S&P 500 hit its 45th all-time high this year despite higher-than-expected inflation data. Weekly market recap, trading week 41/2024

Summary of the trading week using the most popular posts from the X platform

In this series, you can find financial markets posts with the largest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

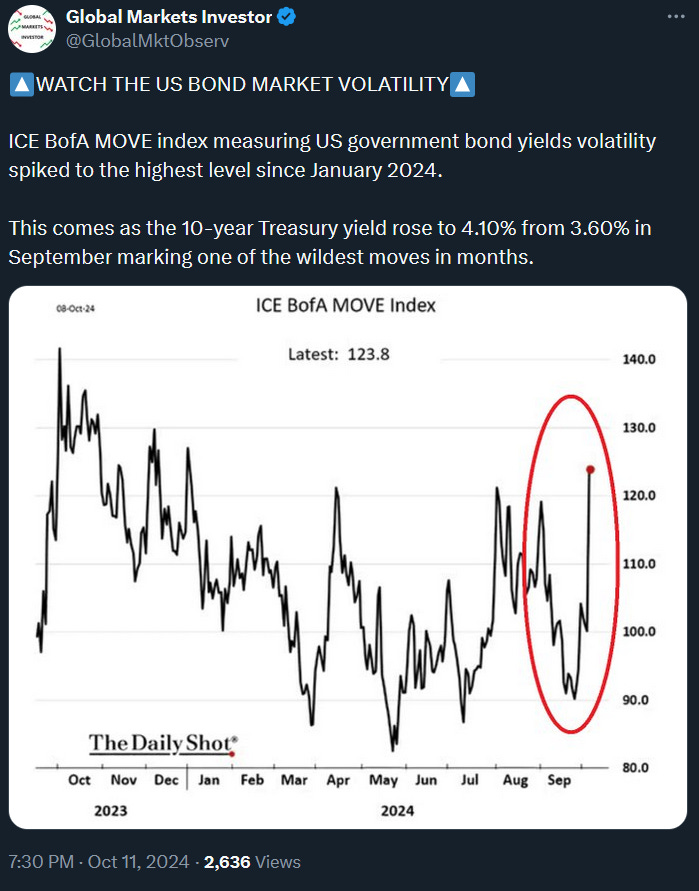

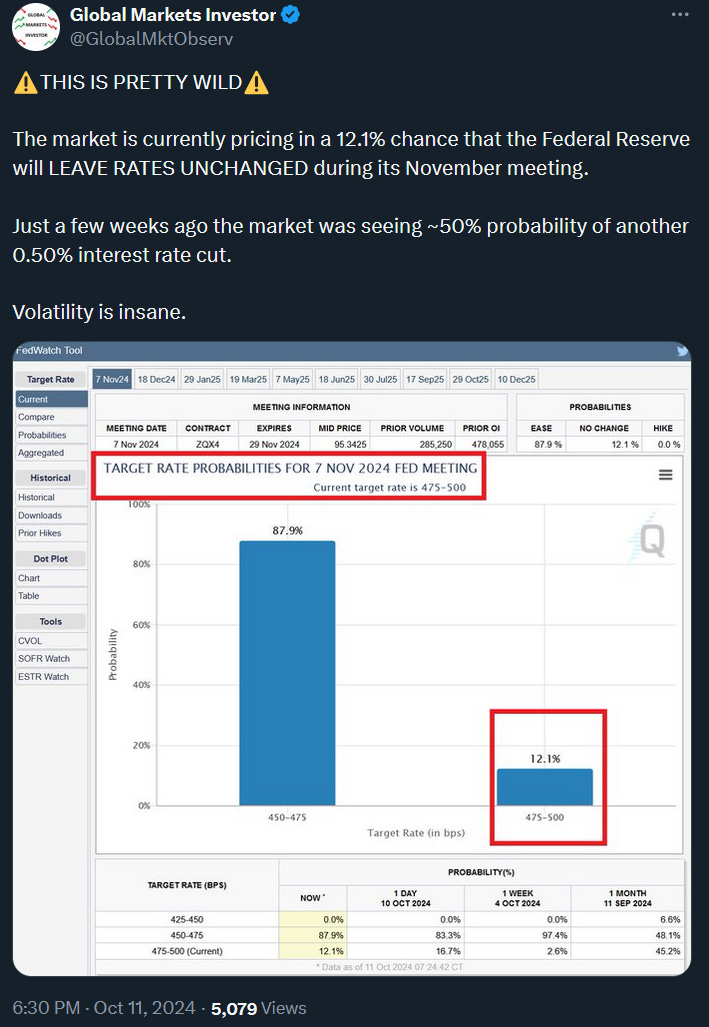

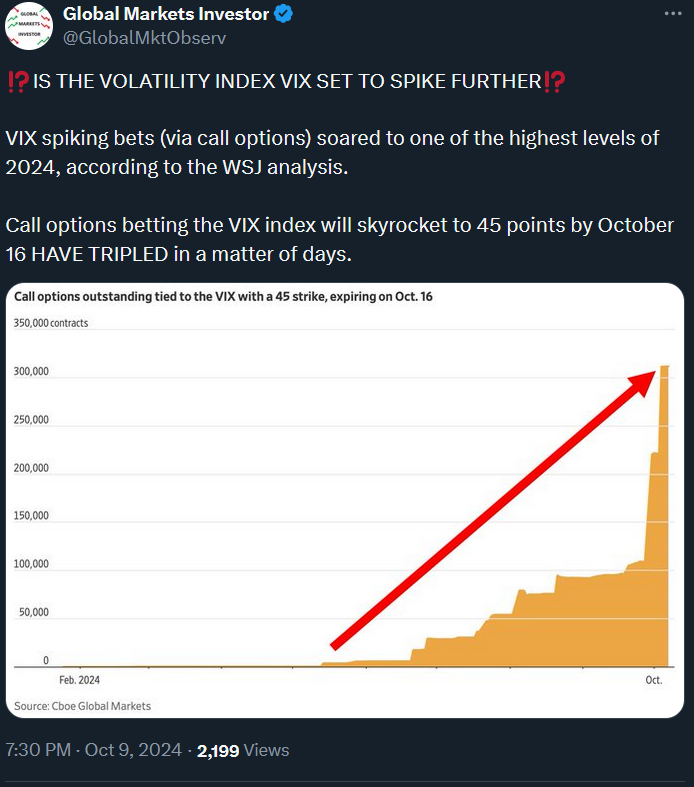

Last week there was a couple of interesting data including US inflation CPI and PPI both coming in above expectations. Nevertheless, the market continued its grind higher and the S&P 500 recorded its 45th all-time high this year. Notably, the Volatility Index VIX still remains elevated likely due to an upcoming US Presidential Election on November 5th.

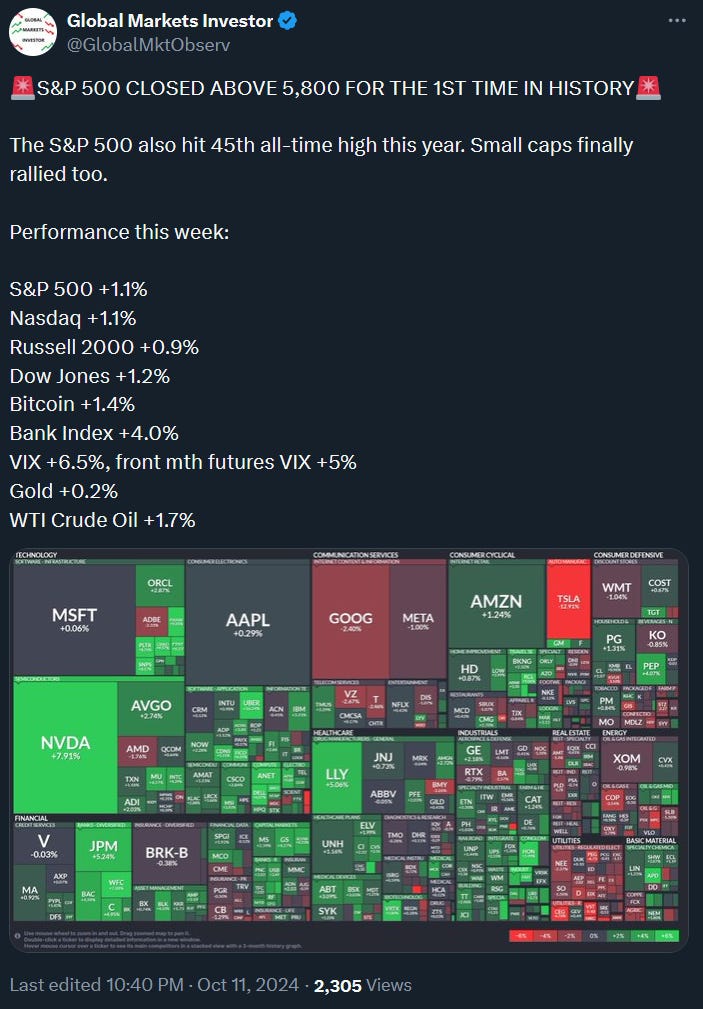

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 was up 1.1% and hit its 45th all-time high this year.

- Nasdaq index increased by 1.1%

- Dow Jones rose 0.9%

- Russell 2000 (small caps) was up 0.9%

- VIX index surged 6.5%

- WTI Crude Oil soared 1.7%

- Gold was up 0.2%

- Bitcoin increased 1.4%

For the trading week ending October 18, key events are:

- New York Manufacturing Index on Tuesday

- US Retail Sales for September on Thursday

- Philly Fed Manufacturing index on Thursday

- US Industrial Production for September on Thursday

- US Housing Starts and Building Permits for September on Friday

- 11 Fed Speakers

- ~10% of the S&P 500 companies reporting Q3 2024 earnings

This week investors will be looking at US retail sales and industrial production data as well as companies’ quarterly financial reports. Along with the Fed Speakers comments the market will likely adjust their interest rate cut expectations for November.

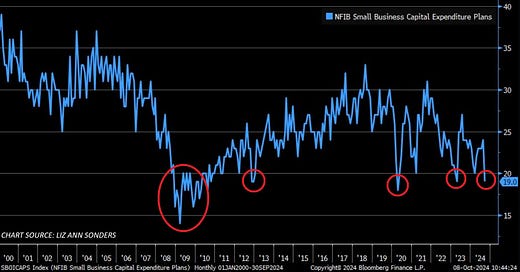

2) US small firms behave as if the US economy is in a recession.