S&P 500 hit its 31st all-time high this year and is up 15%. Weekly market recap, trading week 25/2024

Summary of the trading week in several posts with the most interactions on X

In this series, I’ve been bringing out financial posts with the largest number of interactions from my feed on the X platform over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

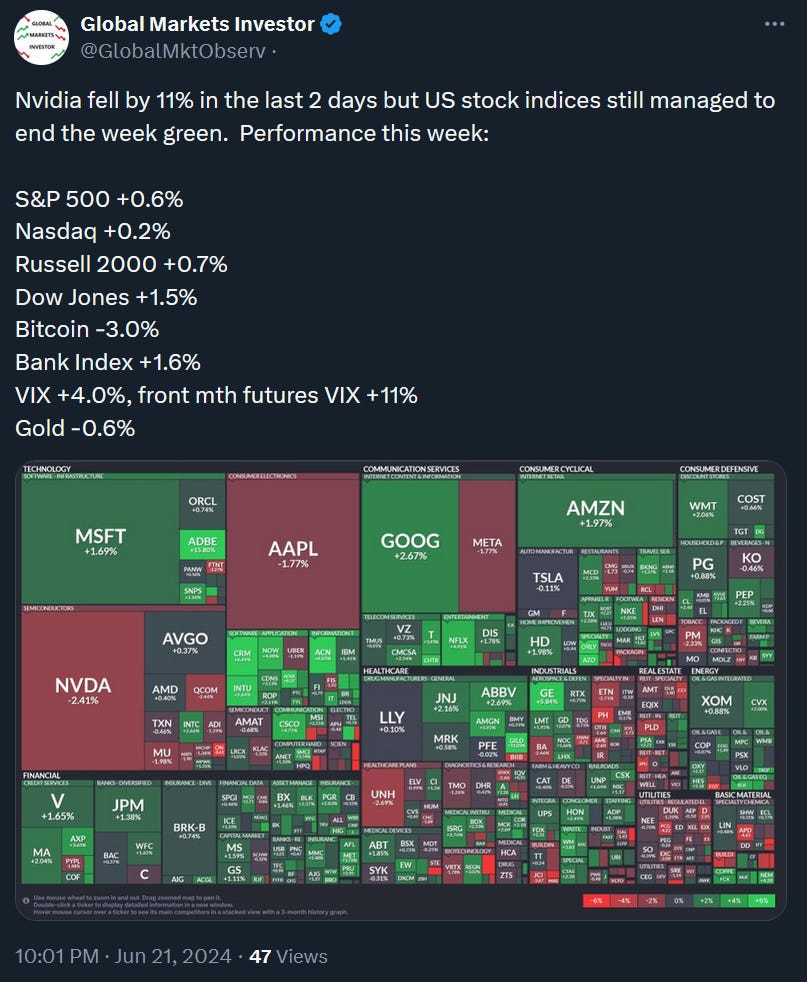

This week had just 4 trading days due to Juneteenth National Independence Day on Wednesday but it was still intensive. The S&P 500 hit its 31st all-time high this year and is up 15%. Meanwhile, the US households’ stock market participation has hit historic levels.

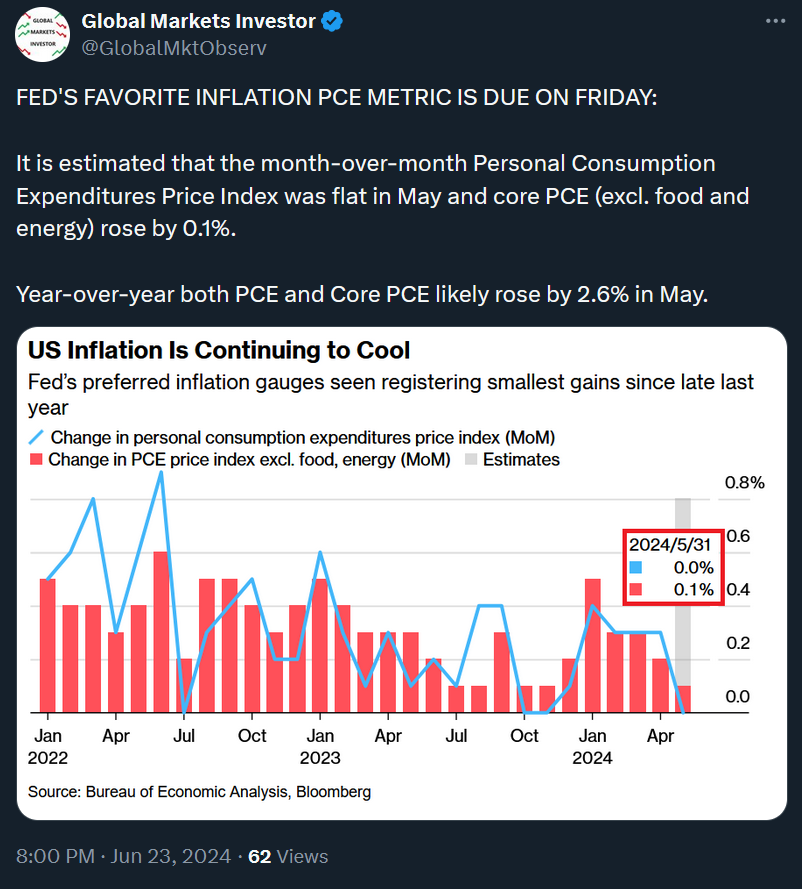

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 ended the week up 0.6%. This was the 8th week of gains out of the last 9. More details regarding the index price action are in the 2nd point below.

- Nasdaq 100 index was up 0.2% as Nvidia posted its first weekly decline since April.

- Dow Jones was up 1.5%.

- Russell 2000 (small caps) ended the week +0.7%.

- VIX interestingly was up 4.0%.

- Gold dropped by 0.6%.

- Bitcoin saw a 3% loss.

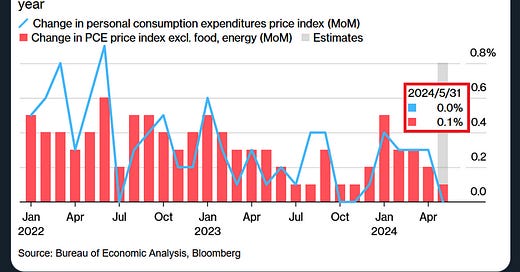

For the trading week ending June, 28 key events are:

- US Conference Board Consumer Confidence data on Tuesday

- US Final Reading of 1Q 2024 GDP data on Thursday

- US PCE Inflation data on Friday

- At least 8 Fed speeches

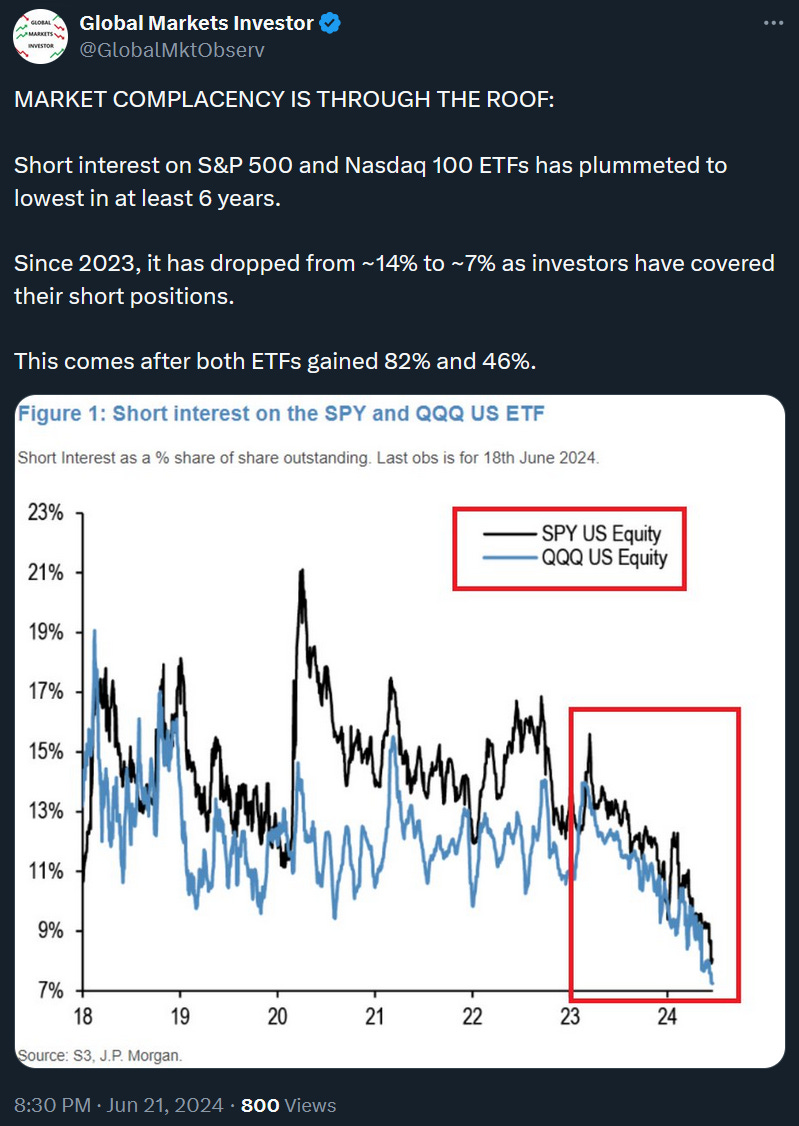

As it is the last trading week of the quarter, we may expect some volatility due to investment funds rebalancing. Key for the markets, however, will be US GDP data and Inflation PCE data for May, the Fed’s preferred inflation metric. As you can see in the above attachment, it is expected that PCE and core PCE rose by 2.6% year-over-year last month.

If this data comes significantly above expectations then stocks will tank. On the other hand, data in line and below expectations should provide some additional boost to the stock market.

2) US STOCK MARKET WARNING: