S&P 500 has declined for the second straight week. Weekly market recap, trading week 44/2024

Summary of the trading week using the most popular posts from the X platform

In this series, you can find financial markets posts with the largest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

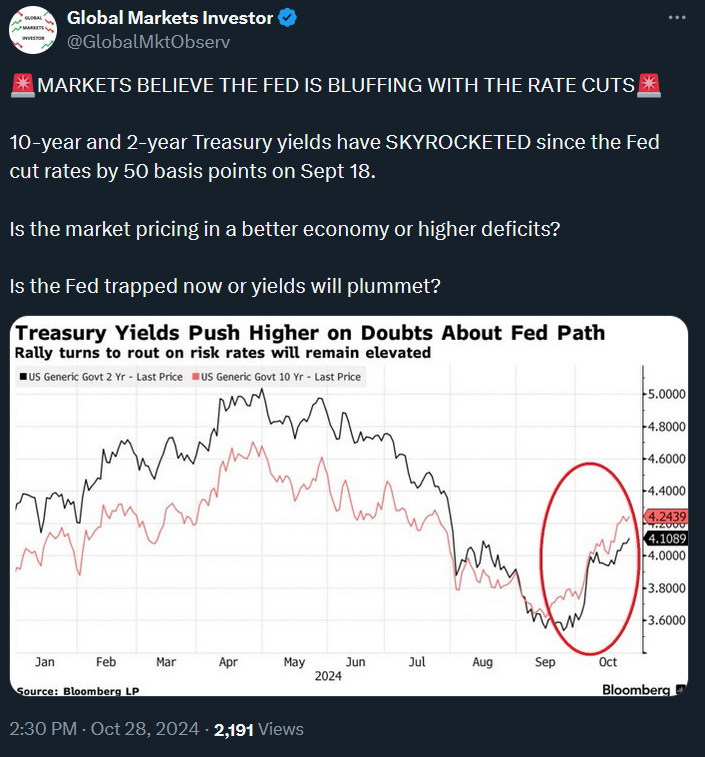

Last week was really intensive in terms of the market events. Job market data disappointed - more on that in a separate piece next week. Big Tech earnings beat forecasts but their outlook was below expectations. PCE Inflation data was mixed. Q3 US GDP came below expectations. As a result, the US stock market declined for the second straight week and 10-year Treasury yields continued to rise. Meanwhile, on Saturday, Warren Buffett’s cash pile hit another historic record which should be a warning for long-term investors.

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 was down 1.4%

- Nasdaq index fell 1.6%

- Dow Jones dropped 0.2%

- Russell 2000 (small caps) fell 0.2%

- VIX index spiked 9%

- WTI Crude Oil tumbled 3.2%

- Silver was down 3.2%

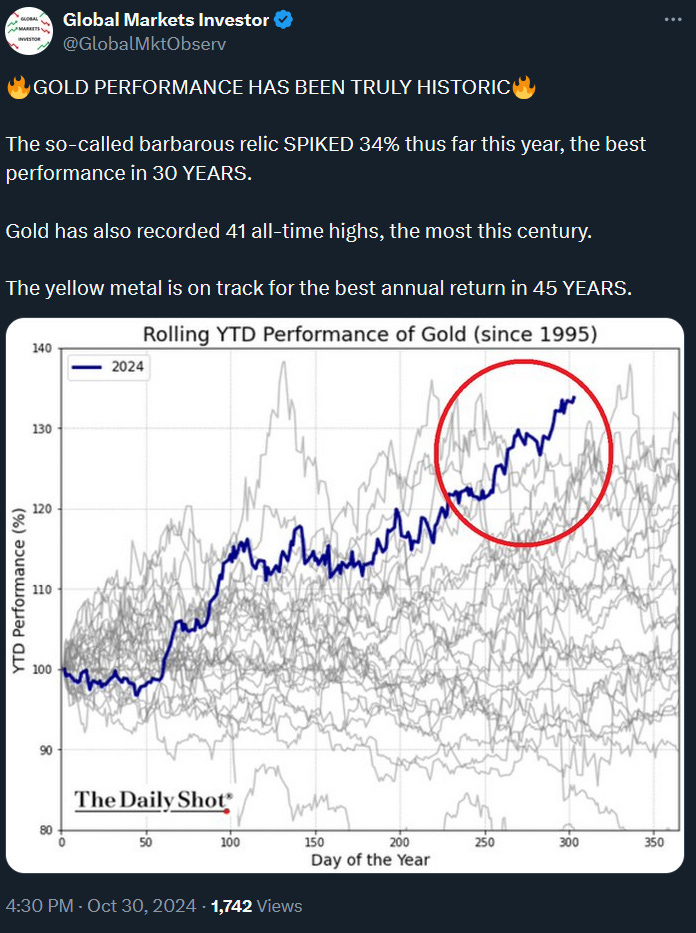

- Gold rose 0.1%

- Bitcoin increased 3.3%

For the trading week ending November 8, key events are:

- US Presidential Election on Tuesday

- US ISM Services PMI data for October on Tuesday

- Fed interest rate decision on Thursday

- US University of Michigan Consumer Sentiment on Friday

- ~10% of the S&P 500 companies reporting Q3 2024 earnings

All focus will be on the US Presidential Election as well as the Fed meeting. The Fed is expected to cut rates for the second time this year on Thursday by 0.25% (after a 0.50% cut in September) as the labor market data continues to weaken. This will be another crazy week in the markets.

2) Wall Street analysts are sharply cutting their S&P 500 earnings estimates - warning for US stocks.