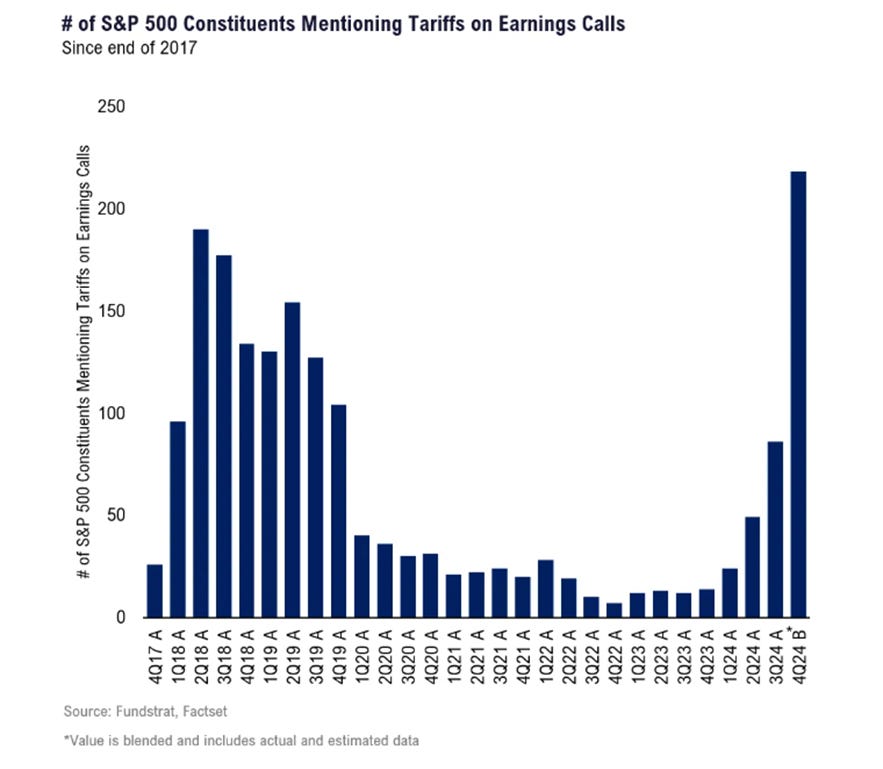

⚠️Tariffs concerns among the S&P 500 companies are rising

The number of S&P 500 firms mentioning tariffs on their earnings calls hit an all-time high.

The number of the S&P 500 firms mentioning tariffs on their earnings calls has exceeded 220 and hit an all-time high in 4Q 2024. This is despite that not every company has reported its results yet.

This exceeded the peak seen during the previous trade war in 2018.

It seems that companies and Wall Street analysts (they ask questions during the calls) are trying to assess the potential impact of the levies.

Besides, some firms may even front-run potential decisions and order more goods than needed at this time which can improve some leading economic indicators in the short-term such as Manufacturing PMIs.

What these developments could overall mean for the US economy and financial markets? Read the detailed piece about tariffs below.

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter or Nostr:

Why subscribe?