Shocking stat of the week: The average retail investor lost ~35% in 2022 and it took 1.5 years to recover all loss.

Common investing mistakes listed below could help avoid such losses

In 2022, the average retail investor’s investment portfolio lost more than 35% and it took 1.5 years to recover the loss. This is much worse than the S&P 500 largest drawdown of 25%. Moreover, the S&P 500 came back to breakeven 6 months before the average investor’s portfolio.

This is all in nominal terms. When adjusting this data for inflation most of these investors are still underwater. It wouldn’t be also surprising if many of them sold their assets near the bottom just before the market bounced.

This is an incredibly concerning statistic given that retail investment has become much more common over the last four years.

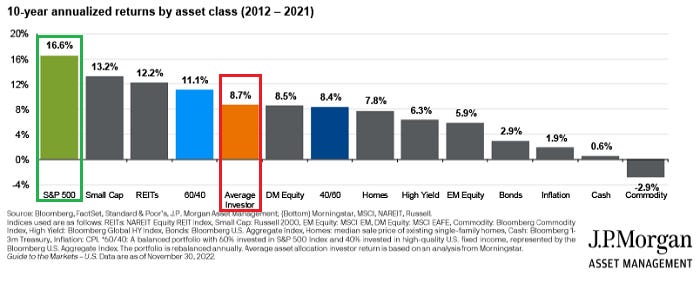

One could say that 2022 was a tough year and it might be an exception. Nothing could be further from the truth. When we look back in time we can see that the average investor has barely beaten inflation, not even talking about the S&P 500.

The 20-year annualized return over 2002-2021 of an average investor was just 3.6%, almost six percentage points lower than the S&P 500 return of 9.5%.

If the average investor invested $10,000 and did not contribute any additional capital over those 20 years it would have $20,285.94. At the same time, a portfolio that invested only in the S&P 500 would have $61,416.12, or 3x more when excluding fees and taxes.

This is a lot of money left on the table over the 20-year period. How does it look in a shorter time frame? From 2012 to 2021 the average investor earned 8.7% a year. This is a much better result. However, it is almost 8 percentage points lower than the S&P 500 which returned 16.6% over the same time, almost double the return.

Again, if the average investor invested $10,000 and did not contribute any additional capital over those 10 years it would have $23,030.08. At the same time, a portfolio that invested only in the S&P 500 would have $46,449.98, or 2x more excluding fees and taxes.

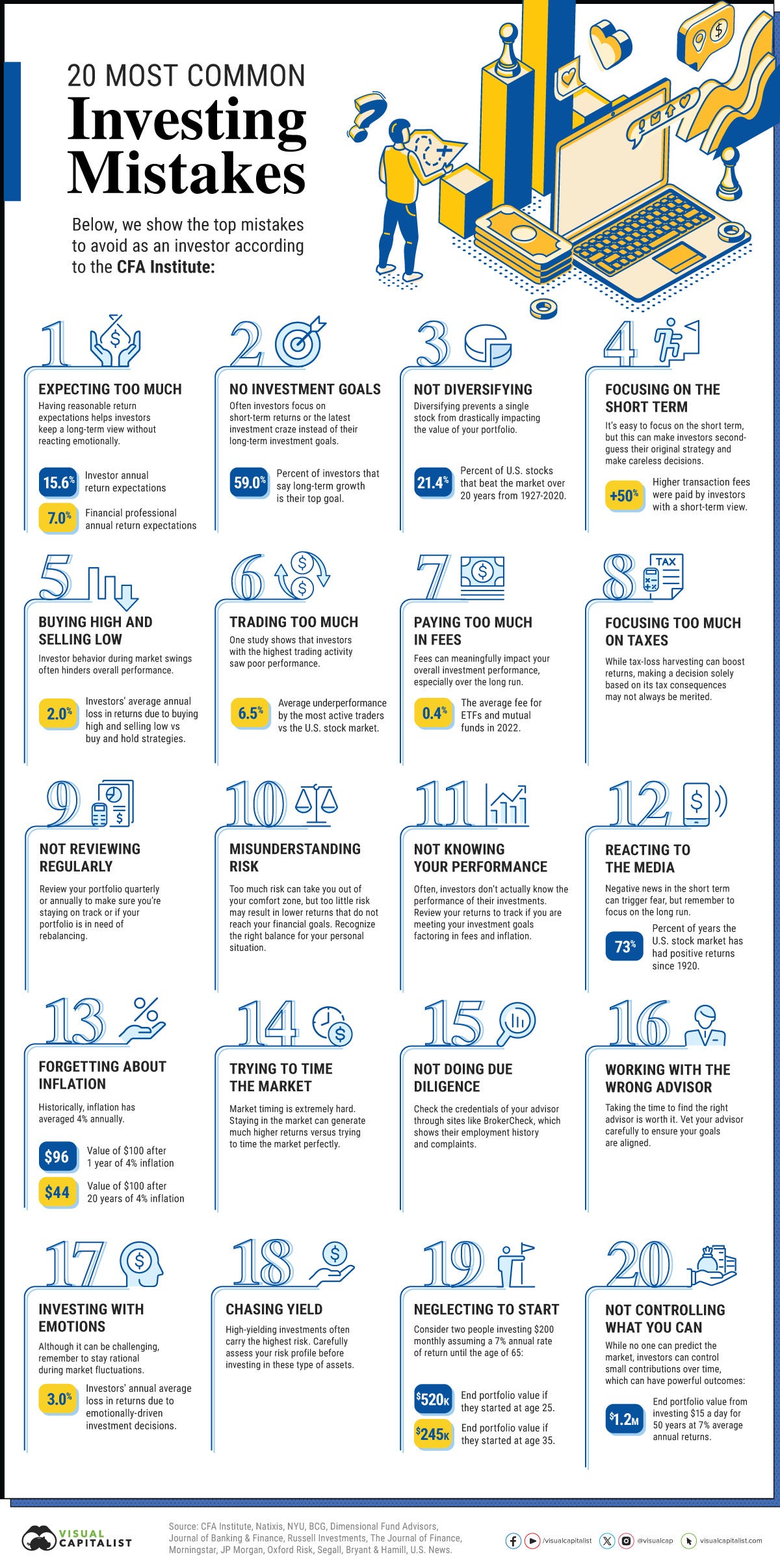

Why the average retail investor has been consistently underperforming the market?

1) Elevated expectations

2) No goals

3) Lack of diversification

4) Short-term trading

5) Not using buy and hold strategy

These are the most popular sins made by the average investor.

Please find out the entire list of the 20 most common investing mistakes according to the most regarded investment organization in the world, the CFA Institute.

If you find it informative and helpful you may consider starting a premium subscription for under $0.50 a day, and following me on Twitter: