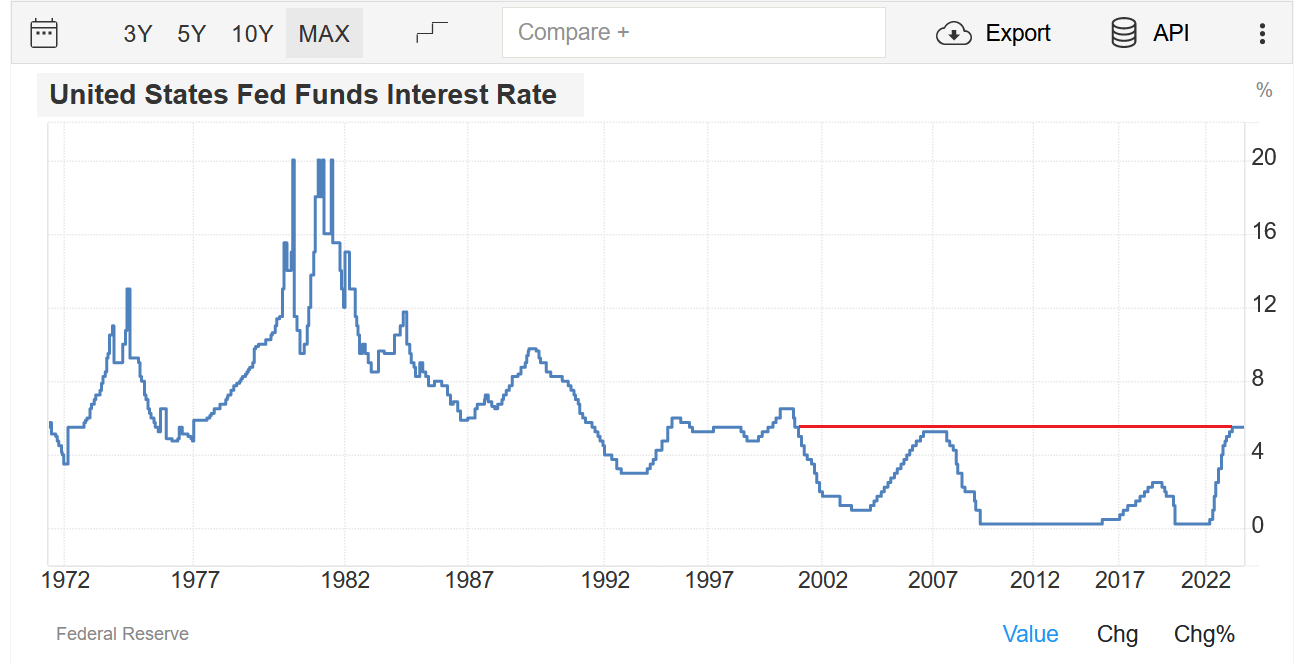

Going forward, the US central bank anticipates three cuts in 2024 as shown in the so-called dot plot, roughly in line with previous forecasts. This is a signal that the recent January and February uptick in inflation did not bother members of the committee. As the below dot-plot graph exhibits the Fed projects rates getting down to 4.6% by the end of 2024. Ten policymakers forecasted three or more 0.25% reductions this year, while nine anticipated two or fewer.

We have to keep in mind that those expectations are subject to change based on future US inflation and labor market data.

Looking further, things get more interesting at the Federal Reserve’s inflation, unemployment, and economic growth forecasts. For 2024, they now anticipate PCE inflation at 2.6% up from 2.4% in December while the long-term inflation at 2.6 up from 2.5%, and GDP growth at 2.1% up from 1.4%. For the unemployment rate, the officials project 4%, down from 4.1% three months ago.

Currently, in the US, the unemployment rate sits at 3.9%. Therefore, it appears that the Fed by lowering its jobless rate forecast made its policy more sensitive to this measure. In other words, if the unemployment rate inches up to 4% that would be a clear signal to the markets that the Fed is going to start cutting rates pretty soon. On the other hand, the change in the long-term inflation could mean that despite the upcoming cuts the central bank will need to stay higher for longer with the level of rates.

To quickly sum this up, the Fed provided a straightforward message: rate cuts are coming even if economic growth and inflation will be coming up higher than expected. That perhaps could also hint at a higher inflation target in the future, for instance, a 3% up from 2% which would be a disaster for the public in the longer term.

FED CHAIR JEROME POWELL’S CONFERENCE

The Fed Chair Powell’s conference did not differ much from the previous ones in regards to his language and tone. The Chairman did not clarify when exactly the Fed expects to cut rates and basically ignored the January and February uptick in inflation saying that they still need more evidence that inflation is headed toward a 2% target. In terms of the labor market, Powell emphasized that significant weakening would be a reason to begin rate cuts which is consistent with the overall Federal Reserve unemployment data projections mentioned in the preceding section.

Interestingly, he outlined that policymakers held a discussion about the pace of the balance sheet reduction and said that it would be appropriate to slow the pace of asset runoff at some point to avoid market turbulence. “In particular, slowing the pace of runoff will help ensure a smooth transition, reducing the possibility of money markets experiencing stress.”

In other words, the most powerful central bank in the world wants to avoid an abrupt liquidity shortage which could trigger financial market issues leading to some sort of banking crisis, assets (stocks, bonds) selling off and the US dollar significantly strengthening.

MARKET REACTION

Following the meeting and the conference, the market has started pricing in a higher chance of a first-rate cut occurring at the 12 June Fed meeting than a week ago. According to the CME FedWatch Tool, the market is pricing a 63% probability of a cut in June’s FOMC Meeting, up from 55% seven days ago.

In effect, the S&P 500, the Nasdaq Composite, the Dow Jones Industrial Average, and gold all closed at a record high on Wednesday with bonds and cryptocurrencies also rallying. On the other hand, the US dollar and VIX index volatility dropped.

The market continued this move on Thursday except for the dollar. The S&P 500 has been trading within a rising wedge since October and is getting closer to the upward band of it. The index is also in overbought territory on a daily basis (above 70 in the Relative Strength Index - bottom part of the chart) as well as the most overbought on weekly candles since before the pandemic crash in 2020 (RSI above 80). We should not be surprised if some sort of breather comes in the upcoming weeks to the market though the overall market fundamentals provided by the Fed remain strong.

Gold prices are also getting a little bit stretched here with the precious metal trading up more than 2% on Thursday at the time of writing. However, given where things are with the Fed and Fiscal policy (huge budget deficits and indebtedness) I would be buying pullbacks in gold unless something fundamentally changes with their policies and inflation data (much higher than expected would be bad for the metal).

By the way, gold price has already hit my base case target for 2024 and it looks like it is heading for my bullish case target. Read below to get more details 👇

CONCLUSION

In summary, the Fed left rates steady as expected at 5.50% and still sees 3 cuts in 2024. It looks like the policymakers aim for the first cut to happen in June even if inflation slightly disappoints upward. The central bank also expects to slow the pace of balance sheet shrinkage at some point this year. In effect, stocks, bonds, cryptocurrencies, and gold have been rallying while the volatility dropped. It is likely that we will see a continuation of those market moves in the following days.

Besides, there are a couple of food of thoughts following this meeting and recent financial market developments:

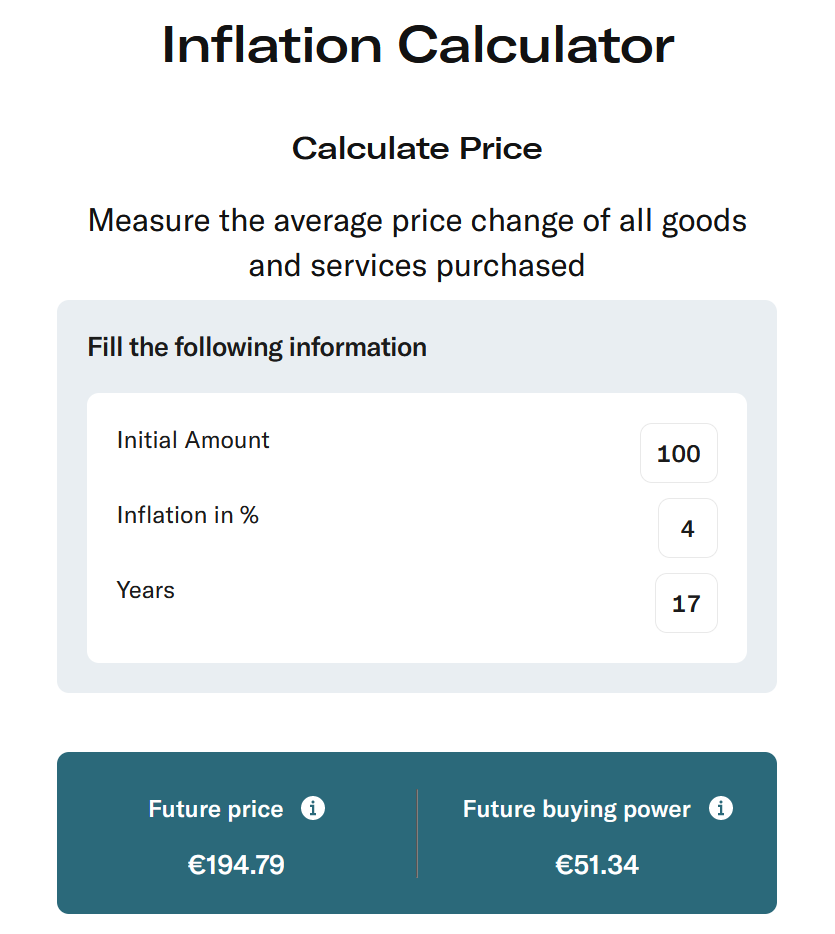

It looks like the Federal Reserve is happy with the current inflation trends despite stubbornly being above 3% and in some cases around 4%. Some market watchers even suggest that the Fed is aiming for a higher inflation target. In fact, with a consistent 4% inflation your purchasing power is cut by 50% in 17 years. In other words, your salary would be worth 50% less.

It is a real catastrophe for ordinary people, especially those in the poorest bracket who can’t fight it with regular wage hikes.

In 111 years of the Fed’s history, most of the times when they started lowering interest rates it has been bad news for the economy and the markets. In other words, in a typical economic cycle, the US central bank begins to cut rates into a recession. Is it different this time?

Bloomberg analysis of past FOMC minutes (detailed record, transcript of the Fed meetings) suggests that the 2 most frequent reasons for Federal Reserve slashing rates are worsening credit conditions and issues within the global economy. Does the Fed know something that we don’t?

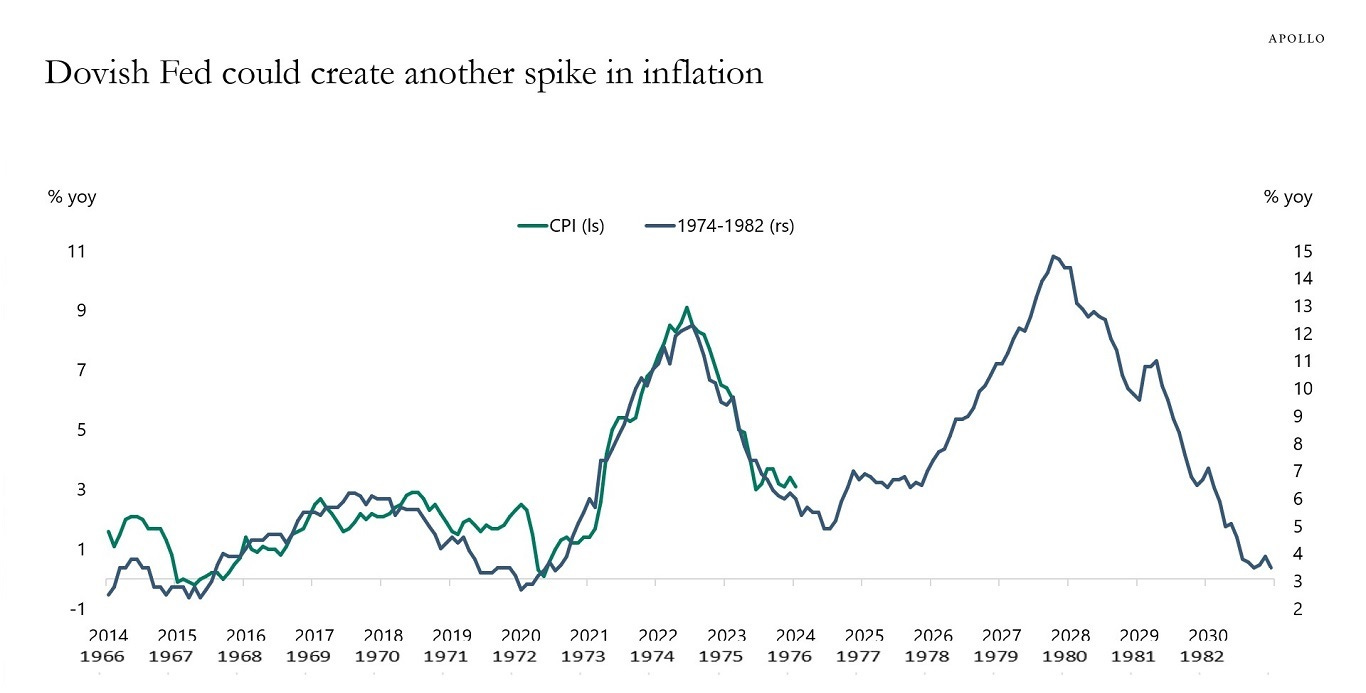

Lastly, as mentioned in one of my articles, if the Fed starts cutting and inflation continues picking up, it would be the biggest monetary policy mistake in this century, similar to the 1970s’ when Arthur Burns, former Fed Chair let inflation run, resulting in the worst economic downturn in the US since the Great Depression. The most important central bank in the world is playing with fire but it appears that they are well aware of it.

If you find it informative and helpful you may consider buying me a coffee and follow me on Twitter: