S&P 500 fell for the 2nd straight week amid tariff uncertainty. Weekly market recap, trading week 06/2025

Summary of the trading week using the most popular posts from the X platform

ANNOUNCEMENT:

In order to improve the content quality and accelerate growth I will be soon moving from Substack to a newsletter platform called Beehiiv - I have no affiliation to the company. I believe Beehiiv provide a more user-friendly platform to readers and will allow for more efficient content creation. Notably, the migration WILL NOT impact your subscriptions and you will still receive all articles via emails. They also will be available on the website. See the example of Daily Chartbook: https://www.dailychartbook.com/. However, after the migration, NEW content will not be available through Substack app. Although, it is possible to create a customized mobile app on Beehiiv directly linked to my newsletter - I will probably launch it over time.

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process. These posts are also surrounded by commentary and explanations of complicated topics.

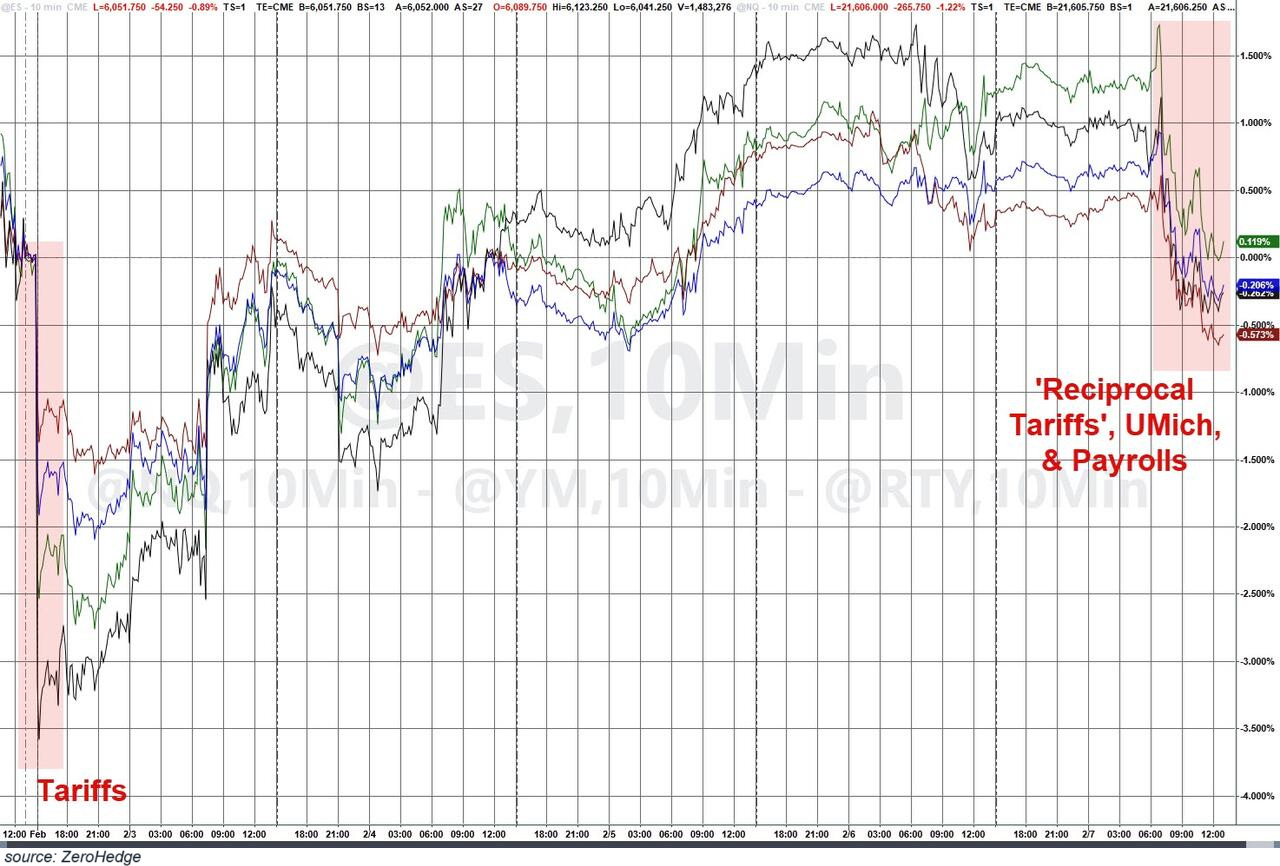

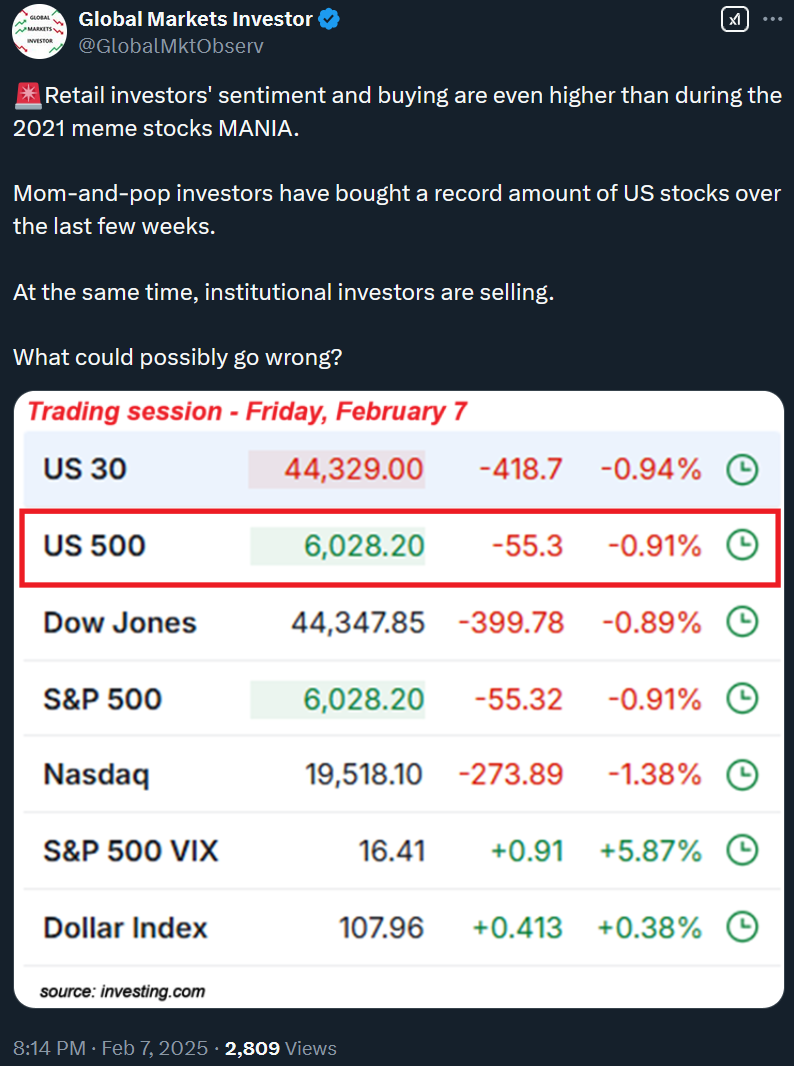

Mixed earnings, strange job market report, rising inflation expectations of US consumers and headlines about potential new US tariffs coming as early as next week caused some volatility in the markets, especially on Monday and Friday. On net, the major indices finished marginally down. The biggest winner arising from this slight chaos has been gold.

The next analysis of the US labor market using January data will be released during the next week. Stay tuned.

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 fell 0.2%

- Nasdaq index tumbled 0.5%

- Dow Jones dropped 0.5%

- Russell 2000 (small caps) fell 0.4%

- VIX rose 1%

- WTI Crude Oil fell 2.2%

- Silver declined 0.1%

- Gold increased 1.9%

- Bitcoin plummeted 4.7%

For the trading week ending February 14, key events are:

- President Trump Additional Tariffs Announcement - likely on Monday

- Fed Chair Jerome Powell speech on Tuesday and Wednesday

- US CPI Inflation for January on Wednesday

- US PPI Inflation for January on Thursday

- US Retail Sales for January on Friday

- ~10% of the S&P 500 companies reporting their Q4 2024 earnings

- A several Fed speakers.

All investors will be particularly following headlines around tariffs following Trump’s promise on Friday that new levies will "affect everyone". Moreover, some updates about the Fed policy path will come from the Fed Chair considering January inflation data are due on Wednesday.

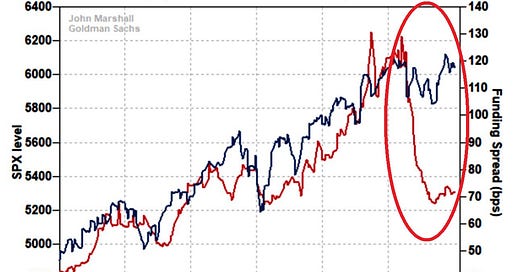

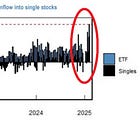

2) Additional evidence of institutional investors’ (smart money) selling of US stocks: