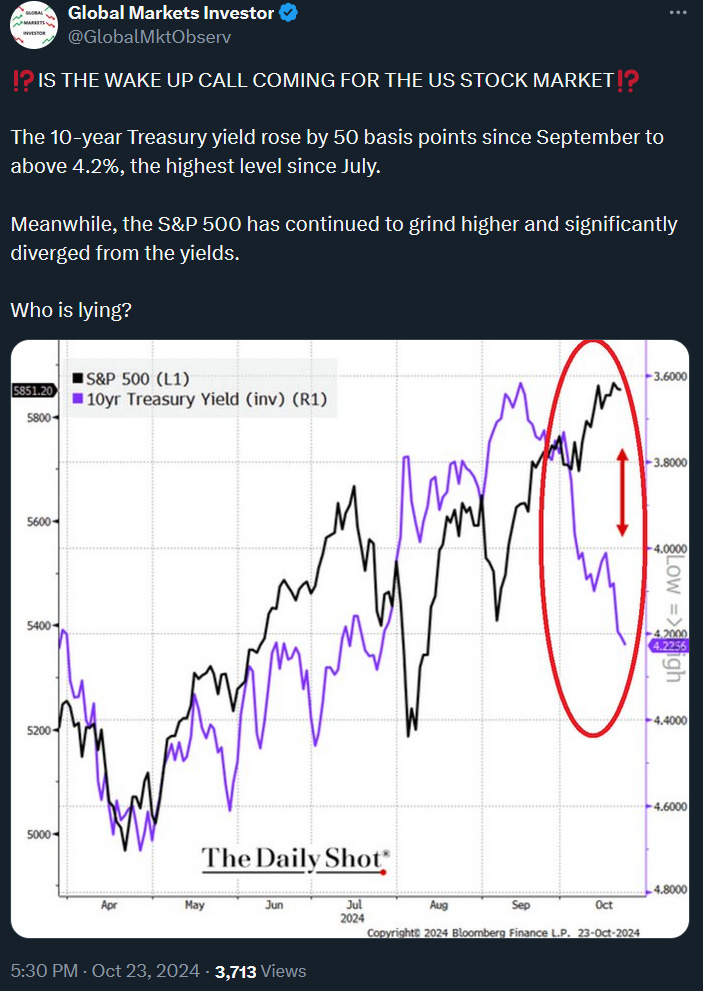

S&P 500 snapped the streak of 6 straight weeks of gains due to rising Treasury yields. Weekly market recap, trading week 43/2024

Summary of the trading week using the most popular posts from the X platform

In this series, you can find financial markets posts with the largest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

The last week in the markets have seen a notable spike in volatility indexes of stocks and bonds, the VIX and the MOVE index. As a result, most major indices were down while gold and silver continued their advance. Looking ahead, the next week will be huge as enormous number of US economic data is scheduled.

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 was down 1.0%

- Nasdaq index rose 0.1%

- Dow Jones dropped 2.7%

- Russell 2000 (small caps) fell 3.1%

- VIX index spiked 13%

- WTI Crude Oil soared 4.3%

- Silver was up 1.7%

- Gold rose 1.0%

- Bitcoin fell 2.3%.

For the trading week ending November 1, key events are:

- US Consumer Confidence on Tuesday

- US JOLTS Job Openings for September on Tuesday

- US ADP Nonfarm Payrolls on Wednesday

- US Q3 GDP data on Wednesday

- US PCE Inflation data for September on Thursday

- US ISM Manufacturing PMI on Friday

- US Jobs report, Nonfarm payrolls, the unemployment rate for September on Friday

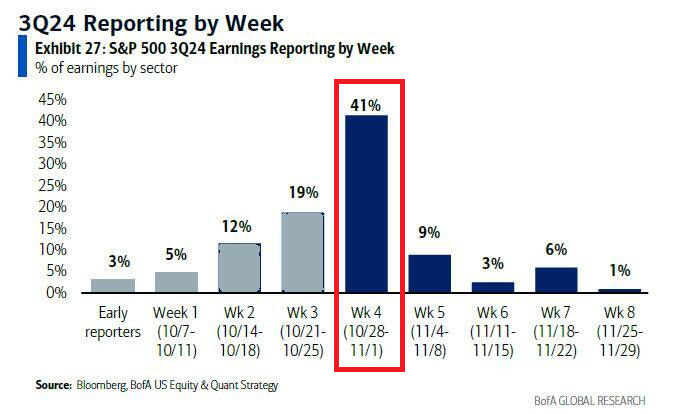

- ~41% of the S&P 500 companies reporting Q3 2024 earnings including Google, AMD, Intel, Microsoft, Meta, Apple and Amazon

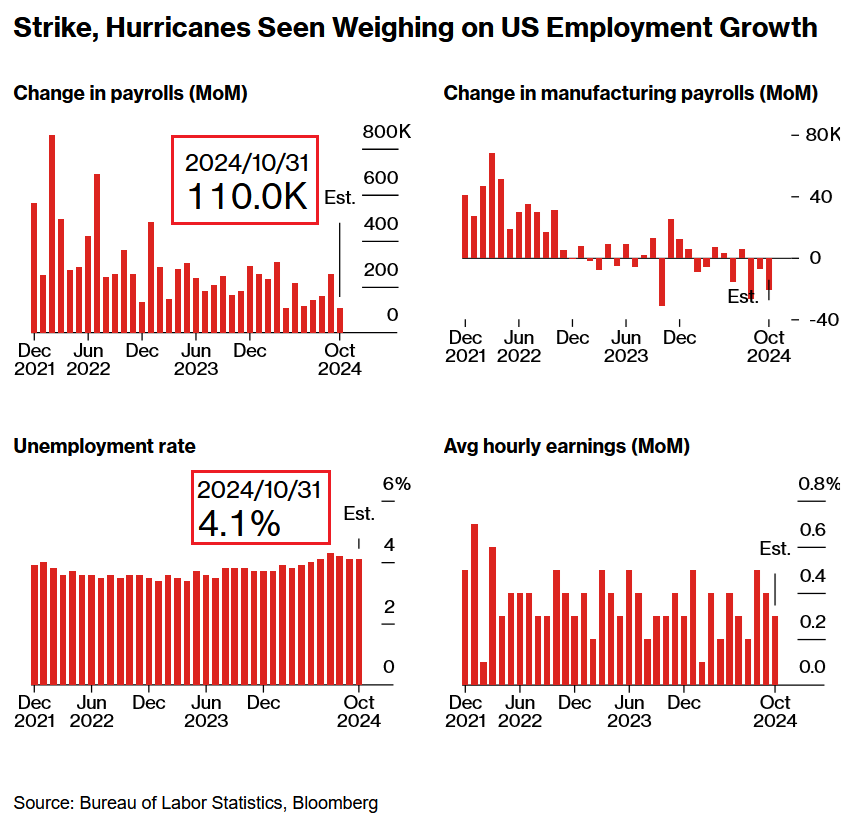

Investors' eyes will be focused on the massive Q3 2024 earnings reports from 5 Magnificent 7 companies and on US job market data. Below you can see that Wall Street expects ‘only’ 110,000 new jobs were created in September due to Hurricanes’ impact while the Unemployment rate stayed at 4.1%. Notably, Bloomberg Economics expect that the US economy actually lost jobs in September and the payrolls growth will be negative.

2) Americans have a hard time finding a job.