S&P 500 rose for the second week despite Friday's fall. Weekly market recap, trading week 04/2025

Summary of the trading week using the most popular posts from the X platform

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process. These posts are also surrounded by commentary and explanations of complicated topics.

Last week was pretty muted in terms of the economic news except for PMI data. US stocks finished higher for the second consecutive week and hit the first all-time high in 2025 on Thursday. On Friday, however, the market pulled back somewhat. To find more broad market assessment read the below piece (first link):

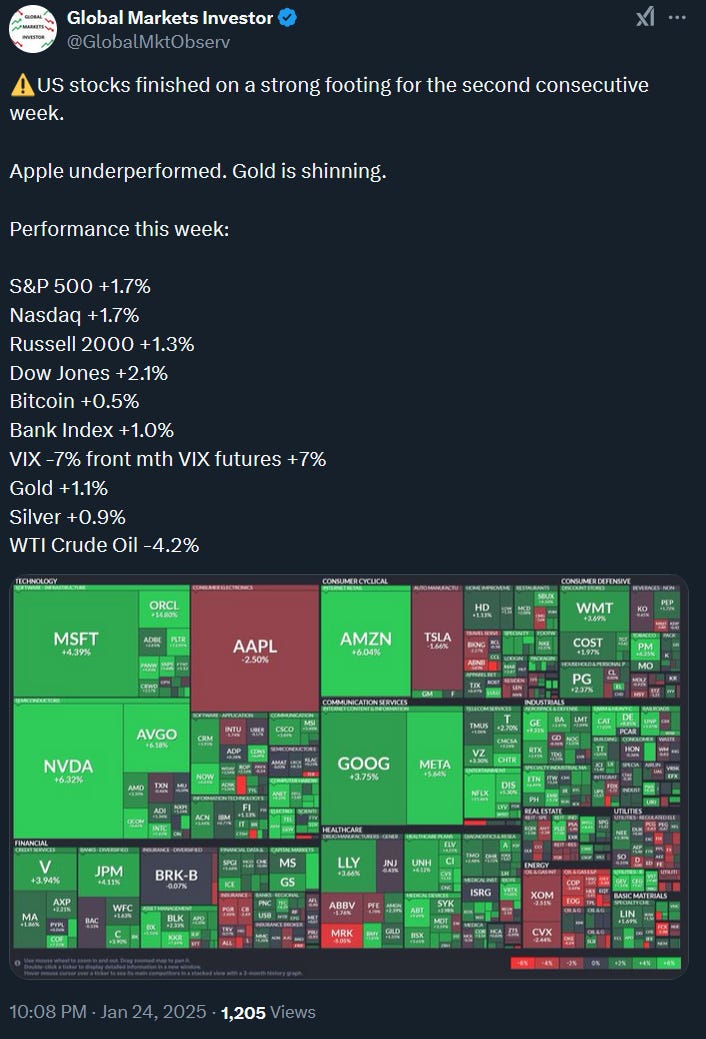

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 jumped 1.7%

- Nasdaq index soared 1.7%

- Dow Jones surged 2.1%

- Russell 2000 (small caps) rose 1.3%

- VIX dropped 7%

- WTI Crude Oil fell 4.2%

- Silver jumped 0.9%

- Gold increased 1.1%

- Bitcoin rose 0.5%

For the trading week ending January 31, key events are:

- US New Home Sales for December on Monday

- Conference Board Consumer Confidence for January on Tuesday

- Fed Interest Rate Decision on Wednesday

- US Q4 2024 GDP on Thursday

- US PCE Inflation for December on Friday

- ~20% of the S&P 500 companies reporting their Q4 2024 earnings

Absolutely huge week ahead. All eyes will be on Fed chair Jerome Powell's commentary about the central bank’s outlook regarding interest rates path.

Additionally, Tesla, Meta, Microsoft, and Apple earnings results, especially their forecasts will be watched. If they exceed expectations for outlook, the market may continue to grind higher.

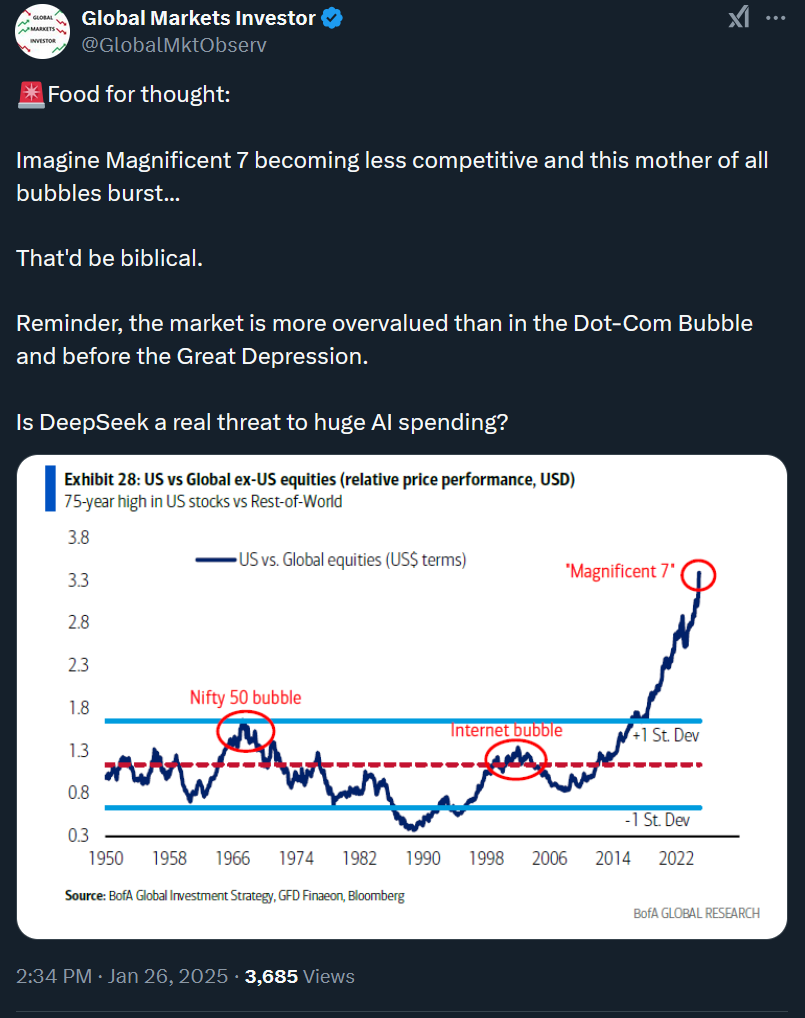

Lastly, in line with or below expectations PCE inflation data should also be market-supportive. It does not change the fact that the market is very vulnerable now to any negative news.

2) Some evidence that the US inflation rate may fall over the next 6-9 months: