S&P 500 has seen 37 all-time high this year. Weekly market recap, trading week 28/2024

Summary of the trading week in several posts with the most interactions on X

In this series, I’ve been bringing out financial posts with the largest number of interactions from my feed on the X platform over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

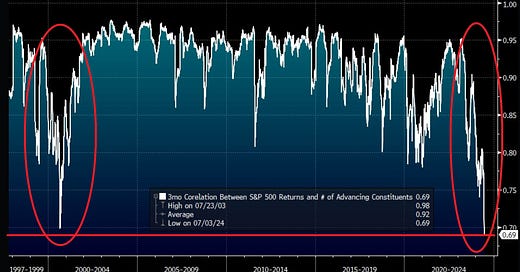

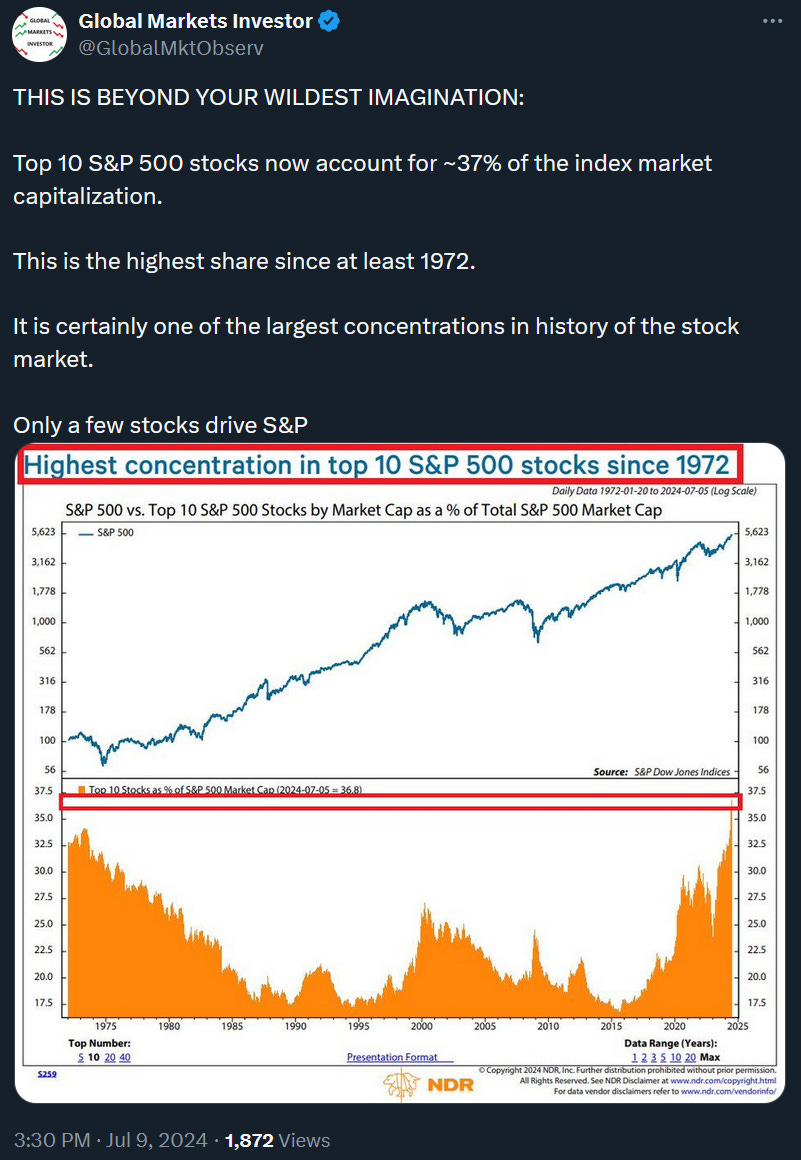

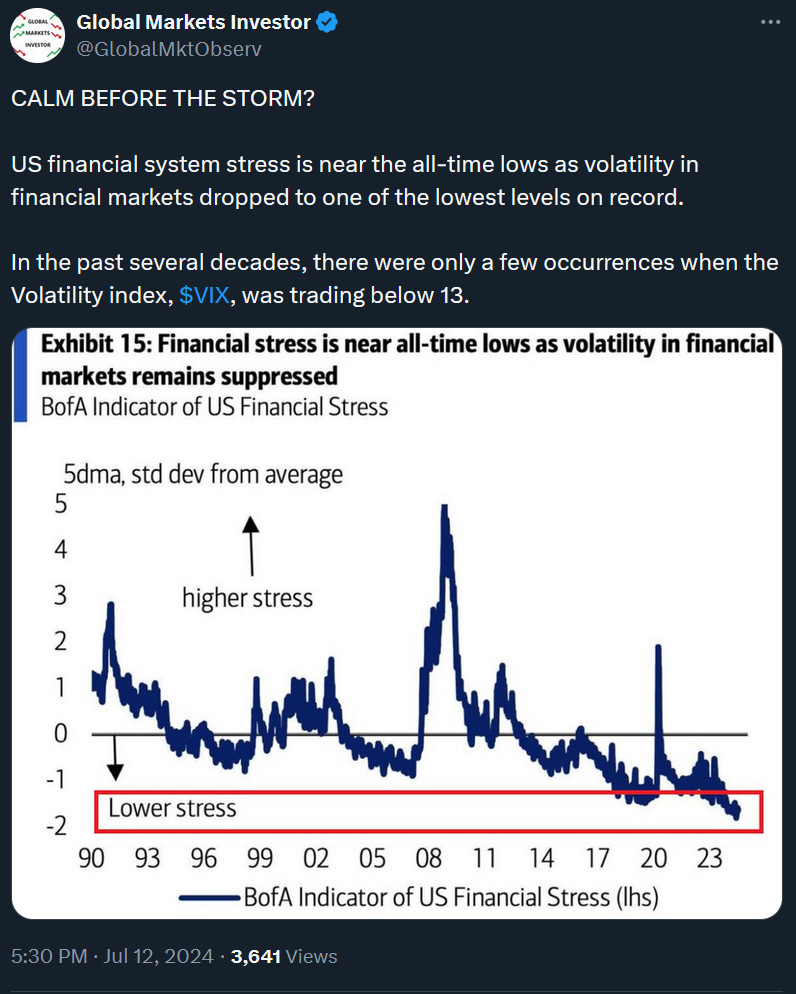

That was a pretty crazy week in terms of market activity. Small-capitalization stocks have seen some wild moves with technology underperforming. Additionally, the options market has experienced one of the highest volumes in history. In other words, stock market sentiment has been euphoric.

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

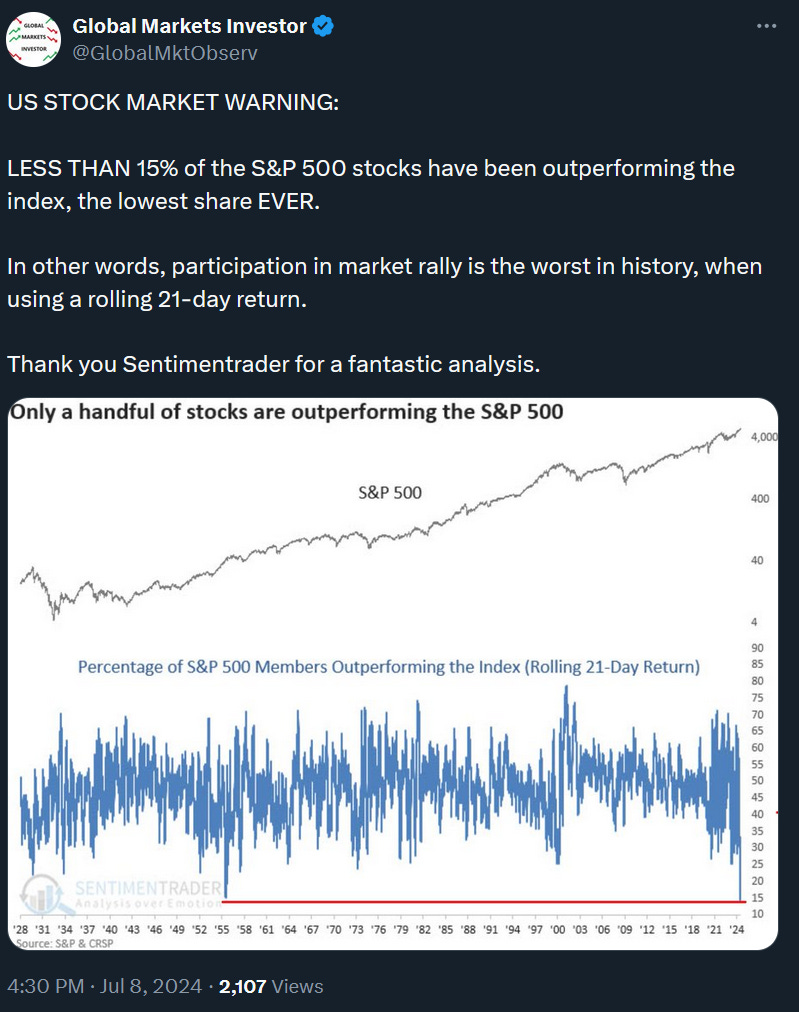

- S&P 500 ended the week up +0.9% and has seen 37 all-time highs this year the most since 2021. Notably, less than 15% of the S&P 500 stocks have been outperforming the index, the lowest share ever.

- Nasdaq 100 index was up by only 0.2%.

- Dow Jones was up +1.6%

- Russell 2000 (small caps) ended the week up by a whopping 6.1%, the most since November,

- VIX was down by 0.2%.

- Gold rose by 0.8%.

- Bitcoin saw a 1.1% loss and fell for the 6th consecutive week.

For the trading week ending July 19, key events are:

- Fed Chair Powell’s speech on Monday.

- US retail sales for June on Tuesday

- US building permits for June on Wednesday

- Q2 2024 earnings reports - Goldman Sachs, Bank of America, Netflix, among others

- At least 11 Fed speeches

US Q2 earnings season officially kicked off on Friday with some big banks’ disappointing results. Will be important to see whether other companies also show some sort of weakness, especially in terms of guidance. Key for the next week, however, will be US retail sales data and investors will be looking for the economic slowdown confirmation.

2) Used car prices are plummeting in the US as if there is a recession.