S&P 500 snapped its 5-week gain streak. Weekly market recap, trading week 22/2024

Summary of the trading week in several posts with the most interactions on X

In this series, I’ve been bringing out financial posts with the largest number of interactions from my feed on the X platform over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

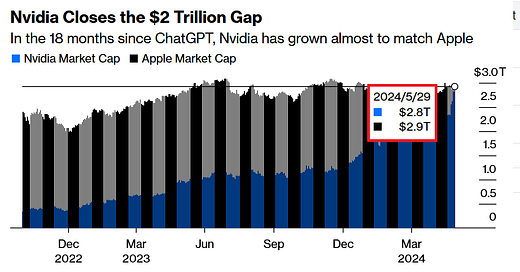

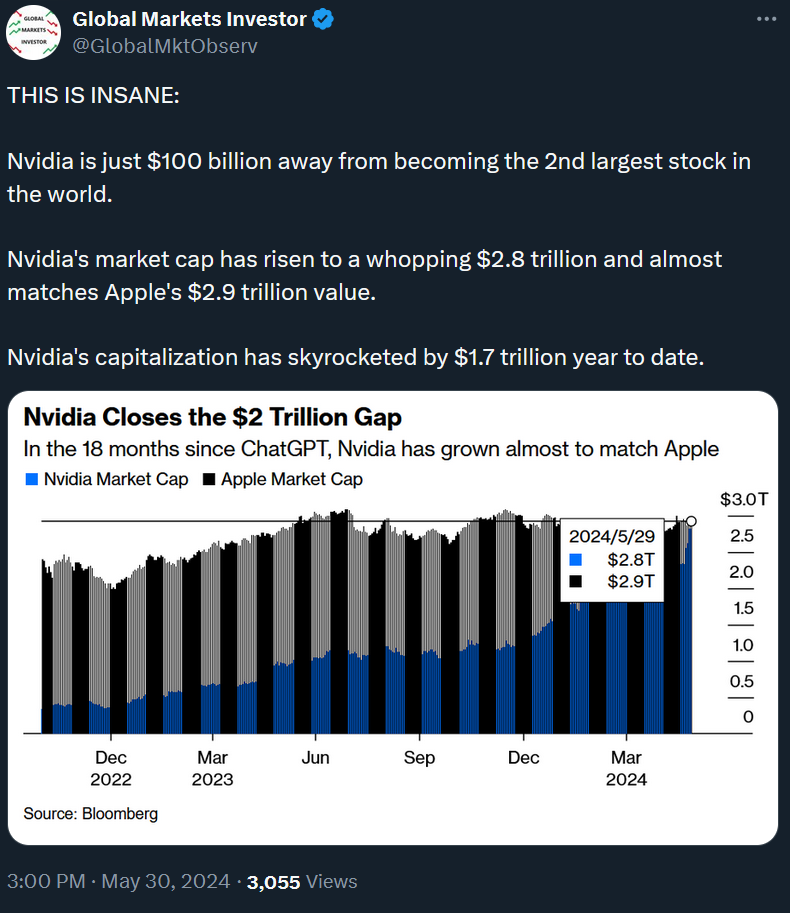

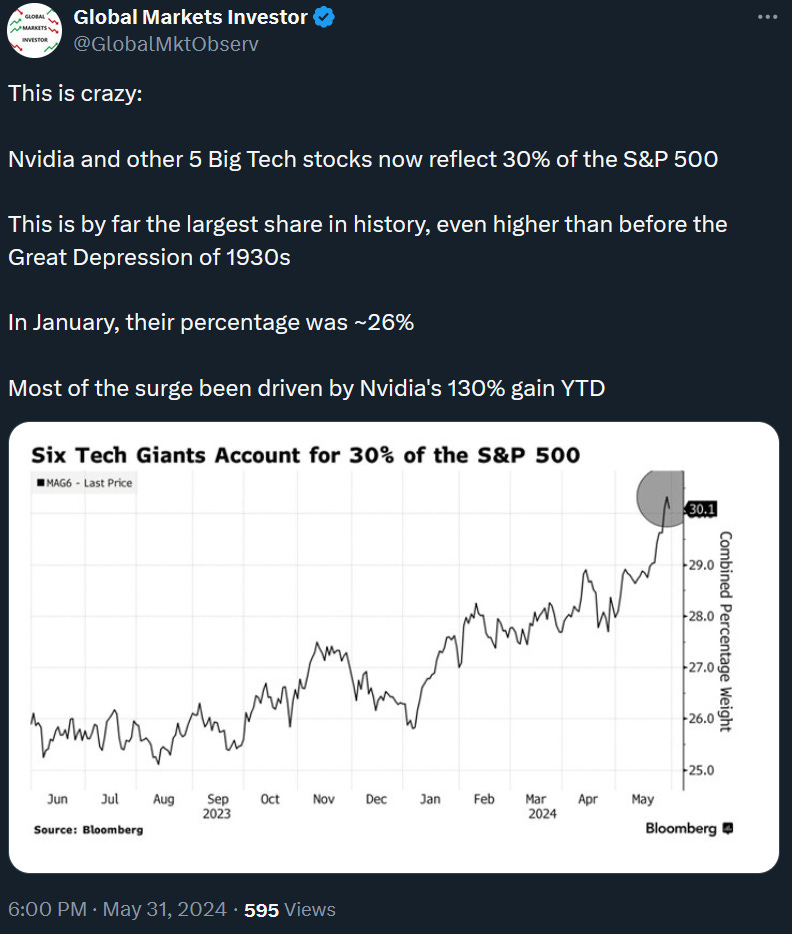

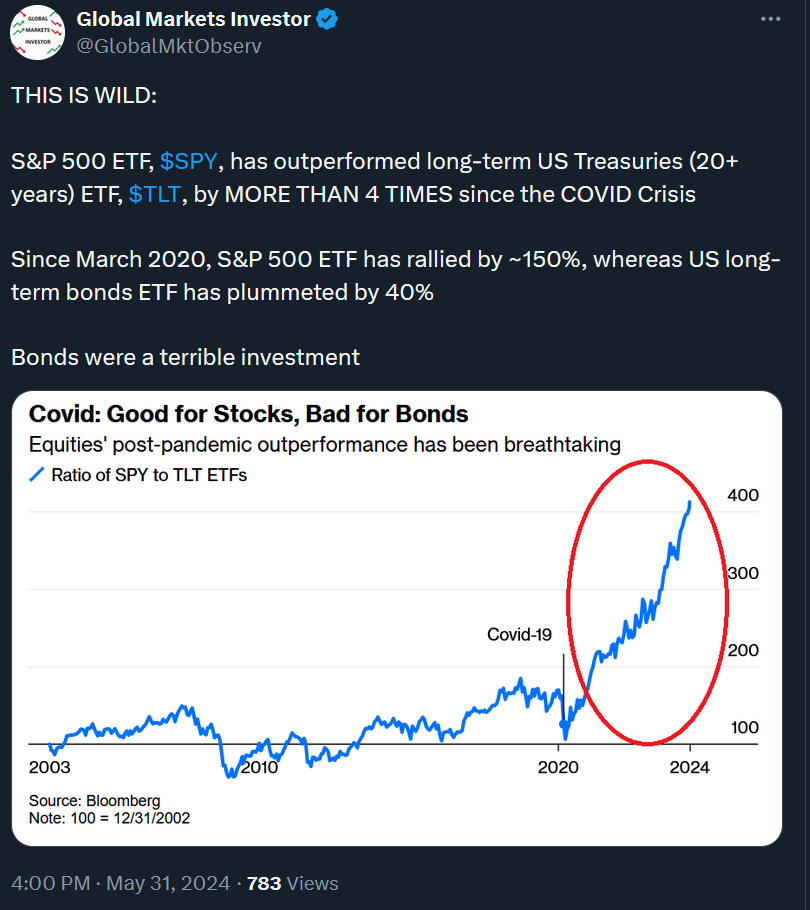

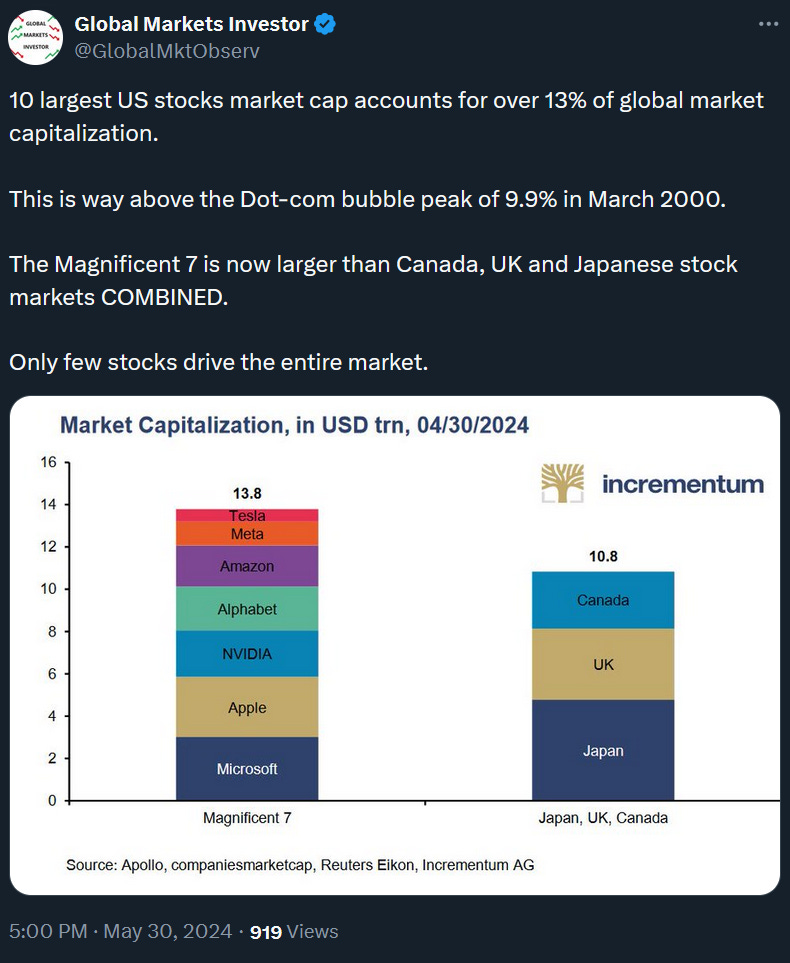

This was a pretty volatile week in the markets, with a mixed bag of results. Nvidia has been still leading, though the stock