S&P 500 rallied for the third consecutive week. Weekly market recap, trading week 34/2024

Summary of the trading week in several posts with the most interactions on X

In this series, I’ve been bringing out financial posts with the largest number of interactions from my feed on the X platform over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

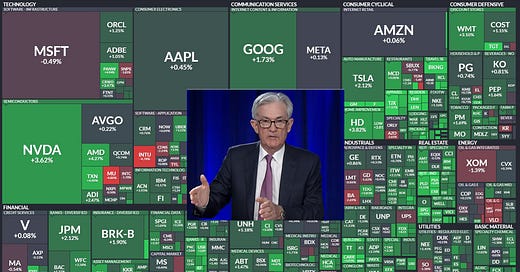

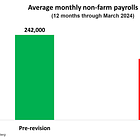

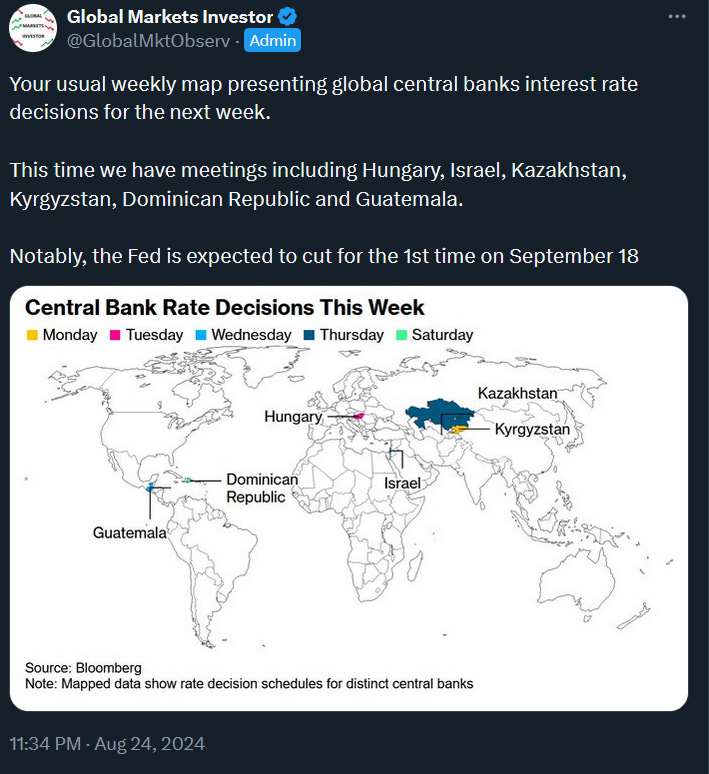

This week was mostly focused on the Fed with FOMC minutes coming on Wednesday and the Chair Powell speech at the Jackson Hole Economic Symposium on Friday. The key takeaway is that the US central bank is going to start cutting rates in September. Notably, on Wednesday, the BLS released a big revision to the non-farm payrolls for the 12 months through March 2024 (more in the below article). Meanwhile, the S&P 500 finished green for the 3rd consecutive week.

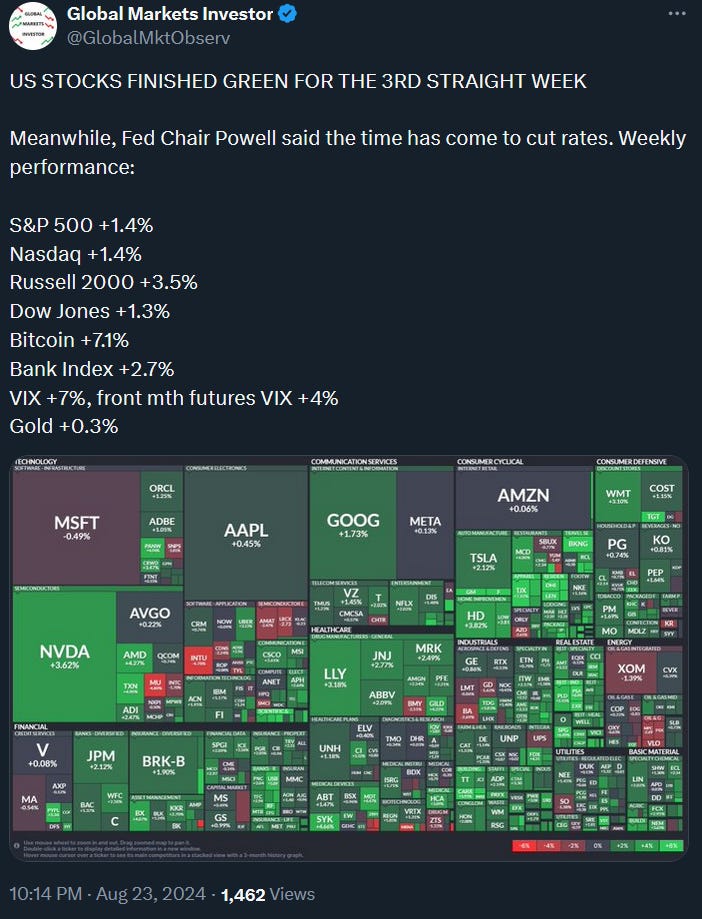

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 finished up by 1.4% and is now just ~1% from its all-time high.