is now off the highs. Notably, the market concentration is still increasing and 6 largest stocks account now for 30% of the S&P 500, the most ever. Is the US stock market in a bubble? Read the full piece below:

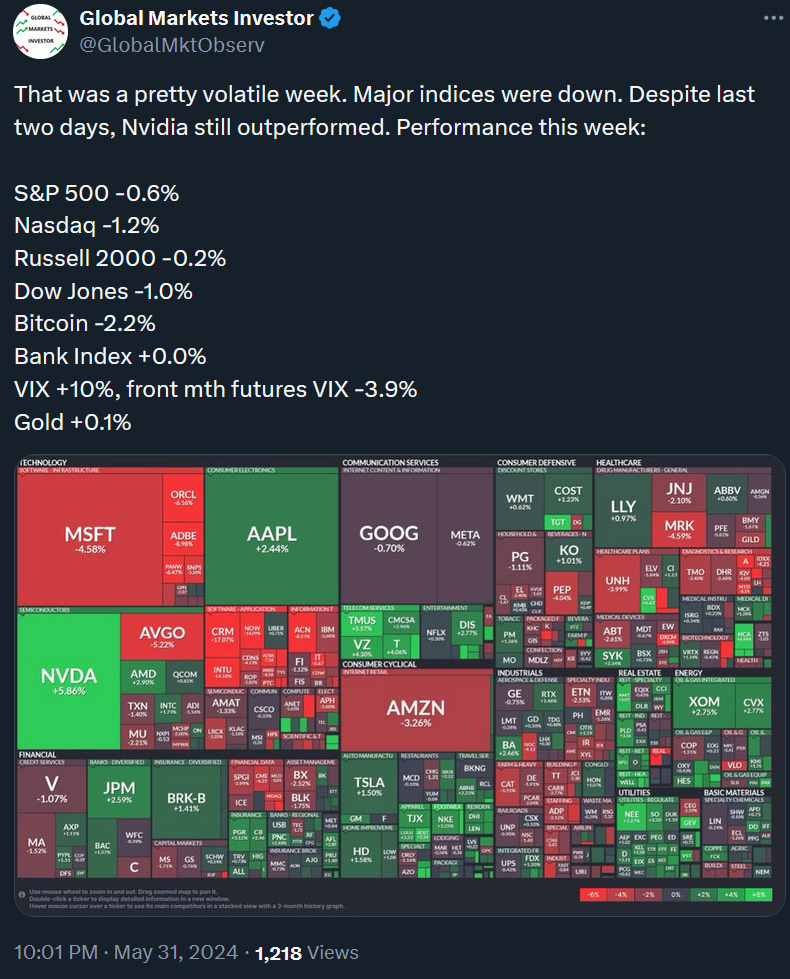

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 was down 0.6% and ended its 5-week winning streak. Notably, in the last 20 minutes of the Friday session, the index went sharply up and closed the day +0.8%.

- Nasdaq 100 index was down 1.2% for the week despite Nvidia’s 6% gain.

- Dow Jones was down by 1% but finished up by 1.5% on Friday.

- Russell 2000 (small caps) outperformed this time and was down just 0.2% this week.

- VIX spiked by more than 10% during the week but eventually was crushed by 11% on Friday, largest drop since October.

- Gold saw a modest 0.1% gain.

- Bitcoin dropped by 2.2%.

For the trading week ending June, 7 key events are:

- US ISM Manufacturing PMI on Monday

- US JOLTS Job Openings on Tuesday

- US ADP Employment data and US ISM Services PMI on Wednesday

- US Non-Farm Payrolls for May and Nvidia 10-1 stock split on Friday.

It will be key to see whether the US labor market continues cooling. Wall Street analysts expect 180,000 new jobs to be added and the unemployment rate to stay at 3.9%.

2) US PCE Inflation data for April (Fed’s preferred metric)