- Nasdaq index was also up by 1.4%.

- Dow Jones increased by 1.3%

- Russell 2000 (small caps) outperformed and gained 3.5%

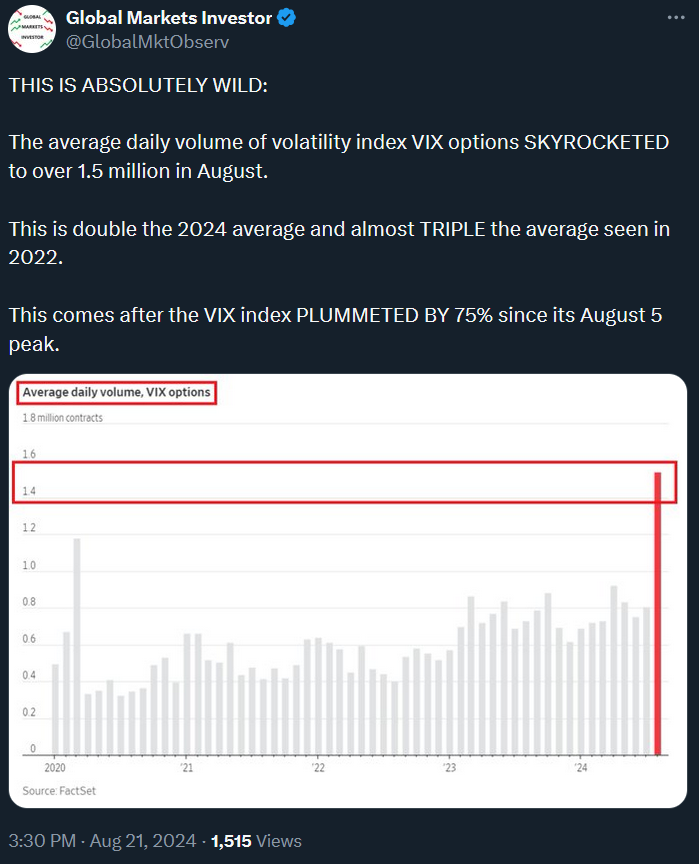

- VIX notably increased by 7%

- Gold was up slightly by 0.3%

- Bitcoin rallied by 7.1%

For the trading week ending August 30, key events are:

- US Conference Board Consumer Confidence on Tuesday

- NVIDIA quarterly earnings on Wednesday after-market close

- US GDP Growth Rate data for Q2 2024, second reading on Thursday

- US PCE Inflation data on Friday

- US University of Michigan Consumer Sentiment on Friday

- At least 3 Fed speeches

Market participants will be focused on NVIDIA earnings on Wednesday, US GDP on Thursday to see whether the US economic growth has not been revised in any direction as well as the Fed’s preferred inflation gauge PCE on Friday.

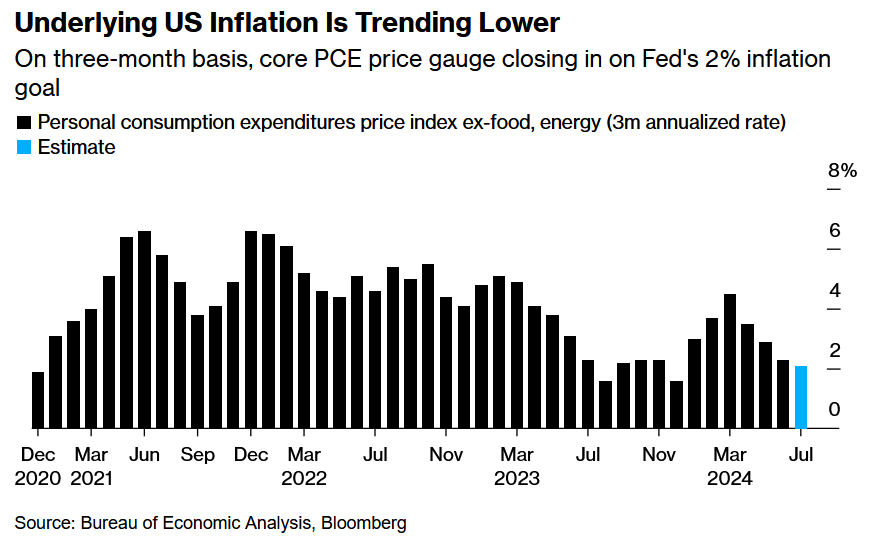

Inflation PCE and core PCE (excluding food and energy) are expected to rise 0.2% month-over-month in July and by 2.5% and 2.6% year-over-year respectively. Interestingly, the 3-month annualized rate is projected to fall to 2.1% which would be a very welcomed improvement by the Fed.

2) “THE TIME HAS COME” for interest rate cuts in the US according to the latest Fed Chair Jerome Powell speech